U.S. Stocks Rally as Techs Rebound and Dow Eyes 10th Consecutive Win

Read about the recent U.S. stock market rally as tech stocks rebound and the Dow eyes its 10th consecutive win. Investors assess second-quarter earnings, corporate results, and tech giants' agreements with the White House on AI rules.

In a promising turn of events, the U.S. stock market saw a strong rally on Friday, with the Dow Jones Industrial Average eyeing its 10th day of consecutive gains, and tech stocks making a remarkable recovery. Investors showed optimism as they closely evaluated the second-quarter earnings season and its potential impact on the market.

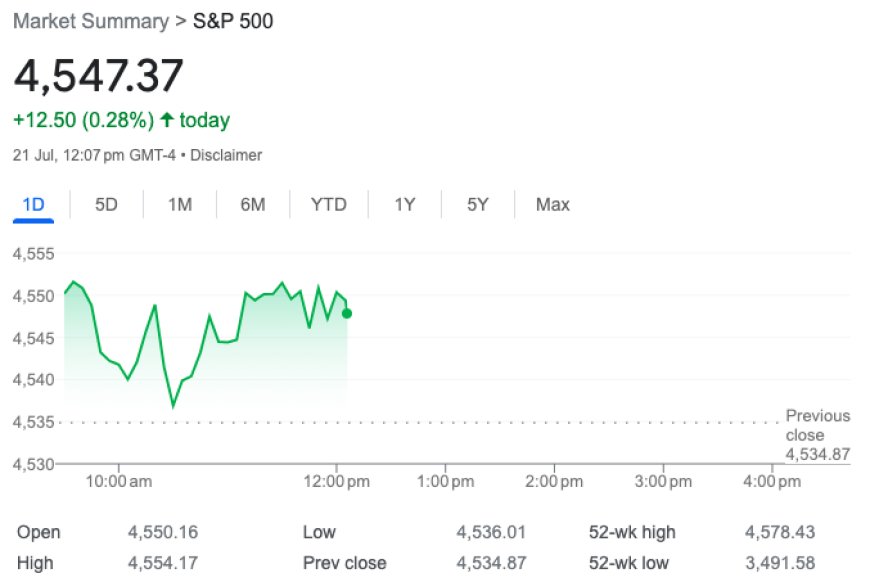

The Dow Jones Industrial Average (DJI) led the way with a 0.2% increase, defying expectations after securing a notable win spurred by Johnson & Johnson's strong performance on Thursday. The S&P 500 (GSPC) also joined the upward trend, adding around 0.4%, while the Nasdaq Composite (IXIC) surged over 0.7%, bouncing back from a significant drop the previous day.

This week's corporate results played a key role in soothing concerns about the resilience of the U.S. consumer and the health of the financial system, particularly following the spring's banking crisis.

Investors are now looking ahead to the upcoming big tech earnings announcements, with Microsoft set to report next week. However, the market remains cautious after Tesla (TSLA) and Netflix (NFLX) posted uninspiring second-quarter updates, which significantly impacted the Nasdaq's performance and led to a sharp decline.

As the stock market remains on an upward trajectory, the Federal Reserve's policy decision scheduled for next week has also garnered attention. Market watchers are closely monitoring the central bank's stance on the chances of the U.S. economy avoiding a severe slowdown. Encouraging data has indicated the economy's robustness amid the ongoing rate-hike campaign by the Federal Reserve.

On another note, American Express (AXP) faced a decline of over 4% during Friday's trading session. The credit card company's quarterly revenue of $15.05 billion fell short of analysts' expectations, resulting in a setback. American Express CEO, Steve Squeri, addressed concerns about the company's full-year outlook, stating that they don't provide quarterly guidance, but remain positive about the company's performance despite any macroeconomic uncertainty.

In other significant news, the White House announced a voluntary agreement with major tech companies, including Amazon (AMZN), Google (GOOG, GOOGL), and Microsoft (MSFT), aimed at managing the risks associated with artificial intelligence (AI). This move is expected to ensure the safety of AI products before their introduction to the public, prioritize security in system-building, and gain the trust of the public regarding AI technology development.

Market Trends:

-

Sirius XM (SIRI) faced an 8% decline after a short squeeze triggered a massive 42% surge the previous day. Evercore ISI analyst, Vijay Jayant, downgraded the stock to Underperform from In Line while maintaining a $4.50 price target.

-

Intuitive Surgical (ISRG) witnessed a decline of more than 2% following its second-quarter results. Despite beating Wall Street estimates for earnings per share and revenue, investors expressed concern over growing competition in the medical weight loss space as procedure volume declined for Intuitive Surgical.

-

Donald Trump-affiliated SPAC Digital World Acquisition Corp (DWAC) made headlines by rising over 70% after settling fraud charges with the SEC.

Looking ahead, tech stocks are expected to rebound further, with Nasdaq 100 futures showing a promising increase of 0.48%. Dow Jones Industrial Average futures (DJI) rose 0.11% or 39 points, and S&P 500 (GSPC) futures surged 0.26%, indicating a positive start to the trading day.

As the stock market gains momentum and techs make a strong comeback, investors remain optimistic about the economic outlook and the potential for continued growth in the coming days.

Also Read: Consumer Confidence and Stock Market Surge Fuel Economic Optimism