Trump’s ‘Big Beautiful Bill’ Offers Tax Breaks, Adds Trade Risks

Senate’s new economic bill delivers major tax relief for businesses, but includes foreign tariffs, clean energy cuts, and deeper debt concerns.

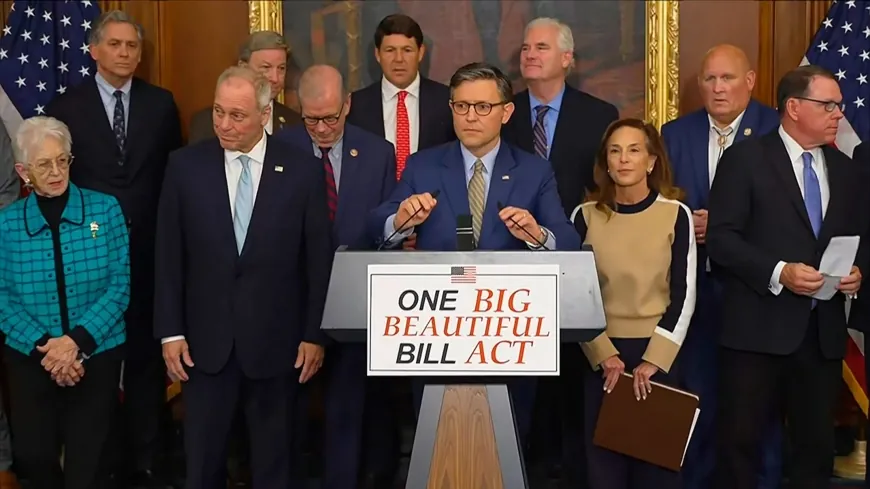

The Senate's version of President Donald Trump's much-anticipated economic package, dubbed the "Big Beautiful Bill," hit the floor Monday with major implications for U.S. businesses. While the proposed legislation delivers long-sought tax relief and investment incentives, it also includes provisions that have set off alarms across multiple industries.

Spanning 549 pages, the bill diverges in key areas from the House version passed in May, particularly on taxes, clean energy, Medicaid funding, and trade penalties. One major victory for corporations: permanent tax deductions for interest expenses and capital investments. Senate Republicans argue this gives businesses the predictability needed to expand operations and hire more workers.

"We are giving American job creators the stability they need to plan and grow," said Senate Finance Chairman Mike Crapo, as he introduced the new tax measures. The proposed deductions, including for factory construction, R&D costs, and depreciation, are more generous and enduring than in the House blueprint, which had set expiration dates for similar provisions.

But that win comes with caveats. The Senate bill retains a controversial proposal nicknamed the "revenge tax" — a retaliatory duty aimed at foreign governments and corporations that enforce policies seen as discriminatory to U.S. firms. While the Senate version reduces the potential tariff rate to 15% and delays implementation until 2027, business groups remain wary, warning it could trigger trade disputes and dampen foreign investment.

Other measures are more industry-specific. Clean energy firms, for instance, face a phased rollback of Biden-era tax credits. Under the Senate plan, incentives for solar, wind, and EV adoption will shrink over the next three years, disappearing entirely by 2028. Environmental advocates warn this will undercut growth in green sectors and stall climate goals.

"We're setting back clean energy progress for political messaging," said Amy Hanauer of the Institute on Taxation and Economic Policy. "Communities relying on these jobs will feel the impact quickly."

In contrast, fossil fuel companies stand to gain, as the bill streamlines permitting, opens more public lands to leasing, and eliminates fees tied to methane emissions.

Meanwhile, workers earning tips and overtime pay see modest benefits under the plan. While Trump promised tax-free treatment for these earnings, the Senate version limits the deduction to $25,000 annually. Still, it marks a step forward for service industry advocates pushing for tip protections.

Small businesses also find mixed results. The Senate bill makes the popular 199A pass-through deduction permanent but locks it in at a 20% rate, lower than the 23% in the House plan. Critics say the change weakens its intended benefit for Main Street operators.

Beyond tax policy, the bill carries steep cuts to Medicaid’s provider funding and slashes the SALT (State and Local Tax) deduction cap from $40,000 to $10,000. The SALT reduction, labeled "still under negotiation" in the bill's summary, has drawn resistance from lawmakers representing high-tax states. Several Republican senators have threatened to withhold support if that piece remains unchanged.

Senator Ron Johnson of Wisconsin signaled early opposition, citing both the SALT change and the package's projected impact on federal debt. The Senate version raises the borrowing cap by $5 trillion, a trillion more than the House plan, and includes few provisions to offset the added deficit.

Another point of contention: the bill's section on AI regulation. The Senate framework softens earlier proposals to ban state-level AI rules but still restricts local governance. The issue could trigger procedural hurdles under Senate reconciliation rules, and tech watchdogs are already voicing concern.

With just weeks before Congress's self-imposed July 4 deadline, Republican leaders are racing to resolve disputes and secure votes. But some analysts say that date is likely to slip. "This is progress, not the finish line," said Tobin Marcus of Wolfe Research. "July may come and go before a final deal is done."

Still, business groups are watching closely. With permanent tax relief on the table, many are hopeful. But with volatile elements like the revenge tax, clean energy cuts, and rising deficits, the Senate bill is anything but a slam dunk.

Also Read: Trump Big Beautiful Bill Moves Forward with Tax Cuts for Manufacturers, Setbacks for Green Energy