Bank Account Security 101: Essential Tips for Protecting Your Finances

Is Your Money at Risk? Get Informed About Your Bank Account's Safety

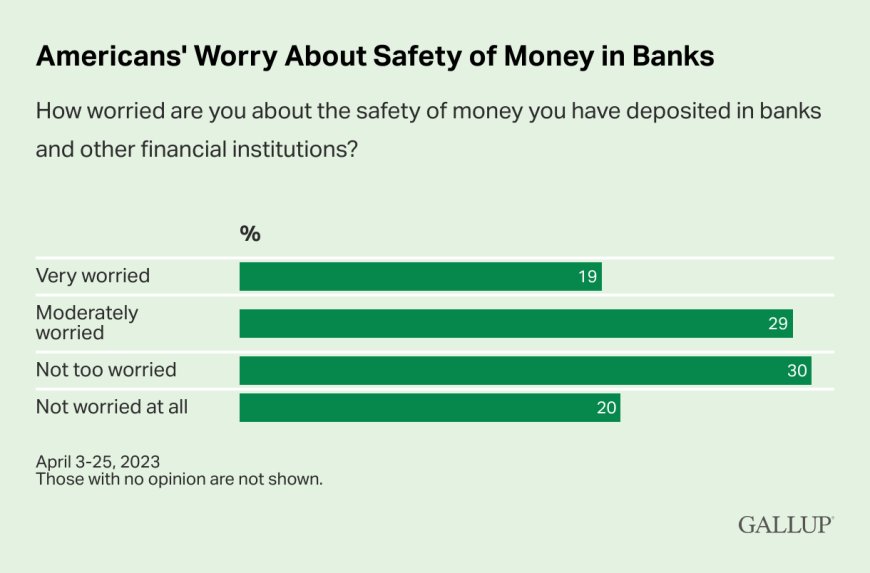

New Survey Shows Nearly Half of Americans Worried About Bank Account Safety, Highest Since 2008 Financial Crisis.

A recent survey conducted by Gallup found that almost half of Americans are worried about the safety of their money in banks, with 19% of respondents saying they are "very worried" and 29% saying they are "moderately worried." The survey, which was conducted between April 3-25, was done in the wake of the failures of Silicon Valley Bank and Signature Bank, but before the takeover of First Republic Bank.

This level of concern about bank account safety is the highest since the 2008 financial crisis, according to Gallup. In September of that year, the percentage of Americans who reported being very or moderately worried about their money held in banks or other financial institutions was 45%.

The results of the recent Gallup survey suggest that the safety of bank accounts has become a growing concern for many Americans, despite the fact that most individuals have nothing to worry about thanks to FDIC-protected bank accounts. The survey's findings may indicate a lack of confidence in the US banking system.

Megan Brenan, a senior editor at Gallup, noted that it is unclear whether people are unaware of the protections provided by federal deposit insurance for small accounts or if they fear a snowball effect that could affect federal insurance as a whole. The survey also found that lower-income adults, those without a college degree, and Republicans are more worried than their counterparts.

For most individuals, the answer to the question of whether their money is safe in their bank account is yes. The FDIC's standard insurance covers up to $250,000 per depositor, per bank, for every account ownership category for deposit accounts like savings, checking, and certificates of deposit (CDs).

Silicon Valley Bank's customers were spooked because their deposits far exceeded the insurance amount, but this is largely not the case for everyday Americans. The vast majority of American households have bank deposits that are well below the $250,000 limit for FDIC insurance, which guarantees that their money is safe.

As Mark Zandi, chief economist at Moody's Analytics, explained, households have no reason to be nervous about getting their money out of the bank when they want it, since these deposits are fully backed by the U.S. government. Even SVB depositors with deposits over $250,000 will not lose their deposits, as the U.S. government has insured these deposits as well.

FDIC Insurance: What You Need to Know

(The Federal Deposit Insurance Corporation (FDIC) in the United States | Image Credit: FDIC)

What Does FDIC Insurance Cover?

In 1933, Congress established the FDIC as an independent federal agency under the Banking Act to revive confidence in the U.S. banking system after the Great Crash of 1929 caused more than a third of the country's banks to fail.

The FDIC is primarily funded by premiums paid by banks and savings associations for deposit insurance coverage. It does not receive any appropriations from Congress.

FDIC-insured deposit accounts include checking accounts, savings accounts (both passbook and statement), money market deposit accounts (MMDAs), certificates of deposit (CDs), negotiable order of withdrawal (NOW) accounts, and official items like cashier's checks and money orders issued by an insured bank.

