Goldman Sachs’ 3 Must-Know Tips to Protect Your Investments in Volatile Markets

Feeling the market turbulence? Learn Goldman Sachs' top investment tips to safeguard your portfolio and thrive in uncertain times.

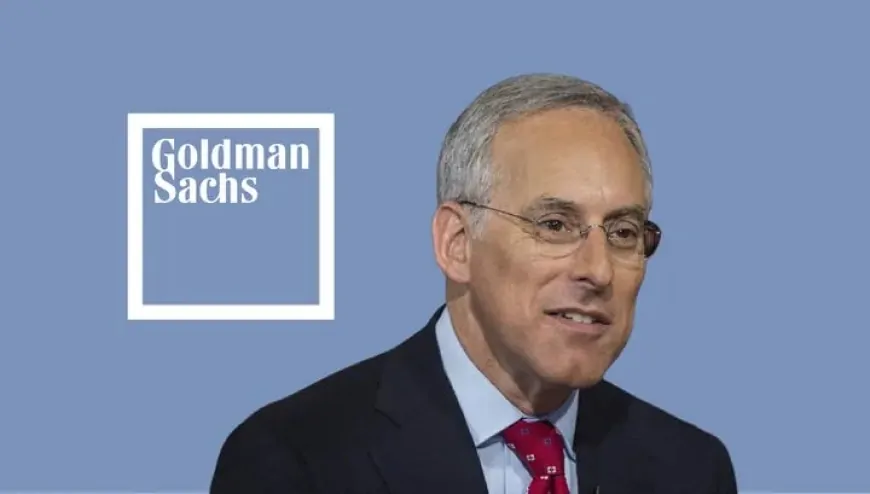

David Kostin, the chief US equity strategist at Goldman Sachs, has been closely observing the markets — and right now, things are looking pretty unpredictable. With the ever-looming trade tariffs and economic concerns, investors are left wondering how to keep their portfolios steady. Kostin, however, has a game plan to navigate through this turbulence, offering three practical tips to keep your investments on track.

1. Stick to US-Focused Stocks

Think local, act local. Kostin suggests focusing on companies that generate most of their revenue within the United States. Why? Because businesses rooted in the domestic market are often more stable in uncertain times. While international conflicts and currency fluctuations can send shockwaves through globally exposed companies, US-based firms tend to weather the storm better. Companies like Costco, Kroger, and Eli Lilly are prime examples of solid domestic investments.

2. Avoid Heavy International Exposure

Global markets are a tricky place right now. From unpredictable tariffs to currency swings, companies with a significant international footprint are facing challenges. Goldman Sachs advises steering clear of those with extensive overseas operations. While global expansion has its perks, it also opens companies up to market volatility. Focusing on businesses with strong US sales can provide a more predictable and stable return.

3. Invest in Second-Derivative AI Stocks

Everyone knows about the giants of artificial intelligence, but Kostin suggests a different angle — investing in companies that support the AI revolution rather than those leading it. Software services, cloud providers, and data management firms are the backbone of AI technology. By placing your bets on these foundational companies, you could tap into AI growth without the risks of investing directly in major AI firms. Companies like Visa, Charles Schwab, and Alphabet are worth considering.

A Rocky Start to the Year

This year hasn’t been easy for the markets. The Nasdaq Composite has plunged 11%, with the S&P 500 and Dow Jones Industrial Average slipping by 2% and 6.3% respectively. High-profile names like Nike, FedEx, and Delta have all issued warnings about weaker consumer demand, further unsettling investors.

Even major tech players like Tesla and Nvidia have faced significant losses, leading to a broader tech sell-off. While volatility is unsettling, Kostin’s tips offer a practical way to manage the uncertainty.

Finding Shelter in Safe Havens

When markets are shaky, investors often turn to sectors that remain resilient. Consumer staples, healthcare, and utilities have shown steady performance even as other sectors falter. For example, the iShares US Healthcare ETF (IYH) has only dipped 2% in March, while pharmaceutical giants like Merck and Amgen have gained around 2.5%. Similarly, utility companies like Duke Energy and Constellation Energy have held firm, with the Utilities Select Sector SPDR Fund (XLU) gaining 4% this year.

Diversify, Diversify, Diversify

Edward Jones CEO Penny Pennington also chimed in with sound advice — rather than trying to predict every market move, focus on diversification. Spreading your investments across multiple sectors can reduce overall risk. A balanced portfolio can help cushion the blow during market downturns and offer better long-term growth.

The market may be unpredictable, but following Goldman Sachs’ practical tips could help you keep your investments stable. Whether you’re playing it safe with domestic stocks or eyeing second-derivative AI opportunities, a strategic approach is key to navigating uncertainty and securing long-term financial success.

Also Read: U.S. Trade Deficit Hits Record $131.4 Billion in January as Imports Surge