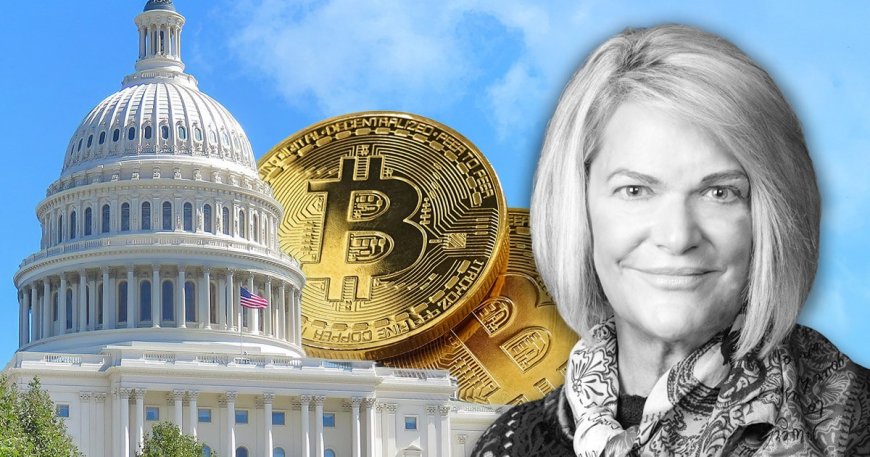

The Senate most prominent advocate for cryptocurrency known as the crypto queen has unveiled a far reaching new bill focused on Bitcoin

The bill's contents are expected to reveal which individuals or groups wield significant influence in the rapidly growing realm of crypto lobbying.

Sens. Cynthia Lummis and Kirsten Gillibrand have generated months of excitement for the highly anticipated legislation in the history of cryptocurrency, which is about to be unveiled.

Throughout the past year, Senator Cynthia Lummis, a first-term Republican from Wyoming, has been building up anticipation for her comprehensive plan to regulate digital currencies. She has teased the contents of the plan through a variety of platforms, including podcast appearances, industry events, and media interviews, all of which have captivated the Bitcoin community. Meanwhile, Senator Kirsten Gillibrand, a Democrat from New York, joined the effort as a co-author in March, adding a touch of bipartisanship to the project and further fueling the hype surrounding it.

As the release of Lummis and Gillibrand's comprehensive digital currency regulation plan draws closer, a frenzy of lobbying has erupted among digital asset startups, venture capitalists, and consumer watchdogs. These groups are vying for the opportunity to influence the bill, which insiders believe will shape how Congress approaches regulation of crypto in the future. While it is unlikely that the bill will pass in its current form, the stakes are high and industry players are keen to make their mark on the legislation.

On May 28th, 2022, Senator Cynthia Lummis made a statement via Twitter.

I am working diligently with @sengillibrand to finalize bill text of our comprehensive digital asset legislation.

Any language circulating online is an incredibly outdated version from March 1. Stay tuned for our release of the actual bill on June 7th! — Senator Cynthia Lummis (@SenLummis) May 27, 2022

Miles Jennings, who serves as the crypto general counsel and head of decentralization at Andreessen Horowitz, has expressed his excitement over the sweeping Bitcoin bill proposed by Senators Cynthia Lummis and Kirsten Gillibrand. According to Jennings, this bill will serve as a starting point for discussions on what crypto regulations should look like in the future. Andreessen Horowitz is a leading Silicon Valley venture capital firm that is known for its investments in the digital assets space and its active participation in lobbying efforts.

The bill's contents will reveal which entities have the most influence in the rapidly expanding field of cryptocurrency lobbying. The legislation has sparked clashes among the industry's numerous trade associations, each supported by rival digital asset startups. Aides from both lawmakers' offices have reported being inundated with input on how to handle issues ranging from cryptocurrency exchange regulations to tax policies.

Lawmakers have recently started drafting several crypto bills as companies vie for power and influence.

During her speech at the Bitcoin Miami conference earlier this year, Lummis, who has been holding Bitcoin since 2013, shared her thoughts on the impact of digital assets on the political sphere, saying, "It's difficult to focus on things that are abstract, and for most members of Congress, this has been abstract for a long time. That has changed significantly in the last 12 months — and part of that's thanks to all of you."

