US Stock Market Opens Higher Amid Steady Yields: Latest Stock Market News

US stocks show strength in opening as Treasury yields remain robust. Get the latest stock market updates and insights. Stay informed with market news.

The trading day commenced with a positive tone as US stocks sought to regain momentum after enduring consecutive declines. Simultaneously, the 10-year Treasury yield held firm, sustaining its position near recent highs.

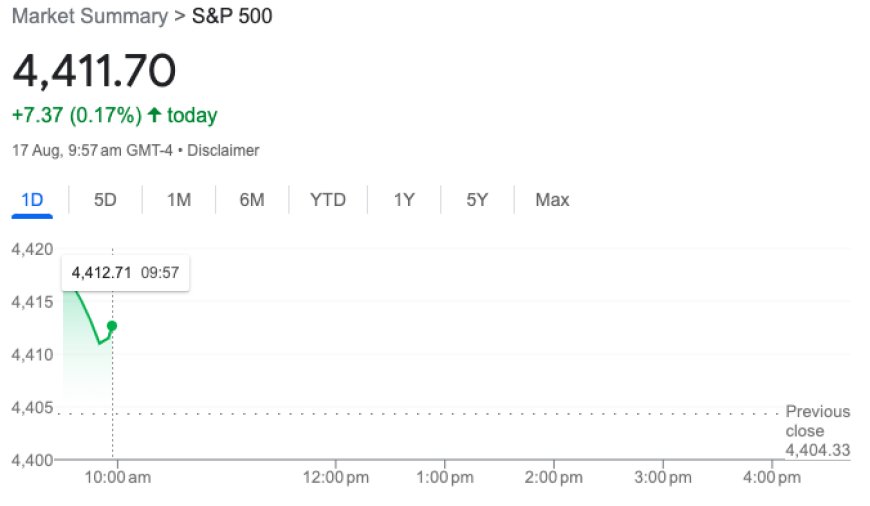

The Dow Jones Industrial Average (^DJI) registered a modest gain of approximately 0.2%, accompanied by the S&P 500 (^GSPC) edging up by 0.17%. The Nasdaq Composite (^IXIC), recognized for its focus on tech stocks, rebounded by 0.3%, attempting to recover from its recent 1% dip across two successive sessions.

In a parallel trend, the 10-year US Treasury yield maintained its level near 4.3%, reflecting its sustained strength. This consistency in yields mirrors a global pattern where rates have reached peaks reminiscent of the period during the Great Recession.

A day earlier, stocks concluded in the red zone following the release of the Federal Reserve's meeting minutes. These minutes conveyed the committee's steadfast dedication to addressing inflation concerns, hinting at potential additional rate hikes scheduled for September.

Of note, retail heavyweight Walmart (WMT) emerged as a focal point, bringing an end to a week dominated by retail sector earnings. The retailer presented robust quarterly results characterized by increased sales and foot traffic at its physical stores. This strong performance underscored consumers' ongoing preference for discounted offerings.

Additionally, a significant economic indicator emerged on Thursday in the form of weekly unemployment claims. These numbers underscored the sustained resilience of the labor market, affirming its positive trajectory.

Opening Bell Spurs Market Ascendance The market's opening bell set the stage for a promising start as stocks exhibited an upward trajectory. Notably, this movement was instigated by Walmart's (WMT) impressive results, surpassing market expectations. In parallel, bonds remained poised at levels not witnessed in the past 15 years.

The Dow Jones Industrial Average (^DJI) made strides with an approximate 0.2% rise, equivalent to around 180 points. The broader market index, S&P 500 (^GSPC), followed suit, marking a 0.3% increase. Meanwhile, the Nasdaq Composite (^IXIC) showcased notable momentum, surging nearly 0.4%.

This optimistic atmosphere was complemented by the 10-year Treasury yield, standing at 4.28%. This yield level has drawn comparisons to its peak during the 2008 Great Financial Crisis, indicating the current heightened market conditions.

Market Trends Prior to Opening

Cisco, Walmart, Tapestry The premarket scene witnessed distinct trends in some key stocks, which caught the attention of investors on Yahoo Finance's trending tickers page:

Cisco Systems (CSCO): The tech enterprise experienced a 2% upswing following the release of its fiscal fourth-quarter outcomes. The company's financials highlighted a surge in demand, attributed to the resolution of supply shortages resulting from the pandemic.

Walmart (WMT): In a noteworthy development, Walmart's shares rose by 1% following its second-quarter earnings release that exceeded market predictions.

BAE Systems (BA.L): An announcement about BAE Systems entering the space sector and its acquisition of Nasa supplier Ball Aerospace for $5.6 billion caused shares to drop by 3%.

Tapestry (TPR): The fashion house encountered a 1% decline in premarket trading due to reporting quarterly sales below market expectations.

Positive Futures Indicate Market Growth, Boosted by Walmart's Performance Early indications from stock futures suggested an encouraging trajectory. Nasdaq futures led the charge with an uplift of 0.25% ahead of the market's opening. Futures linked to the S&P 500 displayed a 0.2% rise, while Dow futures exhibited a subtle gain of slightly less than 0.1%.

The market aimed to rebound following the release of the Federal Reserve's policy meeting minutes, which conveyed a hawkish outlook with the likelihood of future rate hikes. Investors turned their attention to Walmart's (WMT) outcomes, which exhibited stellar performance surpassing market expectations. This robust display propelled Walmart's stock by 1% before the opening bell.

Also Read: Target's Strong Earnings Propel S&P 500 and Dow; Fed Meeting Minutes Awaited