Nvidia Earnings Report Sparks Market Optimism | Today Stock Market News

Stay updated with the latest market trends as investors brace for Nvidia's earnings report impact. Expert insights, premarket fluctuations, and economic signals unfold in this comprehensive news coverage.

New York, NY - The opening bell on Wall Street rang with a chorus of positivity today, as the stock market embarked on a promising trajectory. The focal point of investor attention? Nvidia (NVDA), the renowned chipmaker, poised to reveal its much-anticipated earnings report following the market's closing hours.

Tech Sector Propels Gains

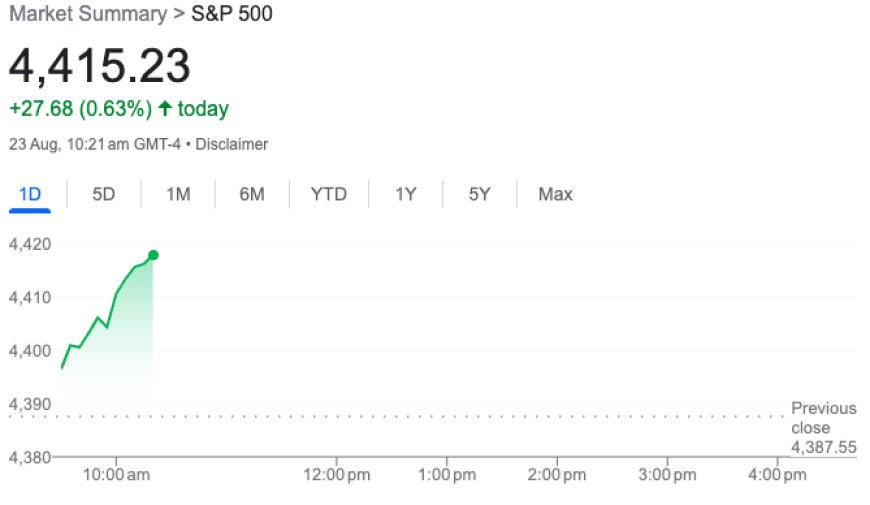

The tech sector took center stage, propelling the benchmark S&P 500 index to a commendable rise of approximately 0.3%. The Dow Jones Industrial Average also responded with a modest uptick of 0.1%. However, stealing the spotlight was the tech-heavy Nasdaq Composite index, which surged an impressive 0.5% during the early morning trading session.

Premarket Fluctuations Unveil Market Dynamics

As the trading day unfolded, several market giants unveiled their performances during premarket trading. Retail giant Kohl's (KSS) saw its shares ascend by 3%. Despite a 53% dip in profits compared to last year, the company's second-quarter earnings report managed to surpass expectations, garnering investor enthusiasm.

On the flip side, sportswear behemoth Foot Locker (FL) witnessed a remarkable 30% plunge in shares. The announcement of a suspension of quarterly dividend payments due to disappointing second-quarter sales and a trimmed full-year profit outlook sent ripples of concern through the market.

Connected fitness company Peloton (PTON) faced its own challenges, with shares tumbling over 25%. The company's fourth-quarter results reflected rising subscriber churn and unexpected costs from a seat post recall, culminating in this substantial decline.

Meanwhile, entertainment juggernaut AMC (AMC) grappled with a decline of up to 20% in pre-market trading. This decrease preceded a significant share conversion, merging its common and preferred stock into a unified share class.

S&P Global's Survey Sends Economic Signals

Fresh insights from S&P Global's economic survey showcased a nuanced perspective on the momentum of the US economy. The services Purchasing Managers' Index (PMI) struck a 6-month low at 51.0, paralleled by the manufacturing PMI at 47.5, marking a 2-month nadir. The implications of these figures suggest potential economic deceleration. Lingering concerns stemming from elevated prices and escalating interest rates have curbed demand, casting shadows over the third-quarter economic vitality.

Anticipation Surrounds Nvidia's Earnings

As the sun sets on today's market activities, all eyes are fixed on Nvidia's earnings release. The company's prior forecast of a revenue surge for the quarter, exceeding Wall Street estimates by 50%, has rendered it a focal point of interest. With its pivotal role in earlier AI-driven market rallies, Nvidia has become a potential catalyst for renewed market vigor. Analysts and market experts anticipate the company's earnings to infuse fresh energy into equity markets, offsetting the sluggishness experienced earlier this month.

Technical Projections Paint a Positive Picture

Market strategist Mark Newton, at the helm of technical strategy in Fundstrat, provided insights into Nvidia's imminent performance. He posits that despite recent momentum fluctuations, the stock's technical indicators remain encouraging. Newton's analysis suggests a promising path for Nvidia, projecting a potential approach to the $500 mark by mid-September. This projection, he believes, represents a significant threshold of resistance and augurs well for the stock's near-term rally.

In the grand tapestry of the stock market, today's upward trajectory and Nvidia's impending earnings reveal a dynamic landscape, where player performances, economic indicators, and expert analyses interweave to shape market sentiment. As the year unfolds, all eyes remain on Nvidia's earnings, poised to influence market momentum and steer the trajectory of the financial landscape.

Also Read: Stocks Rally as 10-Year Yield Approaches 16-Year High: Today Stock Market Insights