Apple's August Woes: From Highs to Correction Amid China and iPhone 15 Buzz

Apple's stock experiences a notable decline in August, entering a correction phase. Economic pressures in China and iPhone 15 expectations contribute. Read more.

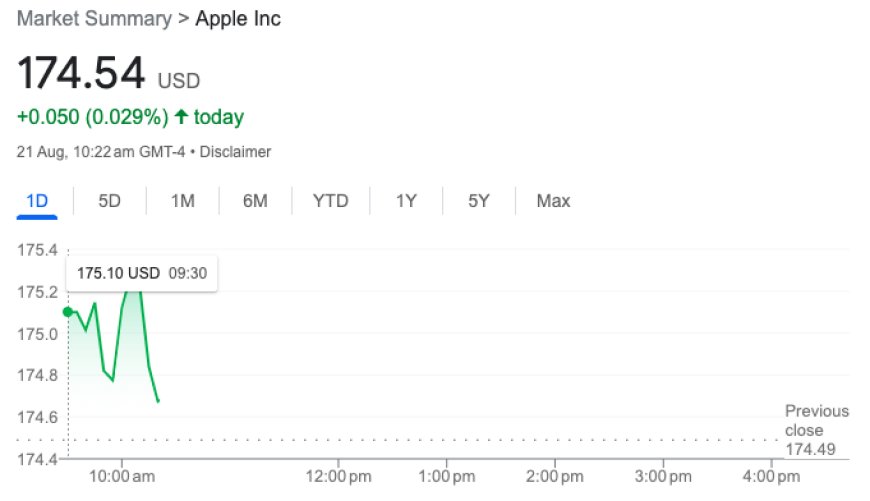

Apple Inc. (AAPL), the tech titan, is grappling with a challenging month as its stock performance takes a notable hit. The company's shares have undergone a substantial 10.8% decline, reaching $175.07 during August. In contrast, the broader market saw a milder 4.8% drop in the S&P 500 and a 3% dip in the Dow Jones Industrial Average, according to data from Yahoo Finance. This stumble has propelled Apple's stock into a technical correction phase, marking an approximately 11% fall from its peak value of $196.45 on July 31.

In stock market terms, a "correction" typically entails a decline of at least 10% from a stock's recent peak.

The downward trajectory of Apple's stock price can be attributed to a multitude of factors, experts suggest.

Foremost among these is the mounting economic pressures in China that have unfolded throughout August. Concerns surrounding the health of over-leveraged property developers, coupled with a cautiously reactive stance by the Chinese government amidst a brewing crisis, have cast an air of uncertainty over the outlook for Apple's product demand. Additionally, a sagging stock market has contributed to the overall gloomy sentiment.

The Chinese market's significance to Apple's financial performance cannot be underestimated.

Recent data revealed that Apple's sales in Greater China surged by 8% in the latest quarter, reaching a remarkable $15.76 billion. Of particular note, iPhone sales in the region experienced a double-digit growth rate, primarily driven by a surge in consumer upgrades of smartphones.

Greater China is poised to make a substantial contribution of $67.2 billion to Apple's fiscal year sales, which concluded on September 24, 2023, accounting for a solid 18% of the total sales figure. Notably, analysts on Wall Street are projecting a nearly 16% uptick in sales from Greater China for Apple's upcoming fiscal year, largely attributed to the heightened anticipation surrounding the much-talked-about iPhone 15.

However, CEO Tim Cook's recent cautious tone regarding China's economic prospects has added an element of caution. In Apple's financial outlook for the September quarter, Cook indicated a modest decline in year-over-year revenue, deviating from the market's initial expectations of a modest growth trajectory during the same period.

Speaking during an earnings call, Cook acknowledged, "We continue to navigate an uneven macroeconomic landscape."

Faced with potential headwinds in China's market, investors have taken a proactive approach by divesting from Apple shares in light of prevailing uncertainties.

Furthermore, Apple's imminent launch of the iPhone 15 in mid-September, though eagerly anticipated, is not without its challenges. Unlike previous groundbreaking releases, the upcoming iPhone iteration is expected to showcase incremental improvements rather than groundbreaking innovations. Analysts, such as Amit Daryanani from Evercore ISI, are anticipating an evolutionary rather than revolutionary shift in the iPhone's features.

Despite the challenges and the decline in stock price, industry experts remain steadfast in their commitment to Apple. Notably, there have been limited instances of downgrades from investment banks. For instance, Rosenblatt Securities analyst Barton Crockett shifted his rating for Apple from Buy to Neutral.

Crockett emphasized, "In light of the impending iPhone 15 cycle and the broader tech bull market, we see Apple as an attractive investment, even amidst the re-emergence of bearish sentiment and the Federal Reserve's 'higher for longer' interest rate stance."

As the month progresses, all eyes are on Apple to see how it navigates the market's challenges and charts a course towards regaining its momentum.

Also Read: Wall Street Anticipates Positive Start: Jackson Hole and Nvidia Earnings in Focus