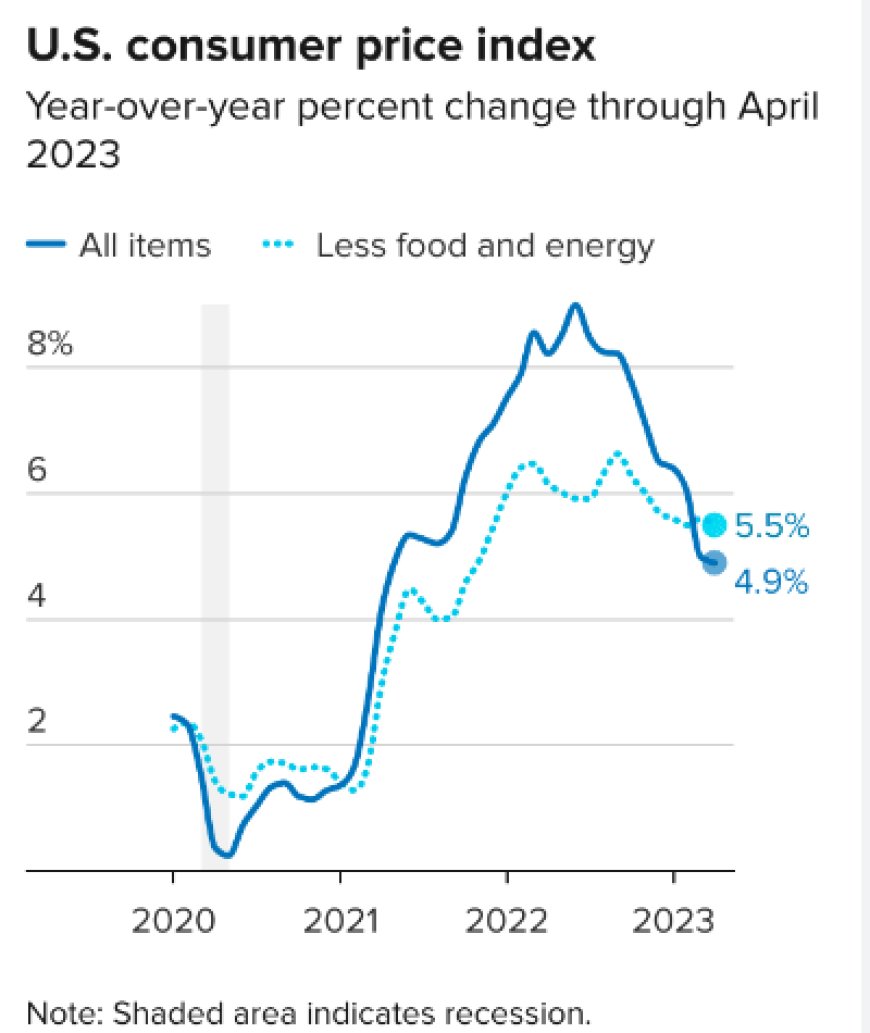

Live Updates: Interest Rate Hike Cools Inflation: April’s Rate Falls to 4.9%, Surprising Analysts

Live Updates: The April report from the Labor Department reveals that the consumer price index rose by 0.4%, meeting the Dow Jones estimate. While the annual inflation rate was 4.9%, it offers hope that the cost of living may decrease later in the year.

According to a report from the Labor Department on Wednesday, the consumer price index, a benchmark measure of inflation, rose by 0.4% in April, with the increase mainly driven by higher shelter, used vehicle, and gasoline prices. However, the annual inflation rate of 4.9% was slightly lower than estimated, raising hopes that the trend may ease later in the year. This news provides insights into the current state of the economy and its potential future trajectory.

The annual inflation rate came in at 4.9%, which is slightly lower than the expected 5%, giving some hope for a lower cost of living later in the year. In contrast, the core consumer price index, which excludes food and energy categories, increased by 0.4% monthly and 5.5% from a year ago, meeting expectations. These figures mark the lowest annual pace since April 2021.

