Live: Unveiling the Market Pulse: How Sentiment and Inflation Data Shape Today's Stock Market Trends

Live market updates as stocks initially open higher but fluctuate due to consumer sentiment and inflation data. Stay informed about the ongoing debt ceiling negotiations and the key meeting between President Joe Biden and House Speaker Kevin McCarthy.

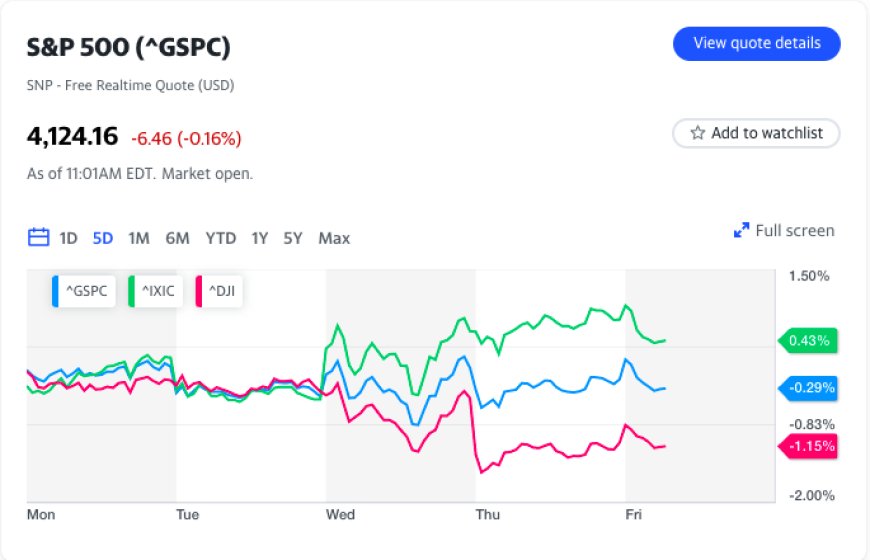

At the opening bell, stocks showed early gains, with the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all rising by around 0.2%. However, the release of consumer sentiment data revealing an increase in inflation expectations caused stocks to flatten during morning trade. Investors are closely following updates on debt ceiling negotiations, including the postponed meeting between President Biden and House Speaker McCarthy. Stay informed on the dynamic market conditions and the significant events impacting the stock market.

Also Read: Dow Jones Futures Slip Amid Disney's Slump and Inflation Concerns

Stay Tuned for the Live Updates Here

Key Moments

- Stocks open higher, S&P 500, Dow Jones, and Nasdaq gain 0.2%

- Inflation expectations impact market sentiment, stocks flatten

- Postponed debt ceiling meeting raises investor anticipation

-

Fed's Bowman Hints at 'Future Rate Increases' in Response to Elevated Inflation

As market expectations indicate a potential pause in the Federal Reserve's rate hiking campaign, Federal Reserve governor Michelle Bowman emphasized that the current inflation data does not definitively signal the end of rate increases for this cycle. In a speech delivered in Germany, Bowman expressed her need for consistent evidence of inflation trending downward before considering future rate hikes and determining the appropriate level of policy rate restriction.

Despite the April Consumer Price Index (CPI) revealing a 4.9% increase in headline inflation and a 5.5% rise in core prices (excluding food and energy), Bowman believes that recent inflation data does not meet the criteria for a more restrictive policy stance. According to BlackRock strategist Rick Rieder, the persistently high inflation depicted by the CPI report contradicts expectations of a decline in the near future. As annual inflation reached its slowest pace in two years at 4.9%, and core inflation remained unchanged from March, the prolonged period of inflation exceeding the Fed's 2% target undermines the potential for a shift in the Fed's policy stance, at least according to the Powell-led Federal Reserve.