Detractors of the crypto industry caution that the hype surrounding the forthcoming bill is indicative of a growing campaign by digital asset firms to persuade policymakers to provide them with exemptions from the regulations that govern conventional finance.

The senators, Lummis and Gillibrand, are competing to position their states as the centers of a blockchain-based economy. Lawmakers in Wyoming have taken the lead in creating new legislation to accommodate crypto banks and decentralized trading platforms. Meanwhile, New York City Mayor Eric Adams has invested his early paychecks in Bitcoin and ether in an effort to attract digital asset businesses to the Empire State.

At a POLITICO Live event earlier this year, Gillibrand emphasized New York's aspiration to participate in the expanding blockchain-based economy. She pointed out that New York is the center of the global financial markets, and stated that this is one of the fastest-growing sectors in which New York certainly wants to have a share.

However, a leaked draft of the bill that dates back to before Gillibrand's involvement caused concern for the Center for American Progress, a left-leaning think tank. Todd Phillips, the group's director of financial regulation and corporate governance, claimed that it would have enabled token-based startups to avoid securities laws and allowed investors to evade taxes on crypto transactions under $600. Securities and Exchange Commission Chair Gary Gensler has been vocal about the fact that most digital assets likely fall under his agency's jurisdiction, which has put him at odds with industry executives who want to steer clear of the agency.

Drafting new legislation on digital assets can be challenging as most aspects are already covered by existing laws. Ty Gellasch, a former SEC official and the executive director of the investor advocacy group Healthy Markets, highlights the challenge with drafting new legislation: "The industry effort doesn’t seem focused on getting clarity, but rather getting loopholes." The upcoming release of the bill on Tuesday is likely to spark debates between industry groups, crypto watchdogs, and academics on the specifics.

The bill is expected to cover several issues, including regulations for trading platforms and crypto service providers, cybersecurity, banking regulation, investor protection standards, and stablecoins.

It seems that the development of the bill has spurred competing interests among different crypto lobbying groups and lawmakers. Kara Calvert, the head of U.S. policy at the crypto exchange Coinbase, said that both Gillibrand and Lummis have an "open-door" policy to feedback on the specifics of the bill.

This creates a balance for congressional staff writing the bill to take into account both the input from stakeholders and the lawmakers' objectives. The bill's earlier draft included a proposal for self-regulatory organizations for the industry, a proposal supported by the Association of Digital Asset Markets (ADAM) but deemed potentially cumbersome by the Blockchain Association.

It seems that the bill aims to exempt Bitcoin miners from financial brokerage regulations and give the Commodity Futures Trading Commission more authority over cryptocurrency markets. ADAM CEO Michelle Bond stated that Lummis and Gillibrand aim to strike a balance between industry interests and consumer protection. However, the specific details of the bill remain to be seen, and the industry is likely to clash over certain provisions.

The level of discretion that the SEC may be given with respect to determining whether certain digital assets qualify as securities could be a disappointment to industry players, according to Miles Jennings of Andreessen Horowitz. Crypto executives have previously been critical of the SEC's strict approach to digital currency trading, and they may hope to see a more lenient approach from the agency as a result of the new legislation.

According to Hill staffers involved in the development of the bill, both the SEC and CFTC have provided input. However, finding a balance between the interests of industry leaders and regulators has proved to be a daunting task, according to crypto attorney Lewis Cohen, who advised Lummis staff on the legislation. Cohen expressed his belief that treating all tokens as securities without exception would be legally incorrect and detrimental to the country's policy. Nevertheless, he also noted that disregarding the SEC's concerns would be legally unsound and have negative implications for the United States.

As the release of the crypto regulation bill draws near, lobbying efforts from various industry groups and stakeholders are expected to intensify in the upcoming months. Senator Lummis and Senator Gillibrand disclosed at a recent conference that their legislation could fall under the jurisdiction of as many as four Senate committees if it advances. According to Kristin Smith, the Executive Director of the Blockchain Association, the debates around this legislation will be a significant focus, and if it is successfully passed, it could be a pivotal moment for the crypto ecosystem.

In conclusion, the proposed bill is set to shake up the cryptocurrency world and reveal who holds sway in the ever-expanding universe of crypto lobbying. The release of the bill is expected to attract clashes between industry groups, crypto watchdogs, and academics over the details, setting the stage for the battle for crypto regulation.

Read Also: The Benefits of Cryptocurrencies in Business: Real-Life Use Cases and Advantages