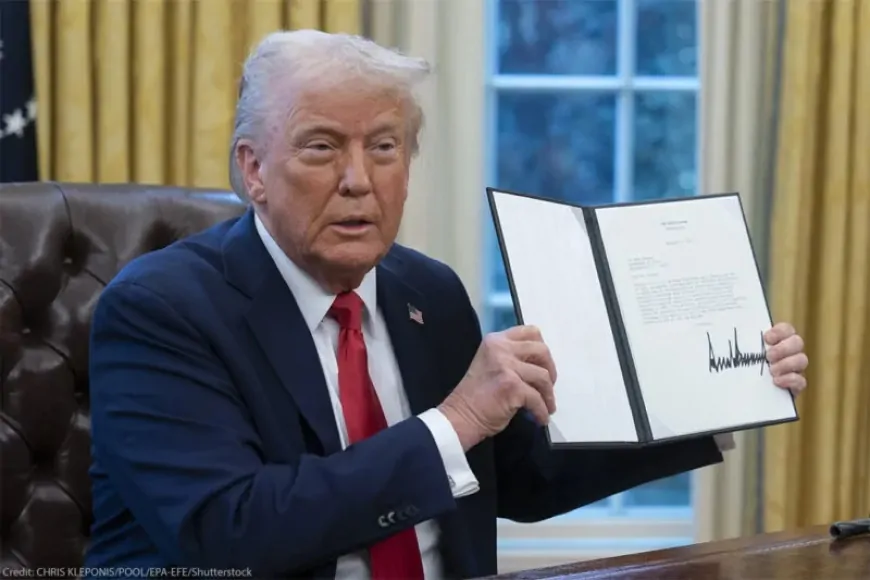

Government Bitcoin Reserve Established Under Trump’s New Executive Order

President Trump orders a U.S. Bitcoin reserve, securing 200,000 BTC. The move signals a shift in crypto policy and strengthens the nation’s digital asset strategy.

President Donald Trump has taken a big step in embracing cryptocurrency by signing an executive order to create a U.S. government Bitcoin reserve. This move could mark a turning point for Bitcoin, bringing it closer to mainstream acceptance.

U.S. Retains 200,000 Bitcoin Instead of Selling

The U.S. government has seized about 200,000 Bitcoin from criminal and civil cases over the years, and rather than selling it off as it has in the past, the new order ensures these holdings will be kept in a national reserve. To put things in perspective, the government previously sold about 195,000 Bitcoin for a total of $366 million—a sum that would be worth nearly $17 billion today.

Trump’s crypto advisor, David Sacks, compared the reserve to a "digital Fort Knox," emphasizing that Bitcoin will be held as a store of value.

“The U.S. will not sell any Bitcoin deposited into the Reserve. It will be kept as a store of value,” Sacks stated on social media. The executive order also calls for a full audit of the government’s Bitcoin holdings, something that has never been done before.

U.S. Government Plans to Expand Bitcoin Holdings

Beyond holding onto its Bitcoin, the U.S. government will explore ways to acquire more of it without affecting the federal budget. This marks a dramatic shift in Trump’s stance—just a few years ago, he called Bitcoin a “scam.” Now, he’s leaning into his role as a crypto-friendly leader, winning over industry insiders who felt the previous administration had been too harsh on digital assets.

Trump Pushes for Pro-Crypto Regulations

Trump’s administration is actively reshaping cryptocurrency regulations. The Securities and Exchange Commission (SEC) has started rolling back enforcement actions against major crypto companies, and Trump is urging Congress to pass laws that favor the industry.

To solidify this momentum, Trump is hosting a White House “Crypto Summit,” bringing together top industry leaders to discuss the future of digital assets in the U.S.

Bitcoin’s Role in the U.S. Economy

Bitcoin, which was created in response to the 2008 financial crisis, has grown into a widely accepted digital asset with a market cap of around $1.7 trillion. While it’s not commonly used for everyday purchases, Bitcoin has gained popularity as a decentralized asset that isn’t controlled by banks or governments.

Since only 21 million Bitcoin will ever exist, many investors see it as a strong hedge against inflation. Some experts even suggest that a U.S. Bitcoin reserve could help offset national debt over time.

Crypto Market Reaction to Trump’s Executive Order

Cryptocurrency prices surged after Trump’s re-election, with Bitcoin hitting an all-time high of $100,000 in December. Trump even took credit for the rally, posting “YOU’RE WELCOME!!!” on social media. However, prices have cooled since, and his executive order didn’t trigger an immediate spike—Bitcoin remained around $86,000 after the announcement.

U.S. Expands Cryptocurrency Holdings Beyond Bitcoin

The executive order also creates a “U.S. Digital Asset Stockpile,” where the government will hold other seized cryptocurrencies. In a surprise move, Trump hinted that he wants the government to keep alternative digital assets like XRP, Solana, and Cardano, which caused their prices to briefly rise.

Trump’s Bitcoin Reserve Marks a New Era for U.S. Crypto Policy

Trump’s decision to establish a national Bitcoin reserve is a historic move that could reshape the role of cryptocurrency in government policy. It not only cements the U.S. government’s position in the crypto space but also signals a broader shift in how digital assets are viewed at the national level.

As the digital economy continues to evolve, the U.S. is positioning itself as a major player in shaping the future of cryptocurrency regulation and adoption. This move could have far-reaching implications for both investors and the global financial system.

Also Read: U.S. to Establish National Crypto Reserve, Giving Bitcoin a Special Status