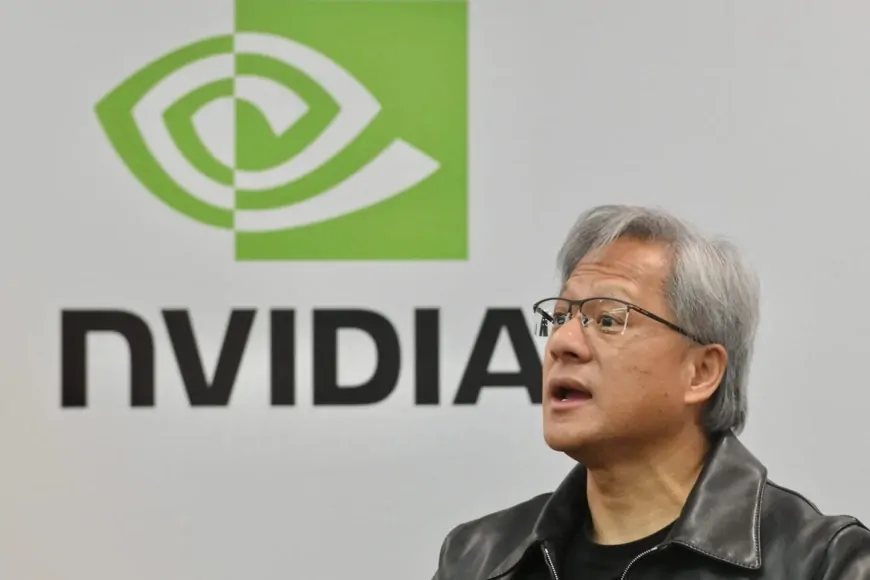

Nvidia Stock Recovers After $600 Billion Loss from DeepSeek's AI Model

Nvidia's stock began to recover after a $600 billion drop triggered by concerns over DeepSeek's cheaper AI model. Discover how this new development challenges Nvidia’s dominance in the AI chip market.

Nvidia’s stock price took a sharp dive on Monday, falling 17% and wiping out nearly $600 billion of its market value. However, by Tuesday morning, it began to recover, with a 2.5% increase in premarket trading. The massive drop was driven by investor concerns over a new AI model developed by DeepSeek, a Chinese startup. The model is cheaper to train than Nvidia’s AI chips, raising doubts about whether U.S. companies are overpaying for artificial intelligence (AI) infrastructure.

DeepSeek made headlines by revealing that its latest AI model, trained using fewer chips and at a significantly lower cost, could compete with Nvidia’s powerful GPUs. This caused a ripple effect in the stock market, especially among tech companies, as many investors feared that Nvidia’s pricing power could be threatened.

On Monday, Nvidia suffered its biggest one-day loss in history, with the company’s market cap dropping by $589 billion. This also impacted the broader tech market, with the Nasdaq falling 3% and chip stocks taking a hit. But by Tuesday morning, stocks started to recover, as the initial panic appeared to ease.

Despite the steep decline, Nvidia remained calm and downplayed the impact of DeepSeek’s announcement. The company referred to the new AI model as “an excellent advancement,” indicating that they weren’t overly concerned about the competitor’s development.

While Nvidia maintained its composure, Wall Street analysts were more cautious. Many were skeptical about DeepSeek’s claim that it had spent under $6 billion to train its AI models, as it used a process called “distillation” that relies on Meta’s open-source AI model, Llama. This approach allows DeepSeek to train its models more cheaply, but analysts like Harlan Sur from JPMorgan and Christopher Danley from Citi pointed out that the costs DeepSeek reported may not fully represent the total expense involved.

Sur and Danley both suggested that the true costs of DeepSeek’s model should be examined more closely before investors draw conclusions. They also stressed that AI is still in its early stages, and there’s plenty of room for growth in AI spending, especially as companies continue to push for more advanced models.

Another point raised by Raymond James’ Srini Pajjuri was that, while DeepSeek’s model is competitive, the startup doesn’t have access to the same level of computing resources as large U.S. companies like Nvidia. Nvidia’s massive infrastructure and partnerships with major cloud service providers put it in a stronger position to handle large-scale AI models.

In the end, the DeepSeek announcement may have rattled investors, but it has also sparked a broader conversation about the future of AI. While cheaper models may put pressure on Nvidia’s pricing, the company’s dominance in the AI chip market and its ability to leverage massive computing power still give it a significant edge. As AI continues to evolve, the competition between companies like Nvidia and emerging players like DeepSeek will be something to watch closely.

With AI spending on the rise, Nvidia remains a major player, but it’s clear that the landscape is shifting. Investors and analysts will need to keep a close eye on how companies adapt to this new, more cost-effective approach to AI.

Also Read: Netflix Stock Hits Record High Following Strong Q4 Earnings and Subscriber Surge