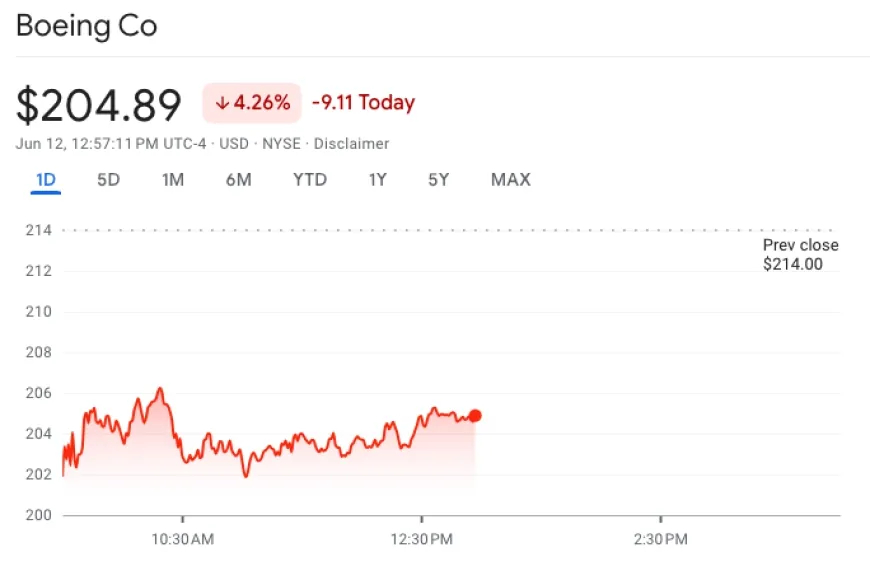

Boeing Stock Crashes After Air India 787 Plane Crash Kills 200+

Boeing shares plunge after Air India Dreamliner crash near Ahmedabad kills over 200. First fatal 787 crash raises new safety concerns.

Boeing (NYSE: BA) stock tumbled more than 4% on Thursday following a tragic crash involving an Air India aircraft shortly after departure from Ahmedabad airport. The flight, bound for London’s Gatwick Airport, was carrying 242 passengers and crew members.

The aircraft, identified as a Boeing 787-8 Dreamliner delivered to Air India in 2014, went down moments after takeoff. According to city officials, over 200 bodies have been recovered from the crash site, and authorities fear there were no survivors.

In a brief statement, Boeing acknowledged the incident and expressed its condolences. “We are in contact with Air India regarding Flight 171 and stand ready to support them,” a spokesperson said. “Our thoughts are with the passengers, crew, first responders, and all affected.”

This marks the first fatal accident involving the Boeing 787 Dreamliner since its commercial debut in 2011, according to internal Boeing safety data. The event is a blow to the company, which had been showing signs of recovery under CEO Kelly Ortberg. Prior to the crash, Boeing shares had risen approximately 18% this year, helped by strong demand and restructuring efforts after a turbulent 2024.

That challenging year was highlighted by a safety issue involving an Alaska Airlines flight, where a cabin panel known as a “door plug” detached midair. The incident sparked widespread legal action, federal investigations, and a company-wide review of manufacturing and safety protocols—ultimately resulting in leadership changes.

The company’s safety record has faced scrutiny before. In 2019, the crash of Ethiopian Airlines Flight 302 and an earlier Lion Air crash led to a global grounding of the 737 Max 8. Investigations into both accidents revealed serious flaws in the aircraft’s automated flight control software.

Following Thursday’s crash, analysts at Edward Jones cautioned that heightened regulatory oversight could slow Boeing’s aircraft deliveries, potentially impacting cash flow. Still, they maintained a Hold rating, citing the company’s strong backlog. “While a delay in deliveries is possible, Boeing maintains a strong order book, and we think significant cancellations of orders are unlikely given the lengthy wait times at Boeing’s primary competitor,” noted Jeff Windau, Senior Industrials Analyst at Edward Jones.

The market reaction extended beyond Boeing. Shares of its suppliers also took a hit, with GE Aerospace (NYSE: GE) sliding more than 2%, and Spirit AeroSystems (NYSE: SPR) falling as much as 3%.

As investigations into the crash continue, the focus now turns to what steps Boeing and global regulators will take to restore confidence in the company’s widebody aircraft lineup.

Also Read: Trump Signs €179B UAE Deal: AI Super Hub, 500K Nvidia Chips & Jet Orders