Billionaire Investors Show Interest in Warren Buffett's Portfolio: Here are the Top Stocks

Discover top stocks from Warren Buffett's portfolio attracting billionaire investors. VeriSign, DaVita, Kraft Heinz, American Express, and Citigroup analyzed. Stay informed with stock market trends.

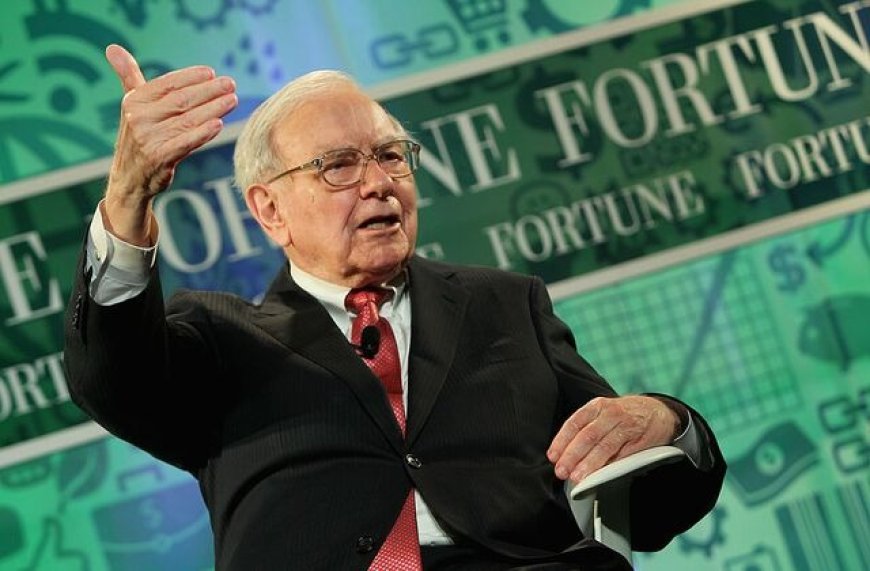

Investing in today's unpredictable stock market can be challenging, but billionaire investors are closely eyeing Warren Buffett's portfolio for inspiration. As the legendary investor and CEO of Berkshire Hathaway, Buffett has a track record of making successful investment decisions. Other billionaires are taking note and loading up on stocks from his portfolio. In this news article, we delve into the top stocks that have captured the attention of billionaire investors.

Analyzing Buffett's Portfolio:

To identify the stocks attracting billionaire investors, we conducted an in-depth analysis of Warren Buffett's portfolio for the first quarter of 2023. By cross-referencing the holdings of 27 billionaire hedge fund managers from Insider Monkey's database, we discovered the stocks that generated the most interest among these influential investors.

Top Stocks in Buffett's Portfolio:

VeriSign, Inc. (NASDAQ: VRSN) - Garnering Attention from 8 Billionaire Investors

VeriSign, a Reston-based software company, offers essential internet services such as domain name maintenance and server management. Our analysis revealed that 37 out of 943 hedge funds had invested in VeriSign. Jim Simons' Renaissance Technologies emerged as the largest investor, owning a significant 3.1 million shares worth $672 million.

DaVita Inc. (NYSE: DVA) - Attracting Interest from 8 Billionaire Investors

DaVita, headquartered in Denver, focuses on providing healthcare solutions for patients with kidney problems, operating both inpatient and outpatient dialysis centers. Our research uncovered 32 hedge funds that had invested in DaVita. Jeffrey Gates' Gates Capital Management stood out as the second-largest investor, with holdings of one million shares valued at $84 million.

The Kraft Heinz Company (NASDAQ: KHC) - Earning Attention from 8 Billionaire Investors

Pittsburgh-based food products company, The Kraft Heinz Company, boasts a rich history dating back to 1869. With a diverse product range including cheese, coffee, meats, and dairy products, it continues to attract investors. Our findings indicated that 34 out of 943 hedge funds had invested in Kraft Heinz. Jean-Marie Eveillard's First Eagle Investment Management held the largest stake, owning 6.6 million shares valued at $256 million. It's worth noting that Warren Buffett retains the title of the largest overall investor, having invested a staggering $12 billion in the company.

American Express Company (NYSE: AXP) - Drawing Interest from 8 Billionaire Investors

Known for its payment platform services, American Express provides credit and debit cards to various banks. Corporate and private customers also benefit from its digital payment solutions and travel services. Among the 943 hedge funds analyzed, 77 had invested in American Express. Warren Buffett's Berkshire Hathaway emerged as the dominant investor, holding a substantial stake worth $25 billion through 151 million shares.

Citigroup Inc. (NYSE: C) - Attracting Interest from 9 Billionaire Investors

New York-based Citigroup, one of the oldest banks globally, offers a range of financial services to retail and investment customers worldwide. Our analysis revealed that 79 hedge funds had invested in Citigroup. Warren Buffett's Berkshire Hathaway holds the largest stake, with 55 million shares valued at $2.5 billion.

Conclusion:

Warren Buffett's investment prowess continues to captivate billionaire investors seeking profitable opportunities. VeriSign, DaVita, Kraft Heinz, American Express, and Citigroup are among the top stocks from Buffett's portfolio that have garnered attention. These stocks not only reflect Buffett's investment acumen but also signify the confidence shared by other influential investors. As the stock market evolves, it's worth keeping a close watch on these stocks to gain insights from some of the most successful investors in the world.