Live US Stock Market Updates: Stock Futures Slide as Record Rally Loses Steam

U.S. stock futures decline as European market concerns and Tesla's pay package news impact sentiment. Tech stocks lead recent gains, but the rally cools.

New York, June 14, 2024 — U.S. stock futures retreated on Friday, signaling a pullback from recent all-time highs. The market's retreat comes amid renewed concerns in European markets and significant developments surrounding Tesla (TSLA).

Dow Jones Industrial Average futures (YM=F) fell by approximately 0.7%, leading the declines. S&P 500 futures (ES=F) dropped by 0.5%, while Nasdaq 100 futures (NQ=F) slipped around 0.2%. This decline follows a record-setting rally, with the S&P 500 (^GSPC) and Nasdaq Composite (^IXIC) achieving record closes for four consecutive days, driven primarily by strength in the technology sector.

A surprising decrease in wholesale price pressures boosted investor hopes for two interest-rate cuts this year. This decline is expected to influence the upcoming PCE inflation reading, closely watched by the Federal Reserve. Despite this, the Fed recently adjusted its forecast, projecting only one rate cut for 2024 instead of the three anticipated earlier. This cautious outlook has left the market vulnerable to shifts in sentiment.

Tech stocks have powered broader market gains, positioning the S&P 500 and Nasdaq for weekly gains. However, the Dow faces a potential weekly loss as questions persist about the breadth and sustainability of this year's rally.

Also Read: Intel's Big Comeback: Why Now Is the Perfect Time to Invest in This Tech Giant

Tesla shares rose about 1% in premarket trading after shareholders approved CEO Elon Musk's $56 billion pay package. Despite opposition from some major investors, 77% of votes were cast in favor, as announced by the electric vehicle maker.

European stocks (^STOXX) are headed for their worst week since October, driven by investor concerns about potential market fallout if the far right gains ground in France's snap election.

Adding to market uncertainties, the Bank of Japan decided to postpone providing details on its bond-buying cuts until July. This unexpected move is interpreted as delaying a potential rate hike.

Adobe (ADBE) shares surged 15% following a positive sales forecast for its AI products, providing a bright spot in an otherwise turbulent market.

Stay informed with the latest updates on market movements and financial news.

Key Moments

- U.S. stock futures drop amid European concerns and Tesla news.

- Tesla up 1% after Musk's $56B pay approval.

- uropean markets hit worst week since October.

- BOJ postpones bond-buying details, adding uncertainty.

-

Market Dips as European Concerns Mount

U.S. stocks pulled back from their recent highs as investors reacted to uncertainties in Europe, particularly ahead of France's upcoming snap election, where there's potential for gains by the far-right party.

The Dow Jones Industrial Average (^DJI) dropped around 0.5%, while the S&P 500 (^GSPC) fell 0.3%. The Nasdaq Composite (^IXIC), which includes many technology stocks, decreased by 0.2%.

-

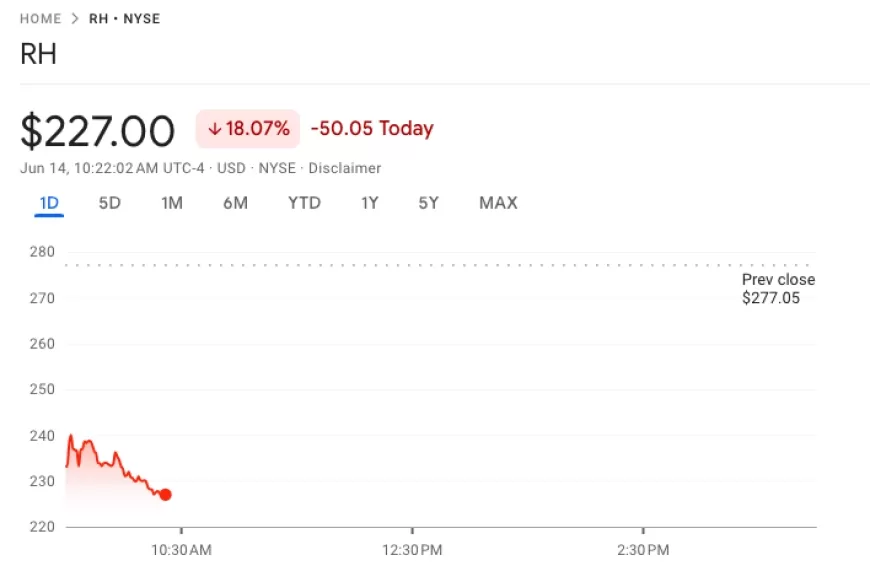

RH Stock Dips After Reporting Larger Loss Than Expected

Shares of RH (RH), a retailer specializing in luxury home goods, dropped sharply by more than 17% on Friday morning. The decline followed the company's announcement of a wider-than-anticipated loss in its recent earnings report.

