China's Real Estate Crisis: Evergrande's Bankruptcy and Implications

China's real estate turmoil triggered by Evergrande's bankruptcy. Delve into economic ripples and broader implications.

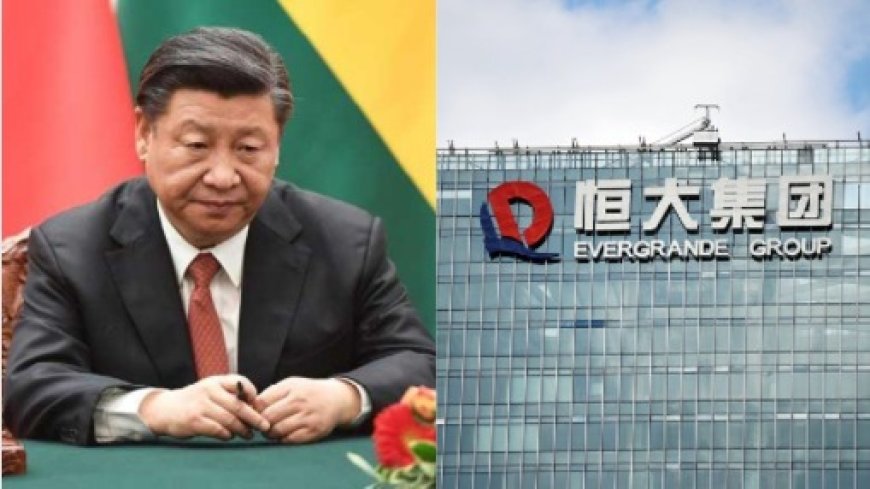

Amidst the bustling streets of China's economic landscape, a narrative of turbulence and reckoning is taking shape. Evergrande's recent filing for bankruptcy in the United States has cast a stark light on the nation's real estate crisis. As China grapples with the aftermath of one of its most prominent real estate giants' downfall, questions arise about the sustainability of its growth-centric trajectory over the past three decades.

The Perils of the Growth-at-All-Costs Model

Evergrande's journey from a triumphant real estate enterprise to a bearer of cautionary tales traces back to the "growth-at-all-costs" paradigm that propelled China's impressive economic expansion over the past 30 years. During this period, the company embarked on a debt-driven pursuit, coinciding with China's booming economy. Fuelled by strong demand for housing, Evergrande often pre-sold apartment units to eager buyers even before construction was completed.

Shift in Policy and Unforeseen Consequences

However, the tide began to turn with a sudden shift in policy orchestrated by China's leaders two years ago. This policy pivot left property developers, once thriving under favorable circumstances, grappling for financial sustenance. A crucial source of funding for these developers was severed, compounding financial risks within the confines of the world's second-largest economy.

The Tragedy of Evergrande

Evergrande's downfall was a story in the making, beginning in 2021 when the central government moved to restrain excessive borrowing, an attempt to temper the escalating surge in home prices. This abrupt maneuver led to a cutoff of substantial funding streams for property developers.

The consequences were dire. Evergrande, bearing a massive burden of $300 billion in liabilities, found itself unable to shore up cash quickly enough to meet its debt obligations. As a result, the company defaulted in December 2021, sending shockwaves through the market. The repercussions were far-reaching, with subsequent defaults creating a pervasive crisis in China's expansive real estate market. The suspension of construction on numerous projects not only disrupted the industry but also left many "pre-sale" buyers in a state of uncertainty, saddled with hefty debts and without the promised homes.

Bankruptcy and Implications

Evergrande's filing for Chapter 15 bankruptcy in the United States serves as a testament to the extent of its financial turmoil. This legal move allows foreign companies to utilize US bankruptcy law for debt restructuring. However, the intricate process is expected to be a protracted affair, given Evergrande's substantial offshore debt of around $19 billion.

The implications of this restructuring reverberate far beyond the company's walls. The course Evergrande charts as it navigates billions of dollars in offshore debts holds significant consequences for China's intricate financial ecosystem.

A Broader Crisis Unfolds

The saga doesn't end with Evergrande. A domino effect has been set in motion, with other prominent real estate players facing liquidity crises as they grapple to secure funds amidst plummeting housing demand. One such entity is Country Garden, a behemoth with around 300,000 employees. This developer recently missed multiple debt payments, prompting Moody's to label its debt as a "very high risk" asset. The downgrade, which took place last week, underscored the growing turbulence within the sector.

Economic Tremors and Societal Impact

China's economic landscape is intertwined with its property market, accounting for up to 30% of the nation's economic activity. Additionally, over two-thirds of household wealth is tethered to the real estate market. The past three years, marked by stringent "zero Covid" measures, have had a dampening effect on China's economic growth. Consumers, grappling with higher unemployment and declining property values, have become cautious about entering the property market.

Despite a brief resurgence earlier this year, China's economic engines are faltering. Consumer prices declined for the first time in more than two years, while youth unemployment reached alarming levels, resulting in withheld July data. Retail sales, export demand, and factory production have all witnessed declines, casting shadows on the nation's economic vitality.

The Evolving Role of Beijing

In light of these challenges, the question emerges: can Beijing orchestrate bailouts to rescue these embattled companies? The landscape has shifted. While Beijing has previously employed large-scale, state-funded bailouts to revive struggling industries, recent signals indicate a departure from this approach.

President Xi Jinping's recent speech underlines the necessity of gradual, patient progress, suggesting a departure from sweeping rescues of bloated sectors.

As China's real estate crisis continues to unfold, the nation finds itself at a crossroads. The once-gilded image of unfettered growth is juxtaposed with a reality marked by caution, introspection, and an evolving economic landscape.

Also Read: China's Economic Challenges Impact Markets: How It Could Affect Your Investments