China Looks for Ways to Boost Economy and Housing Market as Annual Congress Meets

China's plans to revive its economy and stabilize the housing market at the annual congress. Get insights into key strategies and challenges.

As China's yearly meeting of its national legislature gets underway, all eyes are on the government's plans to revive the slowing economy and stabilize the struggling housing market. With China's workforce getting older, strained relations with the United States, and a housing crisis looming, the ruling Communist Party faces big challenges in steering the country towards steady growth.

Despite hopes for a strong recovery led by consumers after strict anti-virus measures were eased in late 2022, things haven't turned out as expected. Local governments are dealing with huge debts, and foreign investment in China has dropped a lot in the past year.

As more than 5,000 leaders from across China gather in Beijing for this important political event, the mood isn't too positive, both in the streets and in financial markets. This is different from the official talk celebrating the 75th anniversary of the People's Republic's founding in 1949.

While state media sound confident about the economy's comeback, real life isn't so rosy. People like Wang Tao, a 41-year-old videographer, are struggling to find work in a job market where age seems to matter more than skills.

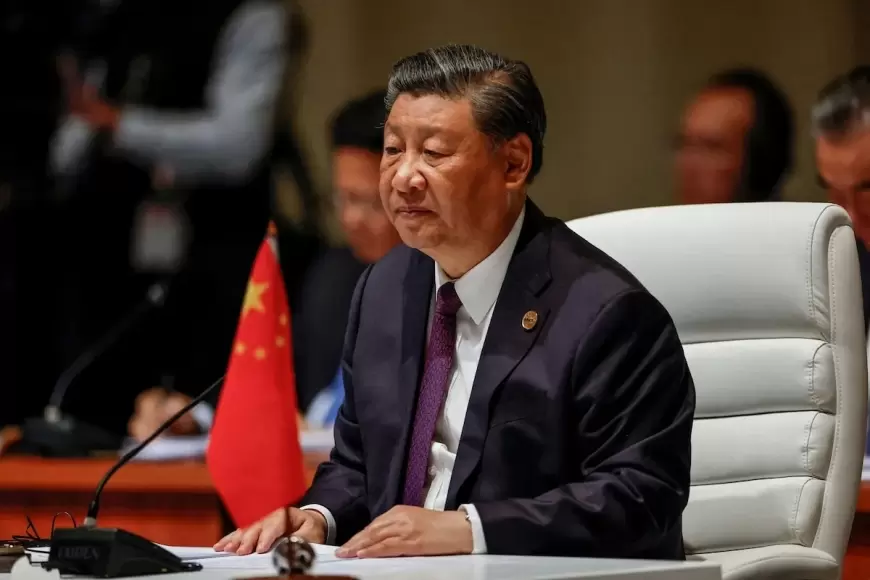

During the congress, leaders will back decisions already made, sharing government plans and telling officials what needs to be done. President Xi Jinping, China's top leader, will lead the session. Premier Li Qiang is expected to set a target for economic growth, with state media hinting it'll be around 5%, like last year's.

But many experts think growth might be slower, maybe 4% or less, because of China's economic troubles. Premier Li's yearly report will probably talk about improving development quality and pushing China forward.

The property market is in trouble because the government cracked down on borrowing too much money. Lots of real estate companies are struggling to pay their debts, and taxes from property sales are way down. To try to help, the government is making it easier to borrow money to buy property.

China's export-driven economy is also facing problems, with exports going down for the first time in seven years. Plus, there are worries about how China's rules for technology companies might scare off investors and hurt small businesses.

To fix all these problems, China needs to find a balance between short-term fixes and long-term changes. Boosting spending, making sure everyone has a fair chance at jobs, and making the economy more stable are all important steps.

Also Read: Foreign Direct Investment in China Hits 30-Year Low