Stock Market Update: Wall Street Eyes Fed Decision with Modest Gains

As US stocks show signs of recovery, all eyes are on the Federal Reserve's policy decision. Get insights into market trends and potential impacts on the economy.

US stocks kicked off the day with a surge. All eyes were on the Federal Reserve's imminent policy decision, while market participants closely tracked developments in the bond market.

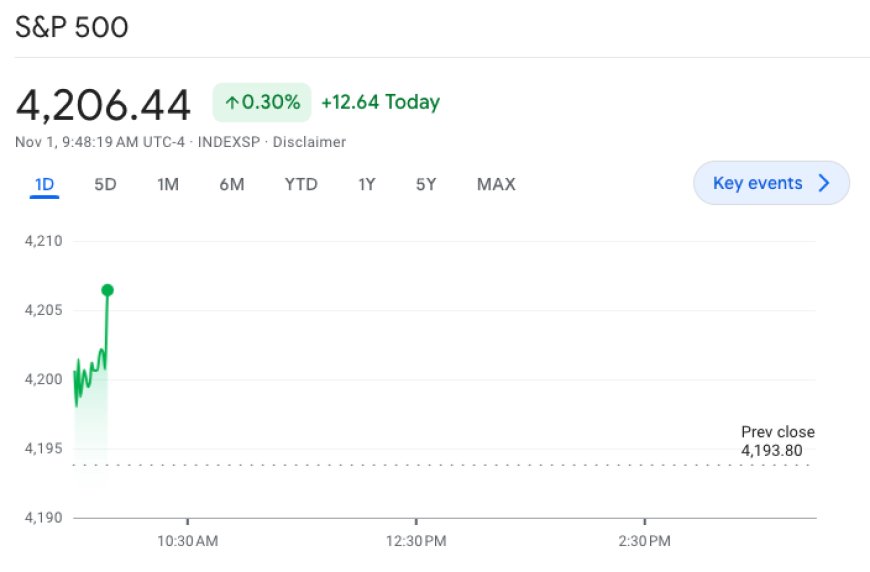

As the opening bell rang, the S&P 500 showed promising signs with a 0.2% increase, while the Dow Jones Industrial Average held steady. The tech-oriented Nasdaq experienced a commendable 0.3% uptick.

The paramount concern for Wall Street was the Federal Reserve's pronouncement on interest rates, slated for Wednesday afternoon, marking the culmination of their meeting. It was widely anticipated that policymakers would maintain the existing rates, while retaining the flexibility for potential adjustments in the future.

Market watchers were poised to dissect the precise wording of the official statement, in addition to parsing through Chair Jerome Powell's remarks for nuanced insights into the Fed's stance on forthcoming rate trajectories. Policymakers have underscored their judicious approach to forestall any substantial deceleration in the US economy, even as they grapple with inflationary concerns.

The 10-year Treasury yield exhibited a slight dip, hovering around 4.87% ahead of the Fed's pivotal decision. This trajectory followed the release of the US Treasury's quarterly refunding update, which disclosed plans to auction $112 billion in debt next week—aligning closely with Wall Street's prognostications. This announcement garnered heightened scrutiny from the stock market, given its palpable influence on the recent surge in yields, precipitated by the August update.

On the economic data front, the ADP National Employment Report for October unveiled that 113,000 jobs were incorporated into the US economy—falling shy of the projected 150,000.

Despite a steady stream of financial reports, this season has thus far failed to galvanize significant upswings in the stock market. Post-earnings, AMD's shares sustained a minor setback; though the chip designer's results surpassed estimates for revenue and profit, it fell short on its fourth-quarter guidance. Concurrently, Kraft Heinz veered off-course, missing analysts' estimates for third-quarter sales, while CVS exhibited an impressive performance, particularly in its pharmacy segment.

The market remains poised and vigilant, awaiting cues from the Federal Reserve, while adeptly navigating the dynamic economic landscape.

Also Read: S&P 500 Faces Unusual Three-Month Slide: Stock Market Insights