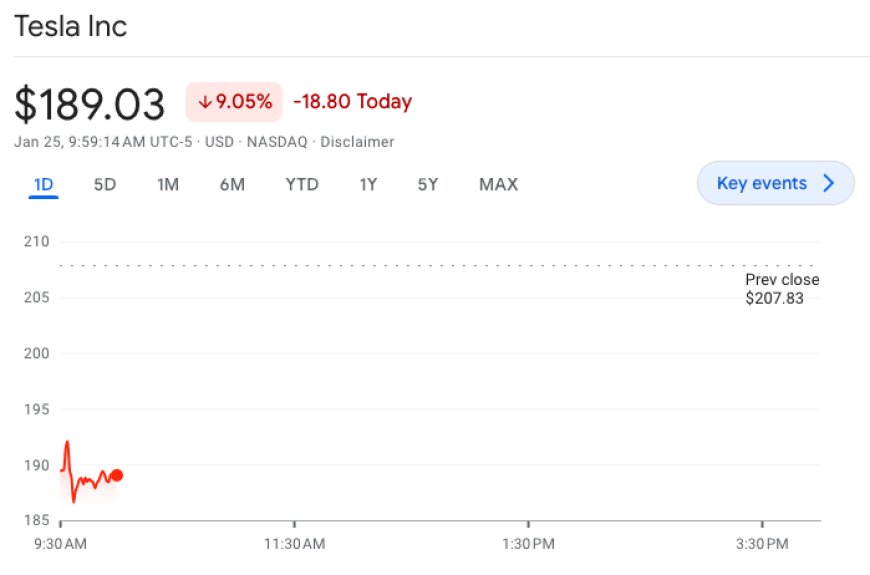

Tesla Stock Faces 9% Dip on Q4 Earnings Shortfall and Lowered Production Growth Forecast

Tesla Stock Plummets 9% on Q4 Earnings Disappointment and Lowered Production Expectations: CEO Elon Musk Provides Glimpse of Next-Gen Vehicle in 2025.

Tesla's (TSLA) stock witnessed a 9% decline early Thursday following the company's announcement of fourth-quarter earnings that fell short of expectations. The electric car giant reported top-line revenue of $25.17 billion for the fourth quarter, slightly below the expected $25.87 billion. Despite a 3% increase in revenue compared to the previous year, Tesla's adjusted earnings per share (EPS) came in at $0.71, missing the anticipated $0.73.

Furthermore, Tesla's full-year production outlook dampened investor enthusiasm, with the company stating that the "vehicle volume growth rate may be notably lower than the growth rate achieved in 2023." The outlook hints at challenges as Tesla's teams concentrate on the launch of the next-generation vehicle at Gigafactory Texas. This revelation dashes hopes of reaching the Street's estimated 2.19 million vehicle production for 2024, representing a 21% increase from 2023.

CEO Elon Musk did provide a silver lining by confirming the arrival of the company's next-gen vehicle in the second half of 2025. During the earnings call, Musk emphasized progress on Tesla's next-gen manufacturing platform, describing it as a "revolutionary manufacturing system, far more advanced than any other in the world."

The drop in Tesla's profitability is attributed to pressure on margins resulting from the company's cost-cutting initiatives initiated in late 2022. The fourth-quarter gross margin of 17.6% fell short of the estimated 18.1%, marking a significant decline from the previous year.

Various factors contributed to Tesla's recent challenges, including Hertz shedding thousands of EVs, price cuts in China, a production halt in Berlin, and Elon Musk's untimely call for more stock. Despite these hurdles, Tesla reported a record-breaking 484,507 deliveries in Q4, surpassing Street estimates.

Looking ahead, Cybertruck deliveries remain in demand, although Tesla did not provide specific figures in its Q4 delivery update. Elon Musk expressed optimism about the Cybertruck's popularity and addressed concerns about his influence over Tesla's future, citing potential challenges from shareholder advisory firms like Institutional Shareholder Services (ISS) and Glass Lewis.

In summary, Tesla's stock dip is linked to Q4 earnings missing estimates, coupled with a cautious full-year production outlook. However, the company remains committed to innovation, with the next-gen vehicle expected in 2025 and ongoing progress on a groundbreaking manufacturing platform.

Also Read: Tech Earnings Boost US Stock Futures, S&P 500 Eyes Another Record High