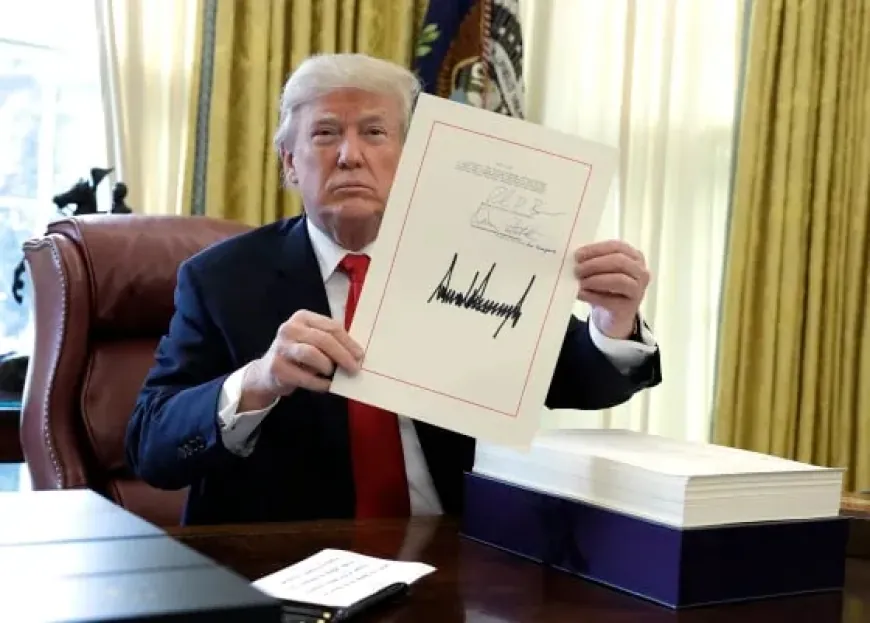

Trump’s New Tax Bill Could Push Bond Yields to 6% and Deepen U.S. Deficit, Experts Warn

Wall Street warns Trump’s revived tax cuts may drive bond yields near 6%, risking fresh market chaos and ballooning the U.S. deficit.

Financial experts are raising red flags over President Donald Trump’s proposed tax legislation, warning it could lead to serious disruptions in the U.S. bond market and broader economy. The bill—designed to extend the 2017 tax cuts—could increase the national deficit by an estimated $4 trillion over the next ten years, according to projections from the non-partisan Tax Foundation.

Though the bill recently hit a roadblock due to internal disagreements among Republicans, many believe that some version of it will pass before the end of the year.

The biggest concern among investors is how the bill might impact the U.S. Treasury market. When the government borrows more money without matching it with spending cuts or new revenue, bond investors tend to react negatively. They worry about the long-term stability of government finances, which can lead to a sell-off in bonds and a rise in yields.

So far, the bond market has remained relatively calm, with yields dipping slightly due to cooling inflation and expectations of future interest rate cuts. But that calm may not last.

Warnings of a 5% Yield Spike

Market analyst Ed Yardeni, head of Yardeni Research, believes the 10-year U.S. Treasury yield could jump to 5% if the bill moves forward in its current form. A yield at that level would mark a key psychological threshold and could trigger panic among stock investors. “The bond market is watching this closely,” Yardeni said, adding that a repeat of past market sell-offs is a real possibility if concerns over government spending grow.

Padhraic Garvey, who leads research for ING in the Americas, agrees that yields could climb sharply. He also noted that discussions around raising the U.S. debt ceiling are likely to take place at the same time, further intensifying fears over rising government debt. “The bond market will have to decide if it can accept this level of borrowing,” Garvey said.

Risk of a Market Shock

Peter Berezin, chief global strategist at BCA Research, warned there is a 30% chance of what he called a "nightmare scenario"—where bond yields spike above 6% due to fears of a fiscal crisis. In such a case, investor demand for U.S. government bonds would collapse, forcing the Federal Reserve to step in and buy bonds to stabilize the market.

Berezin emphasized that while this isn't his base-case scenario, the risk is still uncomfortably high. “Unless Trump is willing to cut major government programs or increase revenue, this could escalate before any action is taken,” he said.

Bond Vigilantes Back in Focus

The term “bond vigilantes” refers to how the bond market reacts when investors lose faith in a government's fiscal discipline. Rather than being a specific group of investors, it describes how rising debt and poor economic policies can cause yields to rise as investors demand higher returns for holding riskier government debt.

During Trump’s first term, bond yields soared after he announced tariffs on countries like Mexico and Canada. Though Trump later denied that bond market reactions influenced his decisions, he admitted to monitoring yields closely.

Now, bond investors are again on high alert, especially as the U.S. faces two major risks: soaring debt levels and the threat of higher inflation. In 2024 alone, the federal government spent $881 billion on interest payments, according to the Congressional Budget Office. If yields rise further, that number could grow rapidly, increasing the pressure on government finances.

Trump has said he wants to lower interest rates to help the economy, but if his tax bill causes yields to rise, it could have the opposite effect—making borrowing more expensive across the board.

White House May Be Forced to Adjust

Yardeni believes the Trump team will eventually have to revise the tax plan to avoid a market backlash. “They’ll try to strike a balance between delivering tax relief and keeping the bond market calm,” he said. “But the market will judge whether their compromises are enough.”

Garvey also expects the final version of the bill to be less aggressive than its current draft. “They’ll likely tone it down to avoid triggering a major sell-off in government bonds,” he said.

With the tax bill threatening to add trillions to the U.S. deficit, investors in government bonds are bracing for a tough showdown. Analysts warn that if the yield on 10-year Treasurys climbs near 5%, it could trigger sharp sell-offs like those seen during previous fiscal clashes. The market’s reaction will likely hinge on whether lawmakers can soften the bill’s impact or if bond vigilantes will push yields even higher, raising borrowing costs and rattling confidence in U.S. debt.

Also Read: Trump Signs €179B UAE Deal: AI Super Hub, 500K Nvidia Chips & Jet Orders