Stock Market Update: Positive Start Amidst Focus on Key Data

The stock market kickstarts the week on an upbeat note, as investors navigate the aftermath of Jay Powell's speech and await crucial inflation and job figures. Gain insights into the latest market trends and forecasts.

The new trading week commenced on an optimistic note, with stocks opening on the upswing. Investors are navigating the aftermath of Federal Reserve Chair Jay Powell's recent speech and eagerly awaiting vital data on inflation and job figures.

Promising Indicators

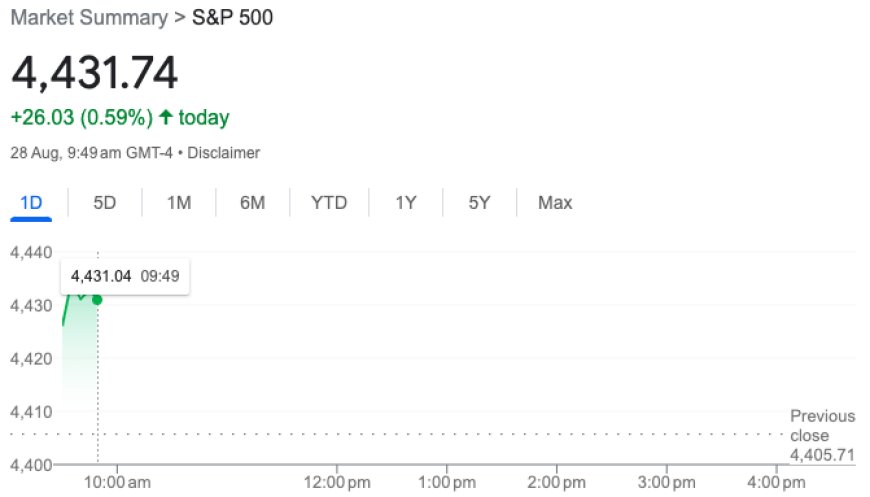

As the opening bell rang, both the S&P 500 and Dow Jones Industrial Average exhibited gains of around 0.5%, conveying a positive sentiment. Additionally, the tech-oriented Nasdaq Composite surged by approximately 0.8%, further signaling the market's encouraging momentum.

Reviewing Last Week

Reflecting on the prior week's performance, the Dow encountered a minor setback of 0.5%, while the Nasdaq saw a robust surge of 2.2%. The market's reaction was buoyed by Nvidia's impressive earnings report and the ripple effects of Powell's address in Jackson Hole.

Approaching August's End

With the month of August drawing to a close, futures tied to the major US stock indexes are pointing towards a favorable trajectory. These futures serve as predictive indicators for market direction and are currently suggesting a positive start to the week:

-

S&P 500 futures are hinting at a potential 0.3% uptick.

-

Dow and Nasdaq futures are reflecting a gain of approximately 0.4% about an hour before the market's opening.

Anticipating Crucial Data

This week is brimming with pivotal events that have captured investors' attention. Of particular significance are two upcoming data releases:

-

Thursday: The unveiling of core PCE inflation data.

-

Friday: The release of the August jobs report.

In light of Powell's speech, experts are less inclined to predict another interest rate hike in September. The prospects for further rate increases, especially in November, have become more challenging to navigate.

Decoding Powell's Message

Analysts are interpreting Powell's speech as a signal that the Federal Reserve is adopting a cautious stance, awaiting specific indicators before considering additional rate hikes. These indicators might encompass robust GDP growth or a cessation of the labor market's cooling trend.

Projected Trajectory

The general consensus is that the economy could witness a slight deceleration, potentially leading to diminished wage and price escalations. Consequently, the Federal Reserve is expected to adhere to its current strategy in response to these shifting dynamics.

As the week unfolds, all eyes are on forthcoming economic data, poised to play a pivotal role in shaping the market's trajectory. Stay tuned for ongoing updates as developments transpire throughout the week.