Stock Market News Today: Wall Street Evaluates Economic Data: Stocks Experience Modest Shifts

Investors Scrutinize Latest Figures for Insights into US Economy

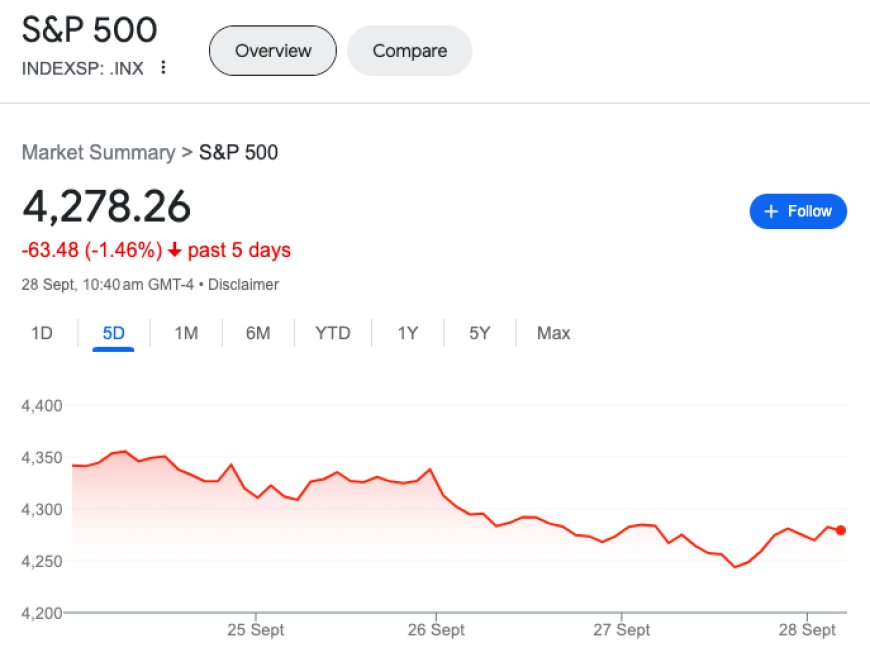

Wall Street exhibited minor fluctuations as investors delved into the most recent data on the US economy. As the opening bell rang, the S&P 500 and Dow Jones Industrial Average registered slight declines of around 0.1%, while the Nasdaq Composite experienced a 0.3% dip.

The key focal point remains whether the Federal Reserve can orchestrate a "soft landing" for the economy. The second-quarter GDP estimate held steady at 2.1%, according to fresh statistics. Official reports unveiled an uptick in jobless claims last week, totaling 204,000—slightly below the anticipated 215,000. All eyes are now on the forthcoming update on pending home sales.

The Federal Reserve's stance, emphasizing sustained higher interest rates, has introduced an element of uncertainty to the markets. Nonetheless, equities are displaying resilience after weathering several days of notable losses. Meanwhile, in the bond market, the 10-year Treasury yield continued its upward trajectory, surpassing 4.6%, a level unseen in over 15 years.

Both markets grapple with the ramifications of an oil price surge. Having reached new pinnacles in 2023 on Wednesday, oil prices have surged by over 35% since June's conclusion. This surge is anticipated to lead to escalated fuel prices, potentially presenting a hurdle to the Fed's anti-inflationary efforts and influencing the likelihood of a rate adjustment.

On Thursday, oil prices shifted course, with West Texas Intermediate futures declining to $92.93 a barrel, following a momentary breach of the $95 threshold earlier in the day. Likewise, Brent crude futures experienced a dip, settling at $95.91, after nearly breaching the $97 mark during the session.

Friday's most anticipated event is the release of the PCE inflation reading, which is closely monitored by the Federal Reserve. However, experts suggest that persistent price hikes may not be the catalyst for central bank action. Rather, it could be the insatiable spending habits of American consumers and the enduring strength of the economy that prompt a response.

In the realm of individual stocks, Micron faced a premarket decline following the announcement of a wider-than-expected first-quarter loss.

Furthermore, GameStop welcomed a new chief executive, Ryan Cohen, the founder of Chewy. Cohen's appointment as CEO and president comes in the wake of the termination of Matthew Furlong in June. GameStop's stock experienced an initial surge of over 3% before stabilizing.

In summation, the stock market navigated the day with cautious optimism, carefully assessing the latest economic data. While certain sectors experienced fluctuations, the overarching sentiment remained one of vigilance. The influence of oil prices and ongoing deliberations regarding Fed policy continue to shape market dynamics.

Also Read: Stock Market Calms After Recent Volatility: Here's What Traders are Awaiting from the Fed