Nike Stock Slips as Quarterly Profit Misses Expectations, Despite Strong Revenue

Nike stock slips as quarterly profit misses estimates, despite strong revenue. Challenges and signs of recovery in Greater China highlight the company's performance.

In its latest quarterly report, Nike (NKE) delivered better-than-expected sales figures but fell short of Wall Street's profit estimates, leading to a decline in Nike stock value. The company faced challenges including lower gross margins due to increased costs, elevated freight expenses, higher markdowns, and currency exchange rate fluctuations. However, Nike's revenue of $12.83 billion exceeded expectations. While concerns about North American demand and COVID-19 restrictions in Greater China persist, Nike showcased signs of recovery in the region, with sales surpassing analysts' projections. Let's delve into the details.

Nike's fourth-quarter earnings report showed a decline in gross margins, falling from 45% in the year-earlier period to 43.6%. The company attributed this decrease to higher input costs, elevated freight and logistics expenses, increased markdowns, and unfavorable currency exchange rate fluctuations. However, strategic pricing actions helped mitigate some of these challenges.

Despite falling short on profit expectations, Nike reported impressive revenue figures. The company generated $12.83 billion in revenue, surpassing the estimated $12.59 billion. This strong performance provides some optimism for investors amidst the overall disappointment.

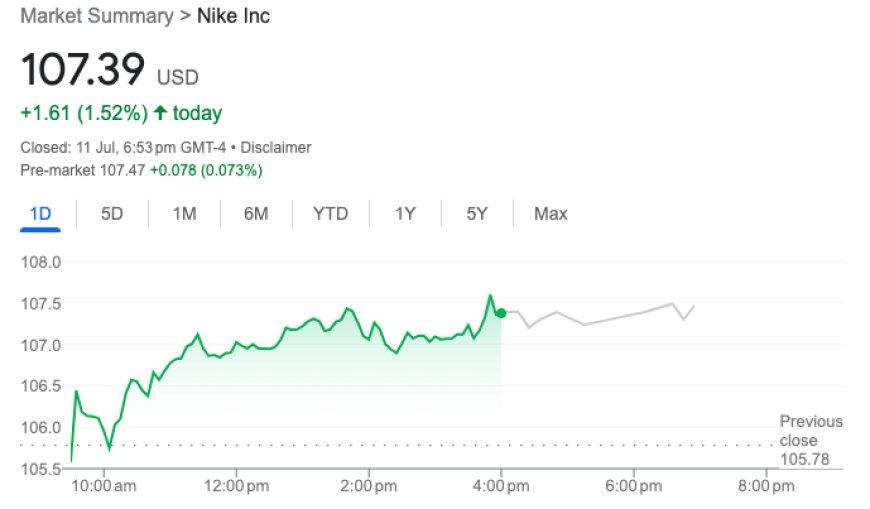

Nike's stock experienced a decline of approximately 3% following the report. Prior to the earnings release, the company's shares had already faced downward pressure, with a 6% year-to-date decline. Analysts had also adjusted their price targets for Nike due to concerns about weakening demand in North America and hurdles in achieving revenue growth in Greater China due to ongoing COVID-19 restrictions.

However, Nike managed to demonstrate resilience in the Greater China region. Sales reached $1.81 billion, surpassing analysts' expectations of $1.64 billion and reflecting a 16% increase compared to the previous year. This recovery suggests a positive market direction and offers hope for Nike's performance in a key market.

It is worth noting that Nike's inventory levels remained stable compared to the previous year, indicating improvements in inventory management. This development alleviates concerns about excessive stock, potentially leading to improved operational efficiency.

Brian Nagel, a Managing Director and Senior Analyst at Oppenheimer & Co., expressed optimism regarding Nike's performance in Greater China. Nagel highlighted a positive trajectory in revenue, noting a rebound in January and February when COVID-19 restrictions were lifted. This latest sales figure is seen as a positive signal, aligned with market expectations.

While Nike faces ongoing challenges, the company's ability to surpass revenue projections in the Greater China region provides encouragement. Market observers will closely monitor Nike's strategic initiatives and financial performance as the company navigates industry headwinds and seeks to sustain growth in key markets.

In summary, Nike's quarterly report delivered mixed results, with revenue exceeding expectations but profits falling short. The company faces various challenges, including lower gross margins and concerns about demand and COVID-19 restrictions. Despite these obstacles, Nike showcased signs of recovery in the Greater China region, surpassing sales projections. Investors will closely monitor Nike's progress as it implements strategic measures to address market challenges and drive future growth.

Also Read: Market Sentiment Improves as Stocks Make Gradual Advances, Awaiting Crucial Inflation Figures