Source: U.S. Bureau of Labor Statistics

The consumer price index rose in April primarily due to increases in shelter, gasoline, and used vehicles. However, prices for fuel oil, new vehicles, and food at home declined, which offset the overall increase. The positive market reaction was evident as Treasury yields dropped, causing futures to turn positive.

Follow Live Updates Here...

Key Moments

- Consumer price index increased by 0.4% in the past month due to higher shelter, used vehicle, and gas prices

- Inflation rate for the past year was 4.9%, slightly lower than expected, providing hope for a downward trend

- Real average hourly earnings adjusted for inflation increased by 0.1% for the month but decreased by 0.5% from last year

-

Positive Inflation Report Boosts Nasdaq, Amazon, and Tesla Stocks

The Nasdaq index received a boost from Amazon and Tesla, with both tech giants registering impressive gains of 2.1% and 0.8%, respectively, contributing to the overall positive performance of the market.

-

Upcoming ETF to Target Real Estate and Infrastructure Sectors

Investors looking to capitalize on government spending trends may find a new ETF appealing, as the IQ CBRE Real Assets ETF (IQRA) begins trading on Wednesday. This new ETF differs from others in the real estate space by including infrastructure holdings as well. CBRE Investment Management's chief investment officer for listed infrastructure, Jeremy Anagnos, stated that the fund will be actively managed and split roughly 50-50 between the two asset groups. Preferred shares may also be held in addition to common equity. With an expense ratio of 0.65%, IQRA offers investors a unique opportunity to diversify their real asset holdings.

-

Consumer Spending Slows Down in Early May, According to Citi Report

Citi reports that consumer spending declined in the first week of May, possibly due to the change in timing of Mother’s Day. In the week ending May 6, total spending in 16 subsectors decreased by 11.5%, compared to an 8.6% decline the prior week. The spending, excluding food, fell by 11.4% in the last week, while it was down by 9.6% the week before. Although the spending trend remained weak, Citi's Paul Lejuez wrote in a Wednesday note, the decline in spending appears to have worsened, and he is looking forward to next week's report to see if there is any improvement.

-

Investors Intelligence survey shows bullish sentiment surpassing bearish for the 25th consecutive week

According to the latest Investors Intelligence survey, bullish financial newsletter editors (44.6%) continue to outnumber bears (24.3%) for the 25th consecutive week, indicating a market on the rise. However, the percentage of editors anticipating a short-term pullback in stocks, or "correction," increased to 31.1%. While this group typically increases as markets rally, the fact that they are doing the opposite by increasing as markets decline could signal a surprise rally, according to II.

-

Rockwell Automation shares tumble following announcement of Biden investigation

Rockwell Automation saw a decline of 2.8% during pre-market trading on Wednesday after news broke out that the Biden administration is investigating the possibility of the infrastructure technology company exposing assets. The investigation is focused on whether the company has exposed US military, infrastructure, and government assets in a potential cyberattack through one of its facilities in Dalian, China. According to The Wall Street Journal, there are no current indications of vulnerabilities, and the probe is limited to the Dalian facility. A spokesperson for the company stated that there has been no report or indication of any breach in practices or protocols, and no products have been intentionally compromised. Additionally, Rockwell Automation has not been informed by any US agency of an investigation into its work in China. However, the spokesperson added that the company would fully cooperate if there was one.

-

Will the prices of groceries decline in the near future?

According to recent data, grocery prices have slightly decreased by 0.2%, marking the second consecutive month of decline. The yearly increase also eased from 8.4% to 7.1%, which can be attributed to the decrease in global demand for commodities like wheat and corn.

The price of eggs in April experienced a decline of 1.5%, which is the third straight monthly decrease, after previously experiencing sharp increases due to bird flu. Despite the recent decline, the cost of eggs is still up by 21.4% over the past year. Other items that experienced a decline in price include pork, which fell by 1.2%, fish and seafood, which decreased by 0.7%, and bread, which went down by 0.3%.

However, some items saw an increase in cost. Chicken prices went up by 0.5%, and uncooked ground beef increased by 0.6%. Meanwhile, restaurant prices increased by 0.4% and have gone up by 8.6% annually.