U.S. Futures Stabilize as Shutdown Threat Eases; China's Growth Forecast in Focus

Stay updated with the latest market developments. U.S. futures hold steady after averted shutdown, while China's growth outlook faces scrutiny. Get insights into the factors influencing global markets.

U.S. stock futures are anticipated to commence the new quarter on a relatively even keel. This comes in the wake of averted government shutdown concerns and amid contemplations on China's economic growth outlook.

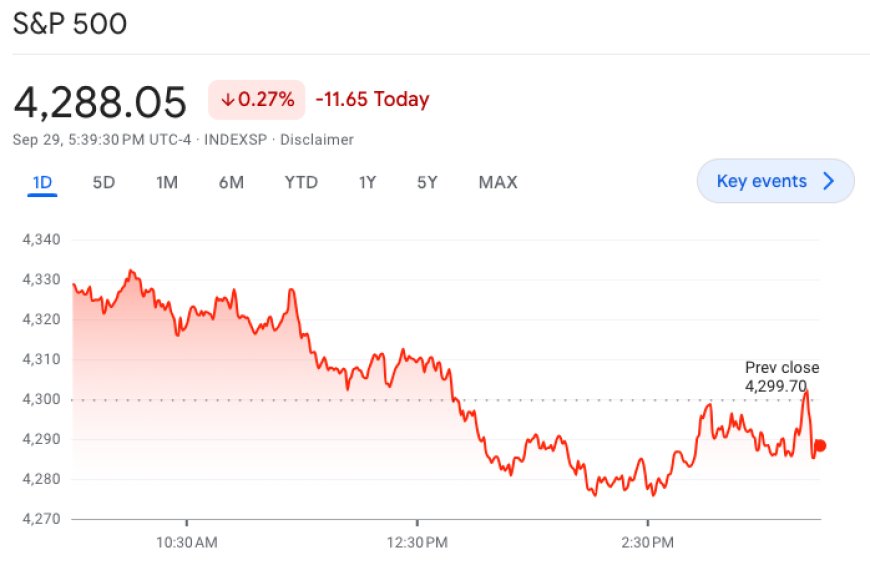

Futures on the S&P 500 and the Dow Jones Industrial Average have relinquished earlier gains, hovering around the baseline. Conversely, the tech-heavy Nasdaq 100 displays a more pronounced uptick, rising by 0.17%.

Over the weekend, Congress managed to broker a last-minute deal, averting what had seemed an imminent government shutdown. This development has brought a sense of relief to investors who were apprehensive about the potential adverse impacts on the economy and the stock market. However, this respite may be fleeting, given that the agreement merely extends the budgetary deliberations temporarily.

Yet, the prominent market indices continue to grapple with other challenges that contributed to substantial losses in the preceding quarter. The resounding message from the Federal Reserve regarding sustained elevated interest rates resonates in the minds of investors. Concurrently, surging oil prices and Treasury yields continue to exert pressure.

The funding accord in the U.S. may fuel speculations of an impending rate hike by the Federal Reserve in November, according to some market participants. Clues on this matter may emerge as Jerome Powell, the central bank's chair, engages in a roundtable discussion alongside Philadelphia Fed President Patrick Harker later today.

Elsewhere, the World Bank has trimmed its growth projection for China in 2024, while maintaining the forecast for 2023, sparking concerns about demand in the world's second-largest economy. The bank cites the failure to make a full recovery from the pandemic's impact and the persistent debt crisis in the property sector.

In the backdrop, the United Auto Workers strike continues to cast a shadow over the markets, extending its reach to more Ford and GM plants. The forthcoming delivery reports from auto companies for the quarter will be closely scrutinized to assess the repercussions of these labor disputes. An agreement between the UAW and Mack Trucks on Sunday could potentially inject a note of optimism.

Moreover, investors are eagerly awaiting the release of the September U.S. jobs report on Friday. Monday's agenda also includes updates on U.S. manufacturing from ISM and S&P Global.

In the realm of futures trading, a sense of stability pervades as the new quarter unfolds. Tech stocks indicate a slightly elevated opening on Monday, with other major indices treading just above the equilibrium. Futures on the S&P 500 exhibit a marginal rise, while those on the Dow Jones Industrial Average show a slight dip. Nasdaq 100 futures, however, demonstrate a more robust uptick.