S&P 500 Faces Unusual Three-Month Slide: Stock Market Insights

Know why the S&P 500 is experiencing a rare three-month downturn. Understand the factors influencing this market shift and potential outlook.

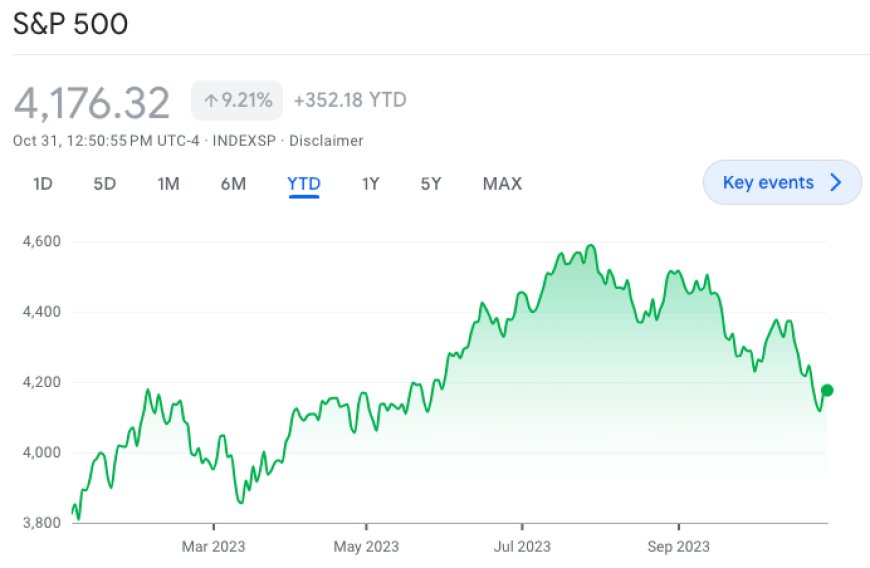

the S&P 500, a widely followed stock market index, is heading for its first three-month losing streak since the onset of the COVID-19 pandemic in March 2020. This signifies a notable shift in market dynamics.

Throughout this year, the tech-heavy Nasdaq has shown remarkable growth, surging by over 22%. However, the broader S&P 500 and the Dow Jones Industrial Average have faced challenges, with the Dow Jones erasing its gains for 2023, reflecting a change in investor sentiment since the summer.

One of the key factors influencing this market shift is the Federal Reserve's unexpected stance on interest rates, which has led to rising yields and a decline in stock prices. Their outlook, suggesting higher interest rates for a longer period, has raised concerns about increased debt costs and their potential impact on business growth.

Additionally, geopolitical tensions in the Middle East and the looming debate over the deficit in Washington have contributed to the list of uncertainties that the market is grappling with.

Putting this year's downturn into perspective, historical data reveals that the S&P 500 typically experiences an average pullback of 14.3% in a given year. Currently, the index stands above 4,150, and for it to align with this historical pattern, it would need to fall to 3,950.

Despite these challenges, there are bright spots. Third-quarter earnings have shown resilience, and the US economy continues to display strength, even in the face of concerns about a potential slowdown. The recent dip in the market has also led to more attractive valuations.

Looking at historical trends, years with downturns in August, September, and October often see a rebound in the final two months. This trend offers a glimmer of hope for a potential market recovery.

While some analysts have adjusted their year-end projections, there remains confidence in the market's potential for growth. A notable strategist now sees the S&P 500 ending the year at 4,400, indicating the possibility of a 15% gain for the year.

As the market navigates through various challenges, including policy shifts and geopolitical tensions, the resilience of the US economy continues to be a crucial factor. Observers will closely monitor the evolving landscape of the market.

Please note that market conditions can change rapidly, and all projections should be interpreted with caution.

Also Read: Good News: US Stocks on the Rise with Exciting Events Ahead