Adani Group Dismisses Claims of 'Opaque' Funds Usage for Stock Investments

Adani Group dismisses allegations of using 'opaque' funds for stock investments following a report by OCCRP. Learn how the conglomerate responds to these claims.

India's Adani Group has firmly denied allegations stemming from a report by the Organized Crime and Corruption Reporting Project (OCCRP). The report suggested that associates of the Adani family had utilized 'opaque' funds to invest in stocks. According to the Adani Group, these allegations have had no substantial impact on its business operations, and it remains in full compliance with the law.

The conglomerate emphasized notable investments from entities like Qatar Investment Authority and GQG Partners. Furthermore, it reiterated its commitment to attracting investors as part of a decade-long capital program launched in 2016.

The OCCRP, a non-profit media organization, recently uncovered that millions of dollars were funneled into publicly traded Adani Group stocks through funds based in Mauritius. This financial mechanism effectively obscured the involvement of purported business partners associated with India's Adani family.

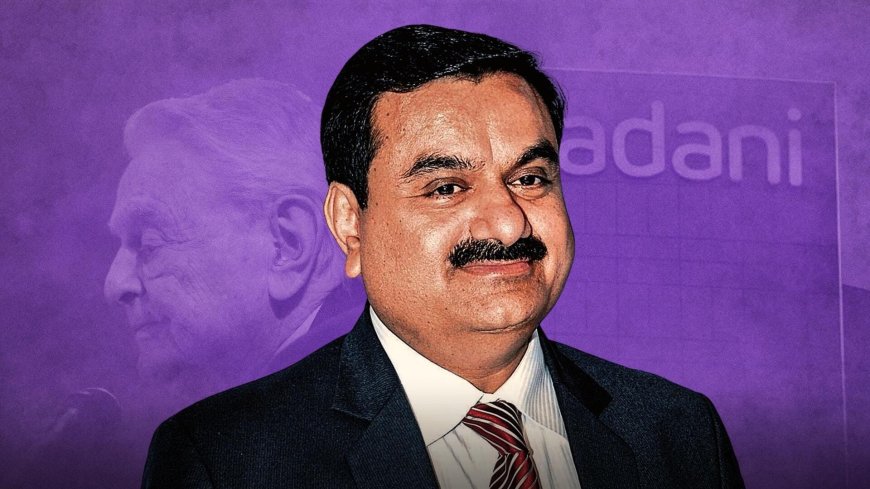

Gautam Adani, the billionaire at the helm of the Adani Group, categorically rejected what he referred to as regurgitated allegations in the OCCRP report.

Shares in Adani Group companies experienced a temporary dip on Thursday, triggered by renewed concerns over corporate governance. However, the statement from the Adani Group noted that leading group stocks rebounded and closed in positive territory on Friday.

This situation comes on the heels of earlier setbacks, when the Adani Group's publicly listed firms witnessed a loss of over $100 billion in market value. This decline occurred earlier in the year after U.S.-based Hindenburg Research raised significant concerns regarding corporate governance and alleged improper utilization of tax havens.

Also Read: Hindenburg's Actions Lead to $99 Billion Wealth Erosion Among Three Billionaires in 2023