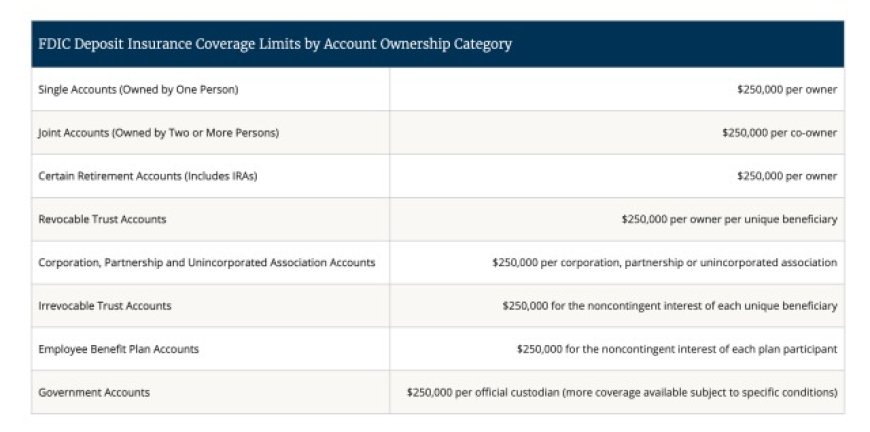

The agency provides insurance coverage on a per-account basis, with eight different ownership categories. These include single accounts, joint accounts, certain retirement accounts such as IRAs, revocable trust accounts, irrevocable trust accounts, corporate or business partnership accounts, employee benefit plan accounts, and government accounts.

A personalized view of how this might work

Suppose you have deposited $150,000 in a savings account, $50,000 in a checking account, and $100,000 in a CD at Bank A. Unfortunately, not all of your $300,000 deposit is fully insured. According to the FDIC's regulations, only $250,000 is covered, while the remaining $50,000 is not. This is due to the "per depositor, per FDIC-insured bank, for every account ownership category" rule.

However, there are options to ensure that your deposits are fully insured. One solution is to transfer the $100,000 from the CD to Bank B. Doing so would result in the $200,000 in Bank A and the $100,000 in Bank B being completely covered by FDIC insurance.

Another way to guarantee full coverage is to open a joint account with the CD at Bank A. The coverage limit for joint accounts is $250,000 per co-owner, and it satisfies the "for every account ownership" criteria. Therefore, the entire $300,000 deposited across the savings, checking, and CDs at Bank A would be covered.

If you're unsure whether your funds are federally insured, you can use the FDIC's Electronic Deposit Insurance Estimator tool. This tool helps customers determine, on a per-bank basis, how much of their money, if any, exceeds coverage limits.

What Falls Outside the Coverage of FDIC Insurance?

The Federal Deposit Insurance Corporation (FDIC) provides insurance for deposits made by bank customers in the United States. However, not all assets held at a bank are covered by FDIC insurance.

Investments such as mutual funds, stocks, bonds, annuities, and cryptocurrency are not considered deposits and therefore are not covered by FDIC insurance. Banks may offer non-deposit items like mutual funds and annuities, but they are required to disclose that they are not insured because they are not deposit accounts, regardless of the amount invested.

Other assets not covered by FDIC insurance include the contents of a safe deposit box, municipal securities, and life insurance policies held at the bank.

It's important to note that U.S. Treasury bills, bonds, and notes are not covered by FDIC insurance, but they are backed by the full faith and credit of the federal government. Therefore, they are considered to be low-risk investments.

Are there any other types of insurance available besides FDIC?

The National Credit Union Insurance Fund (NCUSIF) insures the deposits of federally-insured credit unions, which are administered by the National Credit Union Administration (NCUA). Depositors can enjoy up to $250,000 of coverage per institution, per depositor. Some credit unions may offer additional insurance to cover deposits exceeding the limit. Check with your credit union or visit NCUA.org for a list of federally insured credit unions.

For investors, the Securities Investor Protection Corp. (SIPC) protects against the loss of cash and securities such as stocks and bonds held by SIPC-member brokerage firms. However, the protection limit is $500,000, which includes a $250,000 limit for cash. It's important to note that SIPC does not protect against the decline in value of securities or losses due to a broker's bad investment advice or recommending inappropriate investments.

It's important to recognize that SIPC protection is not the same as protection for cash at an FDIC-insured banking institution. SIPC was not created to protect against investment risks in the stock market. The nonprofit corporation, created by Congress, is aimed at providing protection against losses related to broker-dealer insolvency.

Read Also: Maximizing Home Loan Repayment? Exploring the Pros and Cons of Various Approaches

Key Considerations for Small Business Owners

Small business owners must consider the insurance limits when it comes to their deposits under FDIC rules. Deposits of a corporation, partnership, or unincorporated entity (whether for-profit or not-for-profit) are insured up to $250,000 at the same bank, separately from personal accounts of the owners or members.

To ensure higher insurance coverage for deposits, small business owners have several options. One is to open an account at another FDIC member bank and get another $250,000 coverage. They can also increase coverage by opening an account with a joint owner.

Another option for small business owners is the IntraFi Network Deposits program, which offers FDIC insurance coverage on millions of dollars worth of deposits across a network of financial institutions without the need to open accounts at multiple banks. As long as the bank is part of the network, business owners can keep all their money in one place.

Small business owners can also opt for a cash management account (CMA) that is often accompanied by check writing, a debit card, and earns interest. Nonbank financial service providers offer CMAs and can often insure more than $250,000 by dividing funds into smaller amounts and placing them in deposit accounts at other IntraFi Network Deposits bank members.

A MaxSafe account provides protection for balances of up to $3.75 million total per person, with coverage ramping up to $250,000. This is made possible by spreading out deposits across 15 community bank charters. MaxSafe accounts include CDs, money market accounts, and IRAs.

Although bank failures are rare, business owners must still keep in mind the insurance limits. The last bank failure occurred in October 2020, with the majority happening from 2007-2009 during the recession. As of December 2022, there are around 4,700 FDIC-insured banks.