Stock Market Live Updates: Stocks Edge Up As Wall Street Aims to Close Q2 On a High Note

US stock futures mixed as Wall Street aims to close Q2 on a high. Key economic data and political events in focus. S&P 500 up 4.5%, Nasdaq up 8%. Nvidia dips.

US stock futures exhibited mixed movements early Monday as Wall Street prepares to conclude a robust second quarter. Futures for the S&P 500 (^GSPC) inched up around 0.1%, while Nasdaq Composite (^IXIC) futures hovered just below the flatline. Dow Jones Industrial Average (^DJI) futures climbed 0.3%.

Q2 Performance Highlights

This quarter has been notable for significant stock market gains. The S&P 500 has risen approximately 4.5%, and the Nasdaq has surged around 8%, driven largely by a rally in artificial intelligence stocks. Despite this overall positive trend, the rally showed signs of slowing down at the end of last week. Nvidia (NVDA), a standout performer this year, saw its stock dip after reaching new all-time highs. This decline appeared likely to continue, with Nvidia's stock down about 2% in premarket trading on Monday.

Key Events to Watch This Week

The focus this week extends beyond stock performance to include key macroeconomic indicators and political developments. On the political front, President Joe Biden and likely Republican candidate Donald Trump are scheduled for their first debate on Thursday evening. This event could influence market sentiment and expectations regarding economic policy.

Upcoming Economic Data

Inflation data will be a critical focus, with the Personal Consumption Expenditures (PCE) index set for release on Friday morning. This index includes the "core" PCE measure, which is closely watched by the Federal Reserve. Economists forecast a 0.1% increase in core PCE for the past month, the smallest rise since last November. Such a result could ease some of the Federal Reserve's concerns about the need for rate cuts this year. According to the CME FedWatch tool, traders are anticipating potential rate cuts beginning in September.

Also Read: Cava Stock's Remarkable 114% Surge in 2024: What Lies Ahead for Investors?

Key Moments

- US stock futures opened mixed; S&P 500 up 0.1%, Dow Jones up 0.3%, Nasdaq slightly down.

- Nvidia, a key player in the AI rally, saw a 2% drop in premarket trading.

- This week highlights the Personal Consumption Expenditures (PCE) index release on Friday.

- President Biden and Donald Trump are set for their first debate on Thursday.

-

Is Nvidia Overvalued Compared to Other Tech Giants?

Is Nvidia (NVDA) becoming too expensive when compared to other major tech companies?

Here's something to think about.

According to Creative Planning, Nvidia's stock now trades at over 21 times its forward sales, a significant jump from 12 times just two months ago. In comparison, Microsoft (MSFT) trades at 12 times forward sales, while Apple (AAPL) trades at 8 times.

-

Another Tough Blow for Under Armour

After the markets closed on Friday, Under Armour (UAA) announced it would pay $434 million to settle a lawsuit.

The lawsuit, filed in 2017, was for investors who bought Under Armour Class A and Class C shares between September 16, 2015, and November 1, 2019. It claimed that founder and CEO Kevin Plank gave a false impression of how much demand there was for Under Armour products from Q3 2015 to Q4 2016, misleading investors and breaking the law.

This settlement will resolve all claims against the company and Kevin Plank, once approved by the court.

Under Armour didn’t admit to doing anything wrong and insists their sales practices and financial disclosures were appropriate. Stifel analyst Jim Duffy said the settlement aims to avoid a long legal battle and focus on the business.

“This settlement hurts the balance sheet and puts the company in debt, which limits their financial flexibility,” Duffy explained.

This is another setback for the struggling brand. Earlier this year, Kevin Plank pushed out CEO Stephanie Linnartz to take back his position. The decision to let Plank return, despite his control over the company, raises questions about the board's judgment.

-

Stocks Mixed to Start Final Week of June, Nvidia Continues to Decline

Stocks had a mixed start on Monday as the last week of June began.

The S&P 500 (^GSPC) dropped slightly, while the Nasdaq Composite (^IXIC), which includes many tech companies, fell about 0.4%. The Dow Jones Industrial Average (^DJI) went up by about 0.3%.

Nvidia (NVDA), known for its high performance earlier this month, fell more than 2%, continuing its recent downward trend.

Investors are also watching for the Personal Consumption Expenditures (PCE) index report coming out on Friday. This report includes the "core" PCE measure, an important indicator for the Federal Reserve's economic decisions.

-

S&P 500 Moves Up, Nasdaq Stays Steady

On Monday morning, the S&P 500 (^GSPC) shifted into positive territory, while the Nasdaq Composite (^IXIC) held steady without significant changes. Nvidia (NVDA), a major player in AI chip technology, experienced a decline of more than 3% during the session.

Nvidia, known for boosting stock market highs recently, showed signs of slowing down.

Energy and utility stocks led the market gains on Monday, driving overall positive movement.

-

Bitcoin Dips 4%, Maintains Above $61,000

Bitcoin (BTC-USD) saw a decline of over 4% in the past 24 hours, briefly dropping to its lowest point in more than a month but holding above $61,000 per token.

Investors have been withdrawing from Bitcoin spot ETFs for six consecutive days, reflecting a cautious sentiment in the market. Despite recent setbacks, Bitcoin has still gained nearly 40% since the beginning of the year.

-

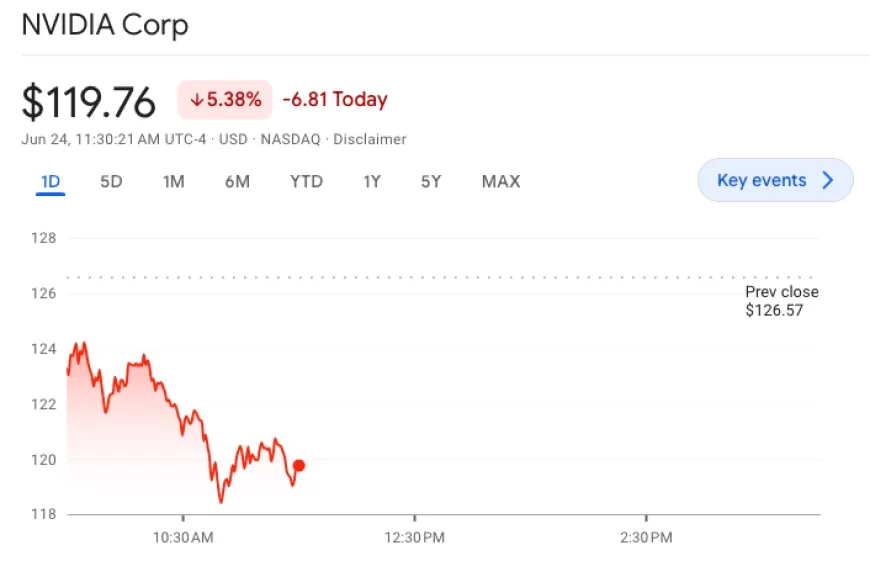

Nvidia Continues Slide, Drops Over 5%

Nvidia (NVDA) shares plunged to session lows on Monday morning as investors shifted away from the AI chip leader.

The stock fell over 5%, extending its recent downtrend. Nvidia has now declined more than 11% from its recent peak of $135.58, reached on June 18.

This marks the third consecutive day of losses for Nvidia's stock as market sentiment continues to sour.