Donald Trump Nears Decision to Sell Trump Media Shares as Lockup Period Ends

Trump may soon sell his Trump Media shares as the lockup period ends, weighing financial needs against political ambitions and business strategy

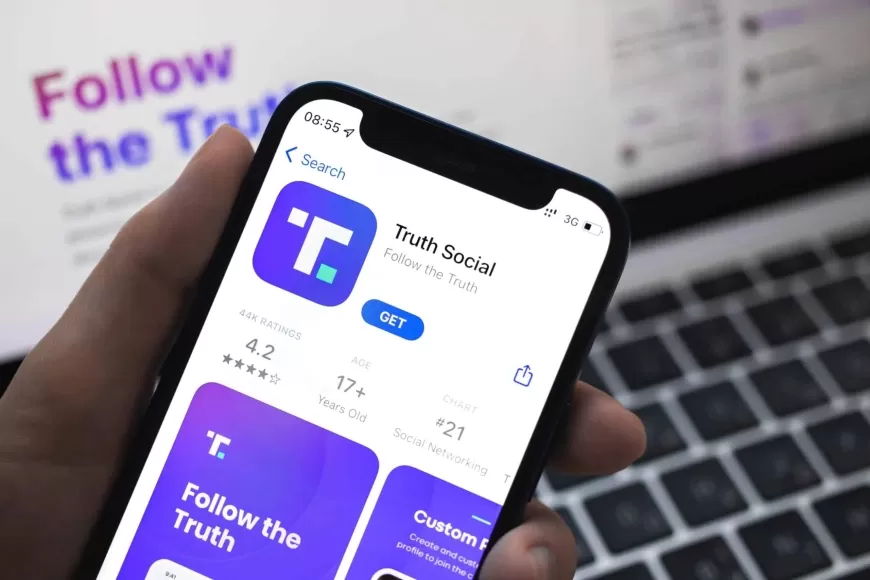

Former President Donald Trump is approaching a crucial moment in his business ventures as he nears the ability to sell a portion of his $2.6 billion stake in Trump Media & Technology Group Corp., the company behind the social media platform Truth Social. Starting in late September, Trump will be eligible to sell shares of his media company, potentially converting his paper fortune into cash. The big question is whether or not he will choose to do so.

Trump Media, which went public through a special-purpose acquisition company (SPAC) merger in March, has experienced significant volatility in its stock price. Over the past few months, shares have fluctuated between highs of nearly $80 and lows just above $22. The company currently holds a market value of $4.3 billion, with the stock closing at $22.24 this week.

While the opportunity to sell shares could provide Trump with substantial financial relief, especially as he faces mounting legal bills and penalties from recent lawsuits, he has yet to indicate any intention to cash out. The decision to sell may carry political consequences, as Trump is positioning himself for another run at the White House in 2024. Selling a significant portion of his stake in Trump Media could be seen as prioritizing his personal financial gain over his political ambitions, potentially alienating his base of supporters.

Moreover, selling a large number of shares could negatively impact the company’s stock price, as it might be interpreted as a lack of confidence in the future of Trump Media. Investors, particularly retail traders who have driven much of the stock’s price swings, could react unfavorably to such a move. This presents a delicate balancing act for Trump, who must weigh the benefits of a potential windfall against the long-term implications for his political and business interests.

Trump’s potential stock sale comes at a time when his media company is grappling with several challenges. Despite initial excitement surrounding Truth Social, the platform has struggled to gain a substantial user base and generate significant revenue. In the first half of the year, the company reported a loss of $344 million, primarily due to paper losses on derivatives, and earned only $1.6 million in sales. As a result, questions have been raised about the long-term viability of the platform and its ability to compete with established social media giants.

Adding to the uncertainty, Truth Social’s user growth has stagnated, with third-party metrics showing little traction in recent months. The platform was initially marketed as a free-speech alternative to mainstream social media, but its limited audience and niche appeal have hindered its ability to scale.

Trump’s decision to sell or hold his shares will likely be influenced by several factors, including the outcome of his ongoing legal battles, the performance of his media company, and his broader political strategy. As the lockup period preventing insiders from selling shares lifts on September 20, Trump and other insiders will have the option to begin selling their stakes. The exact date they can sell depends on the company’s stock price. If shares stay above $12 for 20 consecutive trading days starting August 22, Trump and others will be able to sell as early as September 20. If not, they will still be free to sell by September 26.

For Trump, this period represents a crossroads between his business interests and his political aspirations. With significant financial and legal pressures mounting, selling shares could provide a much-needed financial boost. However, doing so could also raise questions about his commitment to his media company and the broader political movement he has cultivated.

As this key date approaches, investors and political observers alike will be watching closely to see what Trump decides to do. His choice could have far-reaching implications, not just for his business empire but also for his potential 2024 presidential campaign.

Also Read: Donald Trump's Truth Social Platform Surges in Stock Market Debut