Understanding Inflation: Causes, Impacts, and Strategies for Coping with Rising Prices

A Comprehensive Guide to Inflation and Its Effects on Your Wallet

Summary: Inflation is a persistent increase in the price of goods and services over time. It can have a significant impact on your personal finances, from your daily expenses to your long-term investments. In this article, we will explain what inflation is, what causes it, how it affects you, and what you can do to manage its impact on your finances.

Inflation is a critical economic indicator that measures the rate at which prices of goods and services increase over time. It is the result of many factors, including the supply and demand of money, production costs, and government policies. Inflation can significantly affect your financial health, making it essential to understand what it is, how it works, and what you can do to protect your finances.

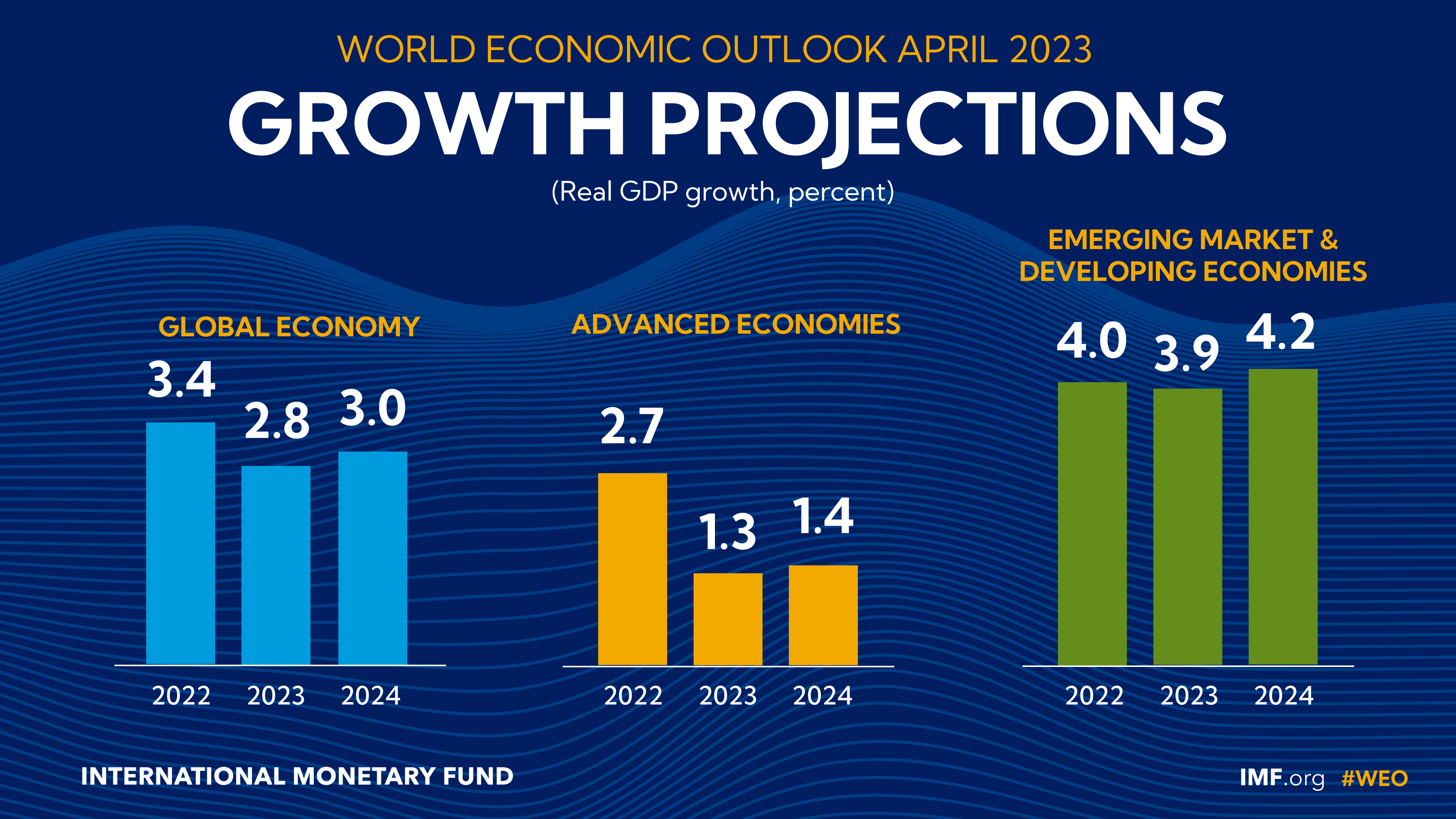

(Image Credit: IMF)

What Is Inflation?

Inflation is defined as the increase in the price of goods and services over time. In other words, inflation is the result of too much money chasing too few goods. It reduces the purchasing power of money, meaning that the same amount of money can buy fewer goods than before.

What Causes Inflation?

There are several causes of inflation, including:

-

Increase in the Money Supply: When there is too much money in circulation, it leads to inflation. Central banks, such as the Federal Reserve in the United States, can increase the money supply by printing more money or lowering interest rates.

-

Increase in Production Costs: When the cost of producing goods and services increases, it can lead to inflation. This could be due to higher wages, raw material costs, or taxes.

-

Increase in Demand: When the demand for goods and services exceeds the supply, it can lead to inflation. This is typically seen in times of economic growth when consumers have more money to spend.

How Does Inflation Affect You?

Inflation can have a significant impact on your finances. For instance, if you have a fixed income, inflation reduces your purchasing power, making it harder to afford the same goods and services. Additionally, inflation can affect the interest rates on your loans and savings, making it more expensive to borrow money and less lucrative to save.

Examples: Let's say you had $100 in 2000. In 2022, due to inflation, the same $100 is worth around $56. This means that you can only buy 56% of the goods and services that you could buy in 2000 with the same amount of money.

Strategies for Coping with Inflation:

Here are some strategies that can help you manage the impact of inflation on your finances:

-

Invest in Assets That Appreciate in Value: To protect your investments from inflation, invest in assets that appreciate in value over time, such as stocks, real estate, and precious metals.

-

Adjust Your Budget: Inflation can increase the cost of living, so it's essential to adjust your budget accordingly. This may mean cutting back on non-essential expenses or finding ways to earn more income.

-

Save for Retirement: Inflation can erode the purchasing power of your savings, making it essential to save for retirement. Consider investing in retirement accounts, such as a 401(k) or IRA, which offer tax benefits and long-term growth potential.

Tips to Manage Inflation:

Inflation can be a challenge for individuals and businesses alike. However, there are some steps you can take to mitigate its impact:

-

Create a budget: Creating a budget can help you track your expenses and identify areas where you can cut back. By knowing exactly where your money is going, you can make more informed decisions about your spending and prioritize the essentials.

-

Invest in assets: Inflation tends to erode the value of cash over time, so it may be wise to invest in assets that appreciate in value. This can include stocks, real estate, and commodities like gold.

-

Pay down debt: Inflation can also make debt more expensive to carry, so paying down high-interest debt can help you save money in the long run.

-

Consider a high-yield savings account: While inflation can erode the value of cash in a regular savings account, a high-yield savings account may offer a higher interest rate, which can help offset the impact of inflation.

In conclusion, Inflation is a complex economic phenomenon that can have significant impacts on individuals and businesses. While it can be difficult to predict and control, by understanding its causes and effects, you can take steps to mitigate its impact on your finances. By creating a budget, investing in assets, paying down debt, and considering a high-yield savings account, you can help protect your financial future and weather the effects of inflation.

Also Read: Live Updates: Stay Informed on the Latest Trends in Stocks, GDP, and Banking Industry