Duolingo Stock Surges on Strong Revenue Forecast Driven by Online Learning and AI Integration

Duolingo's Stock Surges on Strong Revenue Forecast and AI Integration, Signaling Growth in Online Learning

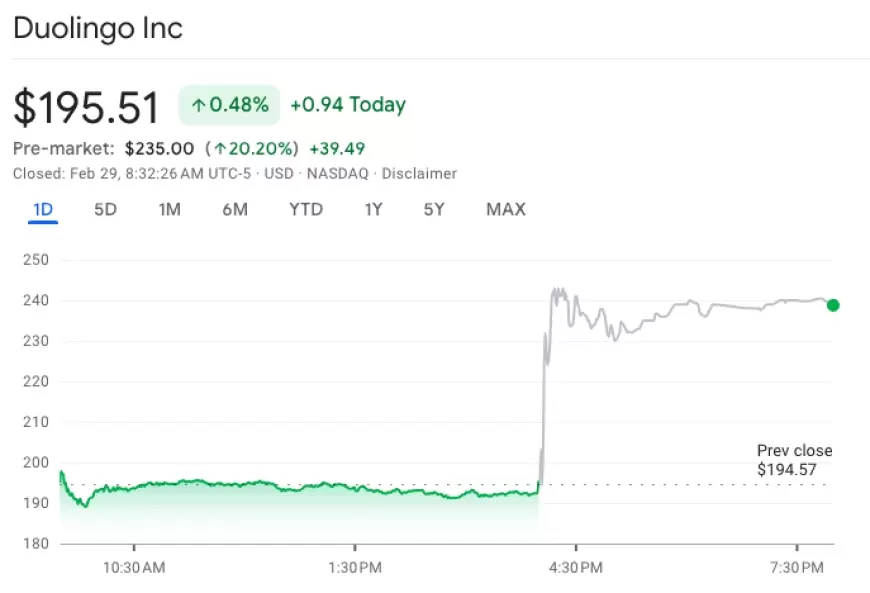

Duolingo, a prominent language learning platform, experienced a significant surge in its stock price, exceeding 20% during premarket trading on Thursday. This surge was propelled by the company's robust forecast for its 2024 revenue, attributed to a substantial shift towards online learning and the seamless integration of artificial intelligence (AI) within its platform.

If the current momentum holds, Duolingo stands to bolster its market value by a substantial $1.68 billion, marking a significant milestone for the company and reflecting investor confidence in its future growth prospects.

According to data from LSEG, Duolingo's projected revenue for the fiscal year 2024 is estimated to fall within the range of $717.5 million to $729.5 million, significantly surpassing analysts' average estimate of $699.3 million. This bullish forecast underscores the growing prominence of online learning platforms in meeting the evolving needs of language learners worldwide.

With the language learning market increasingly gravitating towards online modes, Duolingo has emerged as a frontrunner, leveraging its innovative "freemium" model to cater to a diverse audience. This model, which offers basic services for free while providing premium features through subscription, has resonated strongly with users, contributing to the platform's sustained growth and market leadership.

Analysts have also noted Duolingo's strategic utilization of generative artificial intelligence (GenAI) to enhance its offerings, providing users with personalized learning experiences and improving overall engagement on the platform. The successful introduction of Duolingo Max, a premium subscription tier featuring advanced GenAI features, further underscores the company's commitment to innovation and meeting the evolving needs of its user base.

During a post-earnings call, CFO Matt Skaruppa highlighted the significant demand observed for the Duolingo Max offering, particularly at higher price points, indicating strong market interest in the platform's advanced features and capabilities.

Despite offering its platform free of charge, Duolingo has reported record-breaking total bookings of $191 million for the three months ending December 31, reflecting a remarkable 51% increase compared to the same period in the previous year. Additionally, the platform witnessed a notable surge in paid subscribers, growing by close to 60% to reach a record high of 6.6 million in the fourth quarter alone.

While shares traded above $235 in premarket sessions, representing a slight deviation from analysts' median price target of $251.50, investor sentiment remains overwhelmingly positive towards Duolingo's long-term growth prospects. Notably, the company's robust performance metrics, including a 65% increase in daily active users and a 46% growth in monthly active users year-on-year in the fourth quarter, have garnered praise from investment analysts and industry experts alike.

Dan Coatsworth, an investment analyst at AJ Bell, commended Duolingo's impressive performance metrics, emphasizing the significant growth observed in revenue, user base, and subscribers. This positive sentiment reflects the broader market sentiment towards Duolingo as a key player in the rapidly evolving language learning landscape, poised for continued success in the years to come.

Also Read: Zoom Video Rockets Up on Strong Earnings and $1.5 Billion Stock Buyback