Stock Market News: Stocks Rally in Attempted Recovery Amid Inflation Concerns and Disney Focus

Equity market rebounds as attention shifts to US inflation report and Disney earnings. Banking sector concerns and global recovery remain pivotal.

The equity market has embarked on a promising recovery journey, pushing past recent setbacks fueled by banking sector concerns. Investors have now shifted their attention to an imminent US inflation report, redirecting focus away from disappointing Chinese price data.

Futures Point to Positive Start

Stock futures are painting a positive picture, reflecting optimism in the market sentiment. Dow Jones Industrial Average (^DJI) futures are showing an uptick of approximately 0.1%, translating to around 40 points. S&P 500 (^GSPC) futures are indicating a gain of nearly 0.2%, while Nasdaq 100 futures (^IXIC), driven by technology, have registered an increase of about 0.1%.

Awaiting Crucial Inflation Data

With anticipation building up, all eyes are on the impending July US inflation report set to be unveiled on Thursday. Against this backdrop, the revelation of data today highlighting China's consumer sector slipping into deflation during July has caused ripples in the financial realm. The slump underscores Beijing's ongoing struggle to stimulate demand in the world's second-largest economy, sparking concerns about a prolonged slowdown with potential global ramifications.

Banking Sector Woes and Inflation Pressure

While investors navigate these uncertainties, the recent Moody's downgrade of midsize US banks serves as a reminder that challenges persist in the financial landscape. The performance of the banking sector, coupled with inflationary pressures, remains a pivotal factor influencing decisions made by the Federal Reserve as it navigates its rate-hiking strategy.

Disney's Earnings Awaited

An eagerly awaited highlight on the corporate calendar is Disney (DIS), whose earnings are under scrutiny. Market observers are keenly watching Disney's post-market earnings performance to glean insights into its approach in tackling headwinds in advertising and mounting streaming losses. Notably, Disney's premarket trading witnessed an upward trajectory after its ESPN network forged a groundbreaking sports betting pact with PENN Entertainment (PENN).

Mixed Start for Stocks

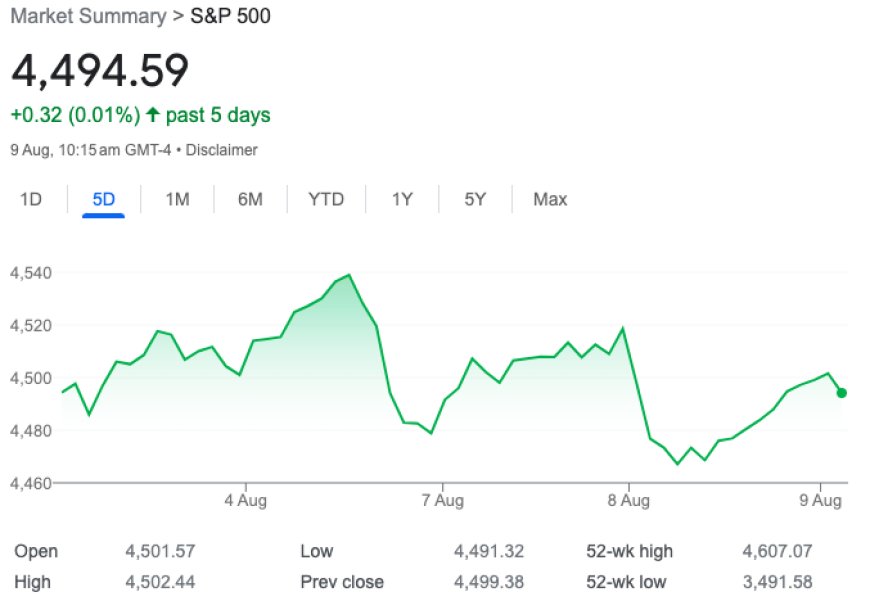

As the market kicked off on Wednesday morning, stocks found themselves at a crossroads. The S&P 500 (^GSPC), the Dow Jones Industrial Average (^DJI), and the Nasdaq Composite (^IXIC) hovered near the flat line, reflecting a cautious sentiment. The balance hinges on Disney's earnings disclosure after the market's close and the impending inflation update scheduled for Thursday morning.

Trending Tickers Pre-Market

Several stocks have caught the market's attention in premarket trading, emerging as trending tickers on Yahoo Finance's radar:

-

Twilio Inc. (TWLO): The software company's shares surged by 7%, riding on an improved profit outlook for the year and quarterly sales and profit figures surpassing analysts' expectations.

-

WeWork Inc. (WE): Shares of the shared office provider plummeted over 25% after casting doubts on its viability, hinting at the possibility of bankruptcy.

-

PENN Entertainment, Inc. (PENN): A remarkable 15% surge followed the gambling and casino company's $2 billion sports betting collaboration with Disney's ESPN. PENN also reported promising second-quarter revenue before the market's commencement.

-

Lyft, Inc. (LYFT): The ride-hailing firm's shares took a hit with a 6% decline, overshadowing a favorable earnings outlook due to the revelation of the slowest second-quarter revenue growth in two years.

Futures Forecast Positive Momentum

Futures for the S&P 500 (^GSPC) signal a positive start, rising by 0.17%, while Dow Jones Industrial Average (^DJI) futures gained 0.12%, equivalent to 40 points. Nasdaq 100 futures climbed by 0.14%, reflecting the technology sector's resilience.

Navigating Banking Uncertainties and Global Recovery

Major indices ended Tuesday's trading session on a cautious note, managing to recover partially from deeper losses witnessed earlier in the day. Concerns about the health of US banks resurfaced, adding to market unease. Concurrently, apprehensions surrounding China's economic recovery trajectory intensified as consumer inflation witnessed its first decline since 2021.

Also Read: U.S. Stocks Begin the Week with Strong Momentum, Focused on Inflation Report