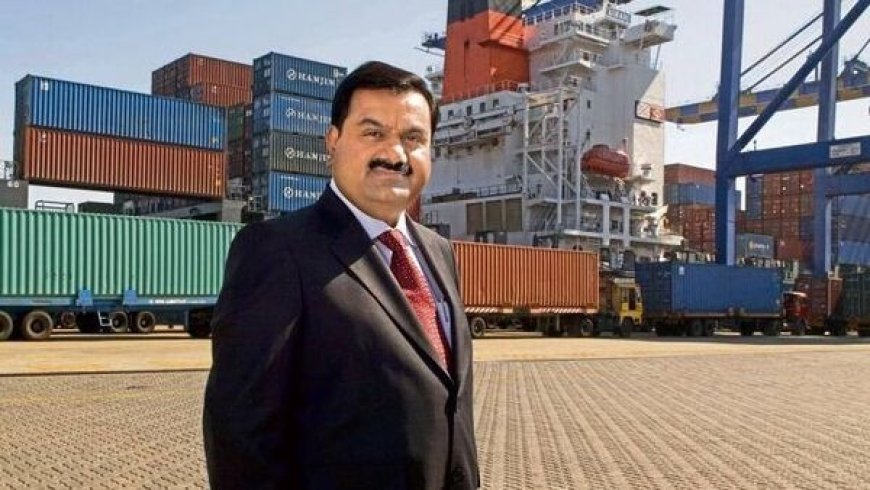

Adani Ports Questions Deloitte's Exit Amid Financial Transparency Debate

Adani Ports questions Deloitte's abrupt exit as auditor, sparking a debate on financial transparency. Explore the reasons behind Deloitte's decision and the implications for the Adani Group

Adani Ports, a major player in India's business landscape, is contesting Deloitte's recent decision to step down as its auditing partner. The company has deemed Deloitte's explanation for the resignation as "inadequate to justify such a move," raising eyebrows and sparking a fresh debate over financial transparency and accountability.

Deloitte, a global auditing giant, cited concerns about specific related-party transactions flagged in a report from U.S. short seller Hindenburg earlier this year as the primary reason for its resignation. However, it has come to light that Adani Ports chose not to independently investigate these transactions, a confidential source revealed to Reuters on Friday.

This abrupt exit of Deloitte from its auditing role has cast a spotlight on the financial practices within the Adani Group, led by Indian business tycoon Gautam Adani. The group swiftly rebuffed Hindenburg's allegations, which center around allegations of improper utilization of tax havens and questionable business dealings.

Breaking its silence on the matter, Adani Ports issued a statement expressing its view that Deloitte had indicated during discussions that it perceived limitations in its broader auditing responsibilities due to its concurrent roles as auditors for other Adani Group companies. Adani Ports, however, clarified that the authority to recommend appointments for other entities rested outside its purview, as these entities function independently.

In an official statement, Adani Ports' Audit Committee stated, "Upon careful consideration, we found the grounds provided by Deloitte for resigning as the Statutory Auditor to be unconvincing and insufficient to warrant such a drastic step."

In a mutual understanding, Adani Ports and Deloitte amicably concluded their contractual relationship, given Deloitte's reluctance to continue as the auditor.

As of now, Deloitte has not yet responded to requests for comments on this matter.

Following the release of the Hindenburg report, the stock value of Adani Group suffered a staggering loss of approximately $150 billion. However, the group managed to recover around $50 billion in market value following strategic debt management measures and by reinstating investor trust, notably that of Australia-listed investment firm GQG Partners.

In a recent development, Adani's Ambuja Cements announced its plans to acquire a majority stake in the smaller rival Sanghi Industries, with the deal valued at up to $295 million. This transaction marks Adani's significant move since the Hindenburg controversy unfolded.

In light of Deloitte's departure, Adani Ports swiftly appointed MSKA & Associates, an independent member of BDO International, as its new auditor. This transition aims to ensure seamless continuity in auditing processes, according to the statement released by Adani Ports.

In May, Deloitte initially highlighted specific transactions flagged by Hindenburg's report and issued a qualified opinion relating to Adani Ports. This opinion reflected the auditor's concerns about certain operational aspects of the company.

The controversy surrounding Deloitte's resignation underscores the intricate relationship between businesses and their auditors, raising important questions about transparency, accountability, and corporate governance. As the Adani Group navigates this situation, the broader financial community will be closely observing the implications of this development.

Also Read: Israeli Tech Industry in Flux as Startups Explore Overseas Moves Amid Judicial Changes