Unstoppable Market Surge: Tech Earnings and Jobs Report Propel Stocks to New Highs

As Q3 Takes Off, Investors Bet Big on Earnings and Economic Data

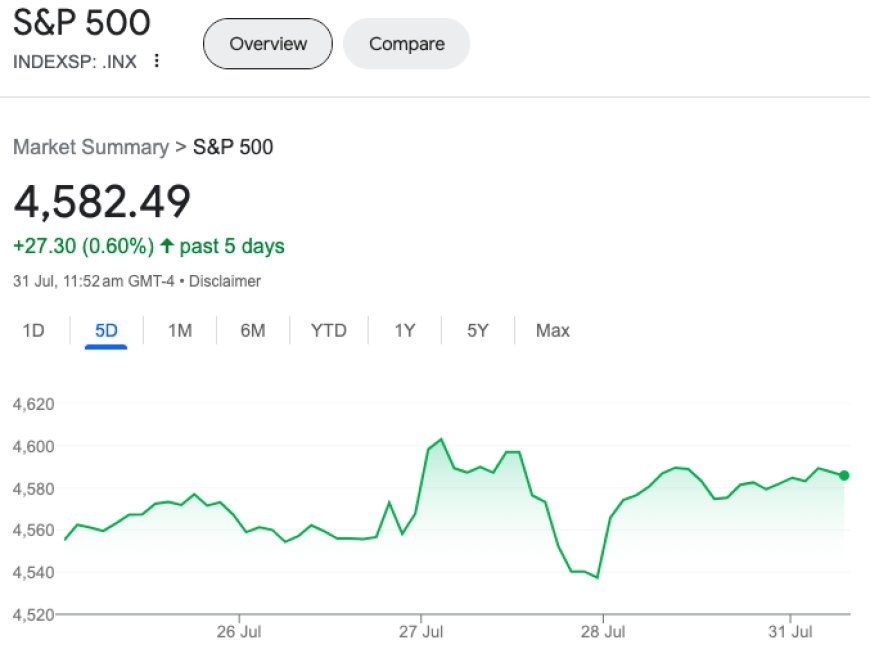

US stocks surged at the start of the week as investors braced for the upcoming tech earnings and the July jobs report. The S&P 500 and the Dow Jones Industrial Average both gained around 0.2%, while the tech-heavy Nasdaq Composite added 0.3%. As attention turns to Apple and Amazon's second-quarter results, market experts draw parallels to the 2019 rally and anticipate more index level upside. Additionally, the Dallas Fed survey revealed a contracting Texas industrial economy, but businesses remain optimistic, signaling a positive outlook amid challenges. The stock market's resilience and strong performance continue to drive enthusiasm and excitement among investors heading into Q3.

Tech Titans Take the Stage

In a sensational market rally, US stocks took off on Monday as investors eagerly anticipated the upcoming earnings releases of two tech giants and the highly anticipated July jobs report later this week. The S&P 500 and the Dow Jones Industrial Average surged approximately 0.2%, while the tech-heavy Nasdaq Composite soared by about 0.3%.

The Stage is Set for Earnings Extravaganza

All eyes are on the second-quarter results of Apple (AAPL) and Amazon (AMZN), following the impressive releases from Meta (META) and Alphabet (GOOG, GOOGL) last week. The tech titans are set to dazzle Wall Street with their financial prowess, and investors are eager to glean insights into Apple's Vision Pro headset and Facebook's cloud business.

Economic Data Under the Spotlight

As anticipation builds, the countdown is on for the monthly nonfarm-payrolls report, scheduled for Friday. Analysts expect it to unveil job growth that remains steady and resilient, boosting optimism that the Federal Reserve can navigate inflation without triggering a recession.

Dallas Fed Survey: Economy Adapting to Change

Earlier today, the Dallas Fed released its monthly manufacturing survey, indicating a continued contraction in the Texas industrial economy. Despite this, fears of an imminent recession seem misplaced, as numerous businesses express optimism about the future. The report sheds light on the changing economic landscape.

A Positive Outlook Amid Challenges

The survey revealed that some industries face challenges, including higher rates, yet they remain committed to growth. A computer and electronic product manufacturing contact expressed optimism, intending to invest in expanding capacity and reducing unit costs, aiming to gain market share amid uncertain times.

Echoes of the 2019 Rally

Morgan Stanley's renowned strategist, Michael Wilson, observed that the current stock market rally mirrors the exuberant trends of 2019, a standout year that saw a 29% return for the S&P 500. Wilson emphasized that the data suggests the current rally is policy-driven and late-cycle, drawing parallels to the 2019 scenario when the Federal Reserve cut rates, prompting a rally driven primarily by multiple expansions.

Stock Market Navigates Uncertainty

While the S&P 500 boasts a 19% gain this year, mirroring the returns of 2019, Wilson advises investors to proceed cautiously, considering the market multiple is already approaching peak levels seen in 2019 when the Fed was already cutting rates.

A Market of High Stakes and Excitement

With the stage set for a blockbuster earnings season and pivotal economic data to shape market sentiment, stocks opened higher but mostly unchanged on Monday. Investors brace themselves for a thrilling week ahead, betting on the outcomes that could steer the market's trajectory.

A Tale of Triumph and Challenge

In premarket trading, Heineken N.V. experienced a 6% drop after revising its financial outlook and net profit, while Yellow Corporation faced a 1% dip amid reports of potential bankruptcy due to debt refinancing issues. Conversely, Walmart's shares rose nearly 1% following its multi-billion-dollar acquisition of Flipkart's remaining stake, and Adobe Inc.'s stock recorded a 2% gain after bullish predictions of further growth.

Onward to Q3: Market Enthusiasm Prevails

As July comes to a close, investors stand on the edge of their seats, eagerly awaiting key earnings reports and economic data. With market sentiment leaning towards a positive outlook, the stage is set for a dynamic and exciting Q3 in the world of finance.

Also Read: Tech Stocks Surge as Meta Shines and Fed's Rate Hike Hopes Soar: Today's Stock Market News