Chinese Stocks Surge as Authorities Target Quant Fund Activity and Provide Property Market Support

Chinese Stock Market Rally Fueled by Government Measures and Property Sector Support

Chinese stocks experienced a significant rally fueled by government actions aimed at curbing trading by quantitative funds and bolstering the property sector.

The Hang Seng China Enterprises Index soared by up to 3.5%, reaching its highest level in seven weeks. Notably, property developers witnessed substantial gains following reports from state media indicating that banks had approved 123.6 billion yuan ($17 billion) in loans for property projects listed on the government's "white list" since January.

Recent weeks have seen intensified efforts from Chinese authorities to stabilize the stock market, including increased purchases by state-backed funds. Additionally, a sizable reduction in a mortgage reference rate on Monday contributed to positive market sentiment. Furthermore, China's primary stock exchanges have pledged to enhance oversight of quantitative trading, particularly leveraged products, which have been identified as exacerbating market volatility.

Shen Meng, director at Chanson & Co in Beijing, noted, "The crackdown on quantitative trading by regulatory agencies helped weaken short-selling forces." Investors are eagerly awaiting announcements related to upcoming policy meetings, Meng added.

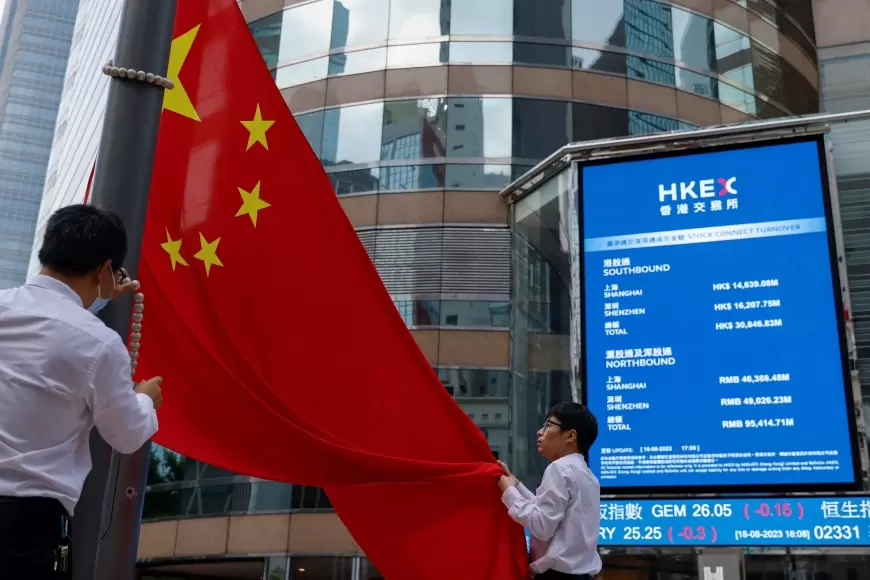

In Hong Kong, banking and technology stocks also saw substantial gains, with Meituan witnessing a surge of over 7%.

On the domestic front, the CSI 300, the benchmark index for mainland China stocks, surged by as much as 1.9%. Foreign investors displayed significant interest in onshore shares, snapping up more than 10 billion yuan worth of stocks via trading links with Hong Kong by mid-Tuesday, according to data compiled by Bloomberg.

The concerted efforts by Chinese authorities to stabilize the market and boost investor confidence have led to a notable uptick in stock prices, signaling a potential turning point in the recent market downturn.

Also Read: Foreign Direct Investment in China Hits 30-Year Low