U.S. Current Account Deficit Narrows to a Two-Year Low in Q3

Economic Update: U.S. Current Account Deficit Narrows, Fueled by Surging Petroleum Exports

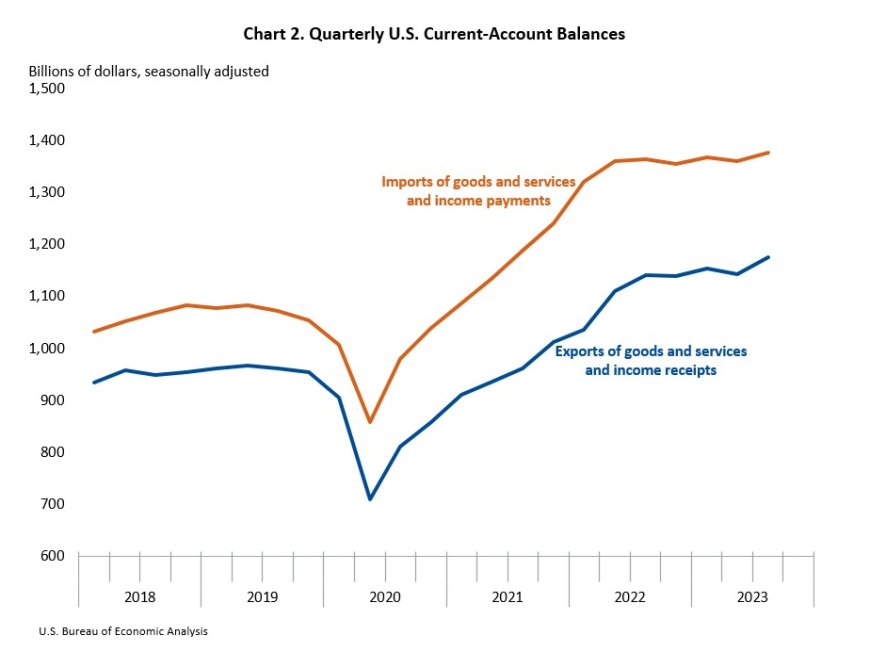

U.S. current account deficit has shrunk, marking its smallest size in over two years during the third quarter. The Commerce Department's Bureau of Economic Analysis revealed a notable contraction of $16.5 billion, a 7.6% decrease, bringing the deficit to $200.3 billion. This figure is the smallest recorded since the second quarter of 2021, surprising economists who had anticipated a deficit of $196.0 billion.

This current account gap represents 2.9% of the Gross Domestic Product (GDP), reflecting the lowest share since the first quarter of 2021 and a drop from the 3.2% reported in the second quarter. Notably, the deficit had reached its peak at 6.3% of GDP in the fourth quarter of 2005.

One key factor contributing to this positive shift is the United States' transformation into a net exporter of crude oil and fuel. While the deficit remains substantial, its impact on the dollar is negligible due to the currency's reserve status.

Breaking down the components, exports of goods saw a significant increase of $19.1 billion, reaching $516.4 billion, primarily fueled by the surge in petroleum and related products. Meanwhile, services exports also saw a boost, rising by $2.7 billion to $252.2 billion. This increase was partially offset by a decline in technical, trade-related, and other business services, reflecting the dynamics of personal travel.

On the import side, goods imports rose by $4.6 billion to $777.4 billion, with passenger cars and other parts leading the way. This increase somewhat offset a decrease in non-monetary gold imports. In the services category, imports fell by $1.9 billion to $176.0 billion, reflecting a decline in sea freight transport.

Primary income receipts increased by $11.8 billion to $362.1 billion, while payments of primary income rose by $14.0 billion to $332.1 billion, contributing to the overall dynamics of the current account balance.

This shift in the U.S. current account balance emphasizes the evolving economic landscape, with the country's changing role as a petroleum exporter playing a significant role in this positive development.

Also Read: Coca-Cola Business Secret: It's Not Just Soda Cans Bringing in the Revenue