Federal Reserve Chair Powell to Discuss Interest Rate Cuts as Inflation Slows

Federal Reserve Chair to Lead Discussions on Potential Interest Rate Cuts Amid Slowing Inflation

Federal Reserve Chair Jerome Powell will start a significant week of commentary from U.S. central bank officials on Monday. They are assessing the recent slowdown in inflation and considering whether to signal upcoming interest rate cuts.

Upcoming Federal Reserve Meeting

The Federal Reserve will meet on July 30-31, but officials must remain silent about monetary policy from this Saturday, July 20, until the Friday after the meeting. With inflation nearing their 2% target and concerns growing about the job market's strength under current economic conditions, officials might use this week to indicate that rate cuts are imminent or explain why the current data doesn't support a shift to easier monetary policy.

Market Expectations

Recently, the market has strongly favored the idea that the Federal Reserve will soon cut rates, after a previous false pivot late last year suggested rate cuts were on the horizon. Citi analysts noted that a strong signal of upcoming rate cuts might be given in July, with a potential start in September if the economy continues as expected. Weak inflation data in June increased the estimated likelihood of a September rate cut to over 90%, as indicated by CME Group's FedWatch tool.

Current Interest Rates

Policymakers are not expected to lower the benchmark interest rate from the current range of 5.25% to 5.5% at the upcoming meeting. However, recent weak inflation reports might lead them to adjust their policy statement to hint at a possible rate cut in September. This week's comments will be closely analyzed to understand how the latest data has influenced policymakers' views.

Recent Inflation Data

In June, the Consumer Price Index (CPI) fell after remaining unchanged in May, and a report on wholesale prices showed slowing price pressures in areas like healthcare. This data supports the case for easier monetary policy.

Key Federal Reserve Speakers

Powell will speak at 12:30 p.m. EDT on Monday at the Economic Club of Washington. Last week, he told U.S. lawmakers that more positive inflation data would pave the way for lower borrowing costs but did not provide a specific timetable.

Other notable speakers this week include Fed Governor Adriana Kugler on Tuesday, Fed Governor Chris Waller on Wednesday, New York Fed President John Williams on Friday, and Richmond Fed President Thomas Barkin, who also speaks on Wednesday. Waller's remarks at a Kansas City Fed event are particularly important as he has been a key voice in the inflation debate.

Labor Market Conditions

Fed officials believe that the cooling job market has mainly been absorbed through a reduction in job openings rather than a significant rise in unemployment. However, the unemployment rate has been steadily increasing, reaching 4.1% in June for the first time in over two years.

Future Projections

In late May, Waller mentioned he wanted to see several more months of positive inflation data before supporting a rate cut. Since then, the Personal Consumption Expenditures (PCE) price index has fallen from 2.7% to 2.6% in May, with further declines expected.

If upcoming data, including the initial report on second-quarter economic growth, continues to show easing price pressures, the Fed might change its long-standing language in the next statement, potentially opening the door for rate cuts.

Inflation Targets

Chicago Fed President Austan Goolsbee stated on Friday that the recent inflation data indicates progress toward the Fed's 2% target. He noted that consistent data like what was observed last week would increase confidence in achieving the target.

This week’s commentary and data releases will be crucial in determining whether the Federal Reserve is ready to shift its policy direction in response to the current economic climate.

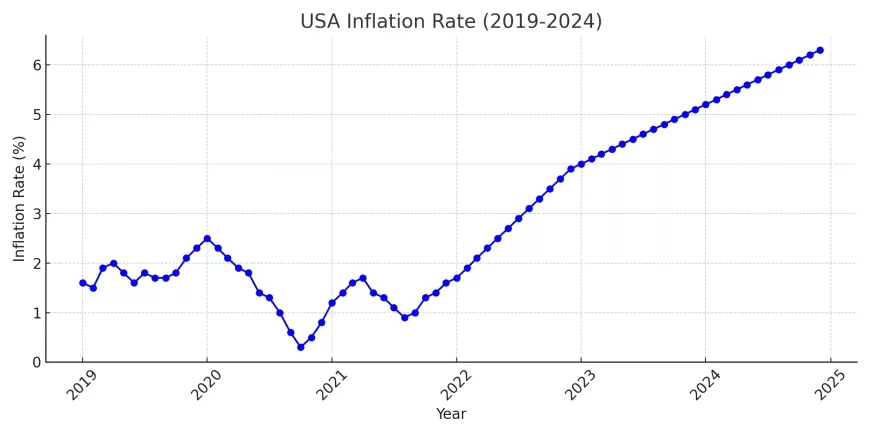

USA Inflation Rate (2019-2024)

How Inflation Has Changed Over the Past Five Years

This chart shows how the monthly inflation rates in the United States have changed from January 2019 to December 2024. Inflation rate is a measure of how much the prices of everyday goods and services, like groceries and gas, are increasing over time.

Key Points:

Stable Prices Before the Pandemic (2019):

- In 2019, inflation rates were quite stable, hovering around 2%. This means prices were increasing at a manageable rate, which is close to what the Federal Reserve aims for.

Pandemic Effects (2020):

- When the COVID-19 pandemic hit in early 2020, inflation rates dropped sharply because people were spending less money during lockdowns.

- Later in 2020, inflation began to rise again as the government introduced stimulus measures to help the economy recover.

Post-Pandemic Price Surge (2021-2022):

- After the pandemic, inflation rates surged, reaching over 5%. This was due to supply chain issues, higher consumer demand, and large government spending.

- Inflation peaked around mid-2022, showing how difficult it was to balance supply and demand during the recovery.

Gradual Improvement (2023-2024):

- By 2023, inflation rates started to stabilize and slowly decrease as supply chains improved and the Federal Reserve adjusted its policies to control inflation.

- By late 2024, inflation rates were getting closer to the target rate again, showing signs of economic stability.

Why It Matters:

Understanding how inflation changes is important for everyone. It helps us make better decisions about spending, saving, and investing. The Federal Reserve watches inflation closely to keep the economy stable and growing.

This data shows how big events like a pandemic can greatly affect the economy and how government policies can help manage these effects. By looking at these trends, we can see how the economy responds to challenges and recovers over time.

Also Read: US Jobless Claims Rise, Signaling Labor Market Challenges Ahead