Market Highlights: Apple and Amazon Earnings, July Jobs Report, and Economic Outlook

Stay updated with the latest market highlights as tech giants Apple and Amazon release their earnings reports. The July jobs report will also be unveiled, providing insights into economic recovery. Positive economic data and the ongoing earnings season add to the optimism.

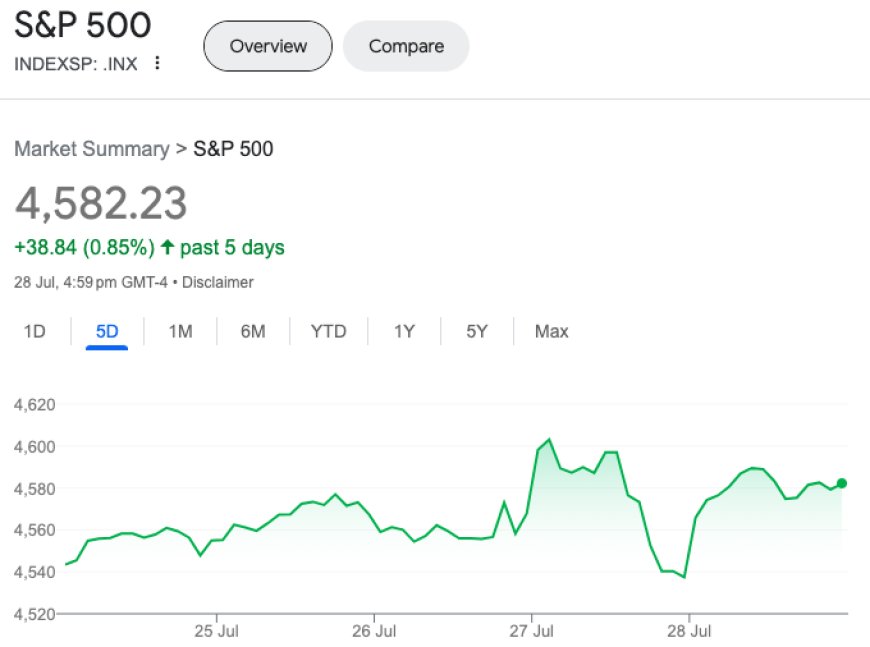

As the third quarter enters its second month, investors are closely following the latest earnings reports and economic data for insights into market trends. This week brings significant updates from tech giants Apple and Amazon, along with the highly anticipated July jobs report.

Apple (AAPL) and Amazon (AMZN) Earnings Take Center Stage

Quarterly earnings reports from Apple and Amazon are the major highlights of this week. Market participants eagerly await these updates, as both companies play a crucial role in the technology and e-commerce sectors.

Apple, with its soaring stock value, has witnessed a remarkable year, recently crossing the $3 trillion market cap milestone. Analysts are curious to see if Apple's financial performance aligns with its stock's impressive run. Goldman Sachs analyst Michael Ng predicts Apple delivering earnings above consensus forecasts, attributing it to the growing iPhone installed base and increased average selling prices.

On the other hand, investors are keen to see Amazon's performance, particularly focusing on its Amazon Web Services (AWS) unit. Recent remarks by Microsoft regarding cooling revenue growth from Azure and cloud services have raised some concerns about AWS's performance. Nevertheless, Google Cloud's revenue growth, surpassing expectations, provides hope for Amazon's earnings report.

July Jobs Report and Economic Sentiment

The Bureau of Labor Statistics is scheduled to release the July jobs report on Friday, which will be closely monitored by economists and investors alike. The job market has been a crucial driver of economic growth, and its strength has a direct impact on consumer sentiment and overall economic recovery.

Economists expect the report to show that around 200,000 nonfarm payroll jobs were added to the US economy in July, with the unemployment rate remaining steady at a historically low 3.6%. The job market's performance will provide insights into the pace of economic recovery and the Federal Reserve's future monetary policy decisions.

Economic Data Continues to Impress

As the economy shows signs of recovery, positive economic data has been a recurring theme. Surprisingly robust second-quarter economic growth and moderating inflation have contributed to the optimism among market participants.

Economists are increasingly considering the possibility of a "soft landing" scenario, where the economy stabilizes without experiencing a significant downturn in growth. The Federal Reserve's Chairman, Jay Powell, has expressed his confidence in this outcome, stating that slowing inflation won't trigger a recession.

Earnings Season Update

As second-quarter earnings season approaches its midpoint, results have been largely positive, with companies exceeding earnings per share estimates. While earnings have declined for three consecutive quarters, companies have continued to outperform Wall Street expectations.

With 170 S&P 500 companies yet to report earnings this week, the market eagerly awaits these updates. The results will play a crucial role in shaping market sentiment and expectations moving forward.

Overall, the market remains optimistic, and investors are closely watching economic indicators and corporate earnings for further clues about the economy's trajectory. As earnings reports and economic data unfold this week, traders will be closely monitoring the developments and their potential impact on market sentiment and future monetary policy decisions.

Also Read: Change Your Name to ‘Subway’ and Win Free Sandwiches for Life