Big Tech Giants Headline Earnings Reports: What Investors Should Watch

Major tech players, including Microsoft, Alphabet, Meta, and Amazon, headline crucial earnings reports. Economic growth and inflation metrics are also in focus.

The upcoming week will be dominated by major tech companies' earnings announcements.

Microsoft (MSFT), Alphabet (GOOGL), Meta (META), and Amazon (AMZN) are set to unveil their financial reports, alongside updates from Coca-Cola (KO) and Exxon (XOM), promising a bustling week for corporate disclosures.

Economic observers will be keenly eyeing Thursday's release of the initial third-quarter GDP estimate, projected to reveal a 4.3% annualized growth for the US economy. Friday will also offer a fresh insight into the Federal Reserve's preferred inflation measure.

These reports from the tech giants come at a pivotal moment for the markets. Recent record-breaking 16-year highs in Treasury yields and uncertainties surrounding the Federal Reserve's trajectory in its interest rate adjustments have cast a shadow over stocks in the past month.

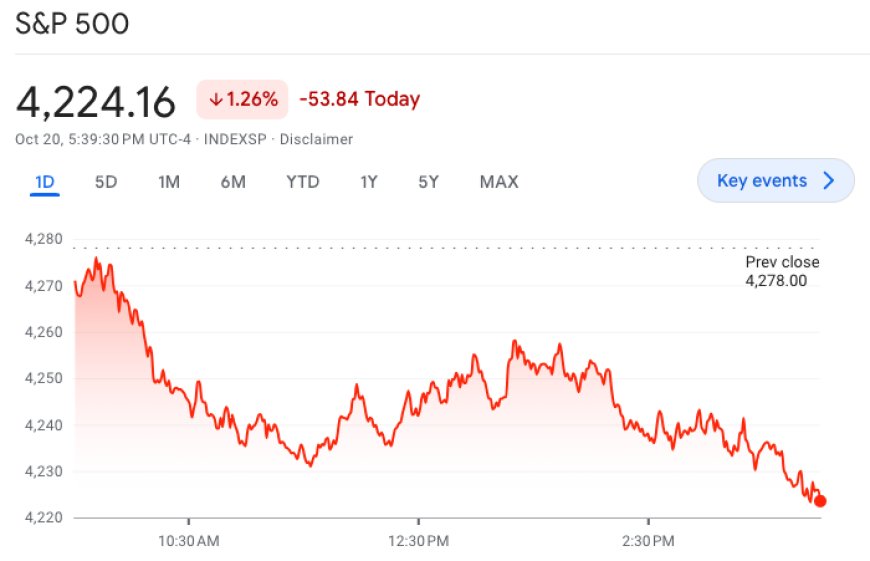

In the previous week, Nasdaq (^IXIC) saw a decline of over 3%, while the benchmark S&P 500 (^GSPC) and the Dow Jones Industrial Average (^DJI) experienced drops of more than 2% and 1.6%, respectively.

The Federal Reserve is entering a blackout period this week prior to its upcoming meeting, commencing on Oct. 31. Current market sentiment suggests over a 96% likelihood that the Fed will not raise interest rates during this meeting.

During his address at the Economic Club of New York on Thursday, Powell provided an assessment of the present economic landscape. He still perceives inflation as "too high" and potentially jeopardized by the "highly resilient economy."

Economists believe this speech may have effectively ruled out a rate hike in November but left the door open for future considerations.

EY's chief economist, Greg Daco, noted in a research report on Friday, "The recent string of positive economic surprises will keep the Federal Reserve on high inflation alert, and although it won’t tilt the Federal Open Market Committee toward another rate hike at the November meeting, the December meeting will very much remain a 'live' one."

The upcoming week will be a pivotal moment for metrics closely monitored by the Fed: economic growth and inflation. Thursday's GDP release is anticipated to represent the zenith of economic growth in 2023, following a series of robust data points that have postponed recession concerns until 2024.

Friday's data is projected to reveal a 3.7% year-over-year rise in "core" PCE (Personal Consumption Expenditures), which excludes food and energy costs, for September. This is a slight dip from August's 3.9%. The Fed's target for inflation is 2%, on average. Over the prior month, "core" PCE is expected to show a 0.3% rise in September.

The interplay between these two figures will be closely monitored over the coming months. Bank of America's US economist, Michael Gapen, elucidated his interpretation of the central bank's recent commentary on these metrics in a weekly research note on Friday.

"Either growth will decelerate or inflation will start to ascend," Gapen noted. "If growth slows, the Fed might not need to implement further hikes. However, if inflation picks up, additional rate hikes may be warranted."

Turning to the corporate realm, four of the "Magnificent Seven" stocks that have been the driving force behind the 2023 stock market surge will provide their quarterly updates. These updates may set the stage for stock movements that could influence the three major indexes.

In a note on Oct. 12, an investment strategist at Bank of America pointed out that without the Magnificent 7, the S&P 500 would be just below 3,900, roughly 10% lower.

At an individual company level, all four of the major tech firms are poised to offer insights into consumer spending, advancements in artificial intelligence, and developments in the advertising industry. Additionally, revenue figures for cloud segments will be closely scrutinized at both Microsoft and Amazon.

Also Read: Big Tech Giants Rescuing S&P 500 Earnings Amid Market Concerns