-

Federal Reserve's Bowman Hints at Potential 'Future Rate Increases' in Response to Elevated Inflation

As the market anticipates a temporary halt in the Federal Reserve's rate hiking campaign, Federal Reserve governor Michelle Bowman emphasized that the current inflation data does not provide a clear indication that the Fed has concluded its rate increases for this economic cycle. Speaking in Germany, Bowman stated her requirement for consistent evidence of inflation trending downward before considering future rate hikes and determining an appropriate level of policy rate restriction. According to her assessment, the recent inflation data falls short of meeting this criterion.

The April Consumer Price Index (CPI) revealed a 4.9% year-on-year increase in headline inflation, while "core" prices, which exclude the more volatile costs of food and energy, rose by 5.5%. In a client note, BlackRock strategist Rick Rieder expressed concerns over the persistently high inflation depicted by the CPI, which he believes exceeds what is beneficial for both the general population and the Federal Reserve. Rieder also noted that the report indicates inflation remains stubbornly elevated, deviating from the expected timeline for a gradual decline.

Although annual inflation experienced its slowest growth rate in two years at 4.9%, and core inflation remained unchanged from March, the longer price increases persist well above the Fed's target of 2% on average, the less compelling a case can be made for a shift in the Fed's policy stance, particularly under the leadership of Chair Jerome Powell.

-

Tesla Stock Surges as Musk Announces New CEO for Twitter

In a tweet on Thursday, Elon Musk revealed that he has appointed a new CEO to lead Twitter, without disclosing the individual's name. The Wall Street Journal reported that NBC ad exec Linda Yaccarino is in talks for the position.

Analysts, including Dan Ives from Wedbush, see this move as a positive development for Tesla and SpaceX, allowing Musk to focus more on these ventures. As a result, Tesla stock rose by approximately 2% in pre-market trade on Friday. Meanwhile, the electric carmaker also faced challenges, as it announced a recall of over 1 million vehicles in China due to a braking issue.

-

Stocks Lose Momentum in Late Morning Trading

Stocks Reverse Course in Mid-Morning Trading, S&P 500, Dow, and Nasdaq Shed Earlier Gains As the clock approached 11:20 a.m. ET, the S&P 500, Dow, and Nasdaq surrendered their previous advances, with the S&P and Dow slipping by approximately 0.3% and the Nasdaq experiencing a slightly larger decline of over 0.4%. This reversal comes after all three indexes began the day on a positive trajectory, highlighting the fluctuating nature of the stock market.

-

Twitter Announces Linda Yaccarino as its New CEO

NBC ad executive Linda Yaccarino has been officially announced as the new CEO of Twitter, according to an announcement made by Elon Musk on Friday.

This announcement comes shortly after Musk hinted that the new CEO would assume the role in six weeks. Yaccarino, who previously held the position of Chairman for NBCU's global advertising and partnerships business, will now lead Twitter.

The impact of this news on Tesla (TSLA) stock has been mixed. While some analysts believed that Musk's reduced involvement in Twitter would benefit Tesla's shares, the stock experienced a decline of approximately 1.7% in early afternoon trading on Friday, erasing earlier gains.

-

WSJ Reports: Netflix Plans to Reduce Expenditure by $300 Million

According to sources familiar with the matter, The Wall Street Journal reported on Friday that Netflix (NFLX) intends to cut its spending by $300 million this year. The decision is partly attributed to the delayed implementation of Netflix's measures to curb password sharing.

In the company's first-quarter earnings report, released last month, Netflix stated that its content spending for 2023 is expected to remain around $17 billion annually through 2024. During the first quarter, Netflix's operating expenses were just below $6.5 billion.

Netflix described its efforts to prevent password sharing as an "evolution" in its business model. When asked about cash flow and long-term margin forecasts during the earnings call, Netflix CFO Spencer Neumann emphasized the balance between revenue growth, margin expansion, and reinvestment in the business to capture a larger market share.

Additionally, Netflix raised its free cash flow forecast for 2023 to $3.5 billion from $3 billion in the same earnings release. The increased forecast reflects the company's confidence in its ability to generate substantial cash flow.

The cost-cutting measures and strategic investments highlight Netflix's ongoing commitment to optimizing its financial performance while continuing to deliver high-quality content to its growing member base.