RH reported a loss of $0.40 per share, which was significantly higher than the expected loss of $0.09 per share predicted by analysts.

During the earnings call with investors and analysts on Thursday, RH's chairman and CEO, Gary Friedman, expressed concerns about the current business environment. He noted that the company expects challenging conditions to persist until interest rates decrease and the housing market shows signs of recovery.

Friedman highlighted the impact of high interest rates, which are currently around 7% compared to 2.6% to 3.3% before the COVID-19 pandemic. He emphasized that these high rates are affecting the affordability of homes, making it difficult for potential buyers to enter the market.

He also mentioned that home prices had surged by 42% during the pandemic years and have continued to rise, exacerbating affordability issues further.

The Federal Reserve's recent decision to maintain interest rates and revise down its forecast for rate cuts from three to one this year has added to RH's challenges. Although the Fed does not directly control mortgage rates, its policies have a significant impact on market conditions.

Freddie Mac data shows that the average weekly rate for a 30-year fixed mortgage slightly decreased to 6.95% from 6.99% the previous week, indicating some fluctuation in mortgage rates amid broader economic uncertainties.

-

Stocks in the Spotlight: Adobe, GameStop, Shopify, and Zscaler Gain Momentum

Here’s what you need to know about these trending stocks in Friday morning trading.

Adobe (ADBE) saw its stock jump 15% after reporting strong earnings for the second quarter. Investors are optimistic due to increased sales of Adobe’s creative products, driven by the popularity of its new AI tools.

GameStop (GME) rose nearly 3%, continuing its recent momentum. Retail trader Keith Gill shared a screenshot showing he now holds over 9 million GameStop shares, up from 5 million earlier in the week.

Shopify (SHOP) gained 3% following an upgrade by analyst Mark Mahaney, who sees potential for a 16% increase in the stock price. The upgrade came after a recent pullback in Shopify’s stock.

Zscaler (ZS) increased almost 2% after JPMorgan upgraded the stock, citing growth potential. Analysts believe Zscaler, known for its cloud security solutions, is undervalued and well-positioned for future growth.

These stocks are catching attention for their significant movements and analyst endorsements, indicating active trading and investor interest in today’s market.

-

Elon Musk Reinforces Tesla's Growth Plans After Shareholder Vote

Elon Musk, CEO of Tesla, is confident about the company's growth after shareholders voted to approve his $56 billion compensation package. Musk, backed by 72% of shareholders, emphasized Tesla's future beyond just making cars.

During Tesla's annual shareholder meeting, Musk talked about the potential of Tesla's humanoid robot prototype, Optimus, suggesting it could become even bigger than Tesla's car business.

“If the price-to-earnings multiple is, say, I don’t know, 20 or 25, that would mean a $20 trillion market cap from Optimus alone,” Musk said optimistically.

However, despite most shareholders supporting Musk's pay package, there could be legal challenges. Critics might question its legality, similar to past disputes resolved in court earlier this year.

Additionally, Musk hinted he might explore AI technologies outside Tesla if he doesn't get enough control over company decisions, showing potential future challenges in his leadership approach.

-

Trump Promises Lower Taxes to Business Leaders

Former President Vows Tax Cuts and Business-Friendly Policies if Elected

Donald Trump is reaching out to business leaders, promising lower taxes if he wins the next election. He met with top CEOs in Washington, D.C., to share his plans for tax reform and other policies to support businesses.

In a conversation with Yahoo Finance's Ben Werschkul, Trump spoke to an audience focused on tax issues. The former president was interviewed on stage by Larry Kudlow, his former economic adviser, and the crowd included notable figures like Jamie Dimon from JPMorgan Chase, Tim Cook from Apple, Brendan Bechtel from Bechtel, and Doug McMillon from Walmart, among others.

During the event, Trump highlighted his past successes in cutting taxes and reducing regulations, and he compared his record to President Biden's on issues like inflation. While Trump criticized Biden, one CEO present was doubtful that these comments changed many minds among the business leaders.

Trump's plan includes extending the 2017 tax cuts, which lowered taxes for many people and businesses. He also suggested the possibility of new tax cuts, including a further reduction in the corporate tax rate.

-

Stocks Slip in Afternoon Trading as Consumer Sentiment Falls

Dow Leads Decline Amid Rising Prices Concerns

U.S. stocks retreated on Friday afternoon following a new report showing a drop in consumer sentiment for June, as rising prices continue to impact Americans.

The Dow Jones Industrial Average (^DJI) fell by around 0.3%, leading the market declines. The S&P 500 (^GSPC) decreased by 0.2%, while the tech-focused Nasdaq Composite (^IXIC) dipped by approximately 0.1%.