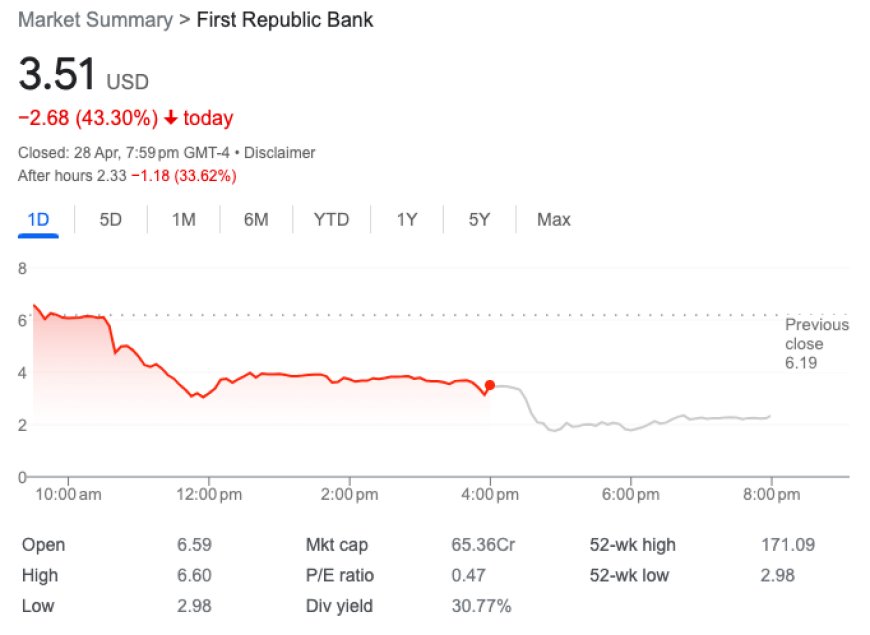

Regulators rush to find buyer for embattled First Republic Bank

Federal Deposit Insurance Corporation reaches out to potential bidders in last-ditch effort

US regulators are scrambling to find a buyer for First Republic Bank after the lender's admission that customers had withdrawn $100bn in deposits in March. The Federal Deposit Insurance Corporation has reportedly reached out to six banks to bid for the mid-sized lender. The agency sought bids for First Republic by the end of last week and has been assessing them over the weekend. The bank's potential collapse follows the recent failures of Silicon Valley Bank and Signature Bank, sparking fears of a wider banking crisis.

The Federal Deposit Insurance Corporation (FDIC) is racing to find a rescuer for embattled lender First Republic Bank after the bank revealed that customers had withdrawn $100bn in deposits in March. The bank's potential collapse has sparked concerns of a wider banking crisis following the recent failures of Silicon Valley Bank and Signature Bank.

According to reports, the FDIC has asked six banks to bid for First Republic and has been assessing them over the weekend. The agency reportedly sought bids by the end of last week.

JP Morgan Chase is believed to be among the banks invited to bid for First Republic, along with Bank of America. However, both banks declined to comment on the matter.

The global banking industry has been under pressure as central banks around the world have raised interest rates to combat inflation. This has caused the values of large portfolios of bonds purchased by banks to fall, raising concerns that other firms could face similar situations.

Also Read: Live Updates: Stay Informed on the Latest Trends in Stocks, GDP, and Banking Industry

In Europe, Swiss banking giant Credit Suisse recently revealed that it had to borrow $54bn from the country's central bank to shore up its finances. The bank has since been rescued by long-time rival UBS.

First Republic is a mid-sized US lender that counts wealthy individuals among its clients. In March, a group of 11 US banks invested $30bn into First Republic to stabilise the business, with JP Morgan among them.

If a buyer for First Republic is not found, its potential collapse could lead to a run on the bank. The FDIC has already stepped in to guarantee all deposits in the wake of Silicon Valley Bank and Signature Bank's failures. In the US, the FDIC insures deposits up to $250,000.

Read Also: Bank Turmoil Results in $72 Billion Loss of Deposits for First Republic