Stock Market Declines Amid Inflation Worries: Latest Market Update

Stocks on Wall Street are facing a downward trend as inflation concerns linger, casting doubts on the Federal Reserve's potential interest rate cuts. Stay informed about the latest market developments.

Stocks on Wall Street experienced a decline on Wednesday, indicating another day of losses as persistent worries regarding inflation raised uncertainties about the Federal Reserve's stance on interest rates in the near future.

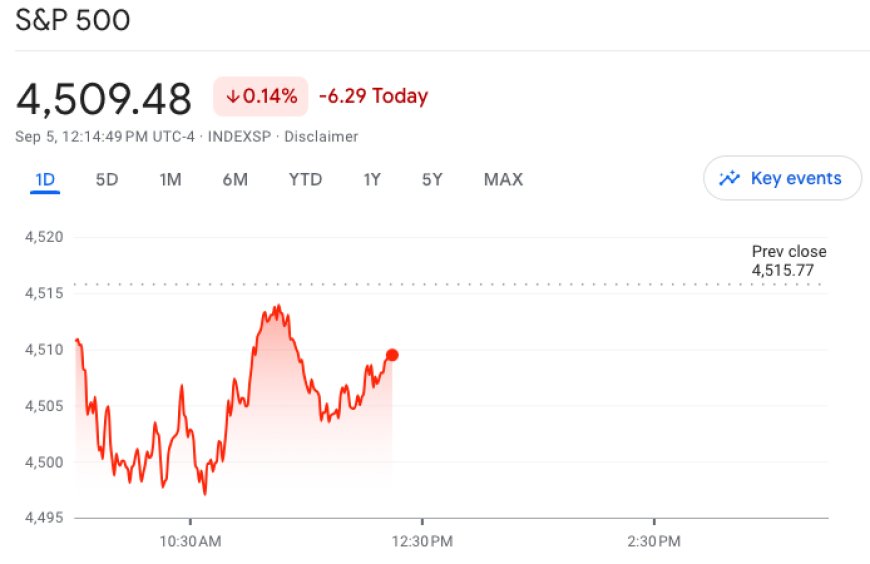

The S&P 500 (^GSPC) recorded a drop of approximately 0.6%, while the Dow Jones Industrial Average (^DJI) saw a decline of around 0.4%, intensifying the overall market losses. The technology-heavy Nasdaq Composite (^IXIC) also witnessed a significant decrease of 0.9%.

WTI crude oil (CL=F) has been trading near its highest levels since November, briefly touching the $90 mark on Tuesday following Saudi Arabia and Russia's commitment to ongoing output cuts. This development reignited concerns about "persistent" inflation, creating downward pressure on stocks and leading to a collective dip in all three major US indices during Tuesday's trading session.

As the Federal Reserve's September 20 meeting approaches, investors are actively debating whether these inflationary pressures will compel policymakers to maintain higher interest rates for an extended period.

Simultaneously, discouraging economic data from Europe and China are fueling concerns about potential demand erosion, which could undermine the resilience demonstrated by the US economy thus far. The abrupt decline in German industrial orders during July has triggered speculation regarding the risk of stagflation.

Given these dynamics, market participants will closely monitor the latest PMI data for the US services sector in August, with a particular focus on inflation indicators. The ISM reading, surpassing expectations at 54.5 compared to the anticipated 52.5, marks the eighth consecutive month of elevated activity.

In earlier developments, the US trade deficit in July expanded less than anticipated, driven by a 1.6% increase in exports after three consecutive months of declines, according to official figures. Furthermore, the release of the latest Fed Beige Book is on the horizon.

Stocks Open on a Weak Note

Stocks began Wednesday's trading session on a negative note, with oil prices hovering near their highest levels since November 2022.

At the opening bell, the S&P 500 (^GSPC), the Dow Jones Industrial Average (^DJI), and the tech-centric Nasdaq Composite (^IXIC) all registered declines of approximately 0.3%. Concurrently, WTI crude oil (CL=F) remained close to the $87 per barrel mark, marking its highest closing level since November 2022.

Premarket Movers: Enbridge, Roku, Photronics, GitLab

Several stocks took center stage during the premarket trading session:

-

Enbridge (ENB): Shares of the Canadian pipeline operator Enbridge witnessed a decline of up to 7% after announcing a $9.4 billion deal to acquire three utilities from Dominion Energy Inc., aiming to create North America's largest natural gas provider. Dominion's stock also faced a decline.

-

Roku (ROKU): Roku's shares surged by 12% after the company revealed plans to reduce its workforce by 10% as part of a restructuring effort aimed at curbing rising expenses on its streaming platform.

-

Photronics (PLAB): The semiconductor equipment supplier Photronics experienced a decline in its stock after failing to meet Wall Street's targets for its fiscal third quarter.

-

GitLab (GTLB): The software development platform GitLab outperformed analyst estimates in its quarterly earnings, leading to a more than 5% increase in its premarket trade.

Stock Futures Indicate Another Day of Losses

Wall Street stocks on Wednesday appeared poised to extend the losses from the previous session, as downbeat German data and rising oil prices reignited concerns about persistent inflation.

Futures on the Dow Jones Industrial Average (^DJI) dropped 0.13% or 46 points, while those on the S&P 500 (^GSPC) decreased by 0.19%. Nasdaq 100 futures also slid by 0.28%.

Also Read: Dow Jones Futures, Meta Buy Signal, and Key Stock Movements - Stock Market Update Today