Apple Faces Stock Decline: What's Behind It?

A look into the recent dip in Apple's stock value and what it means for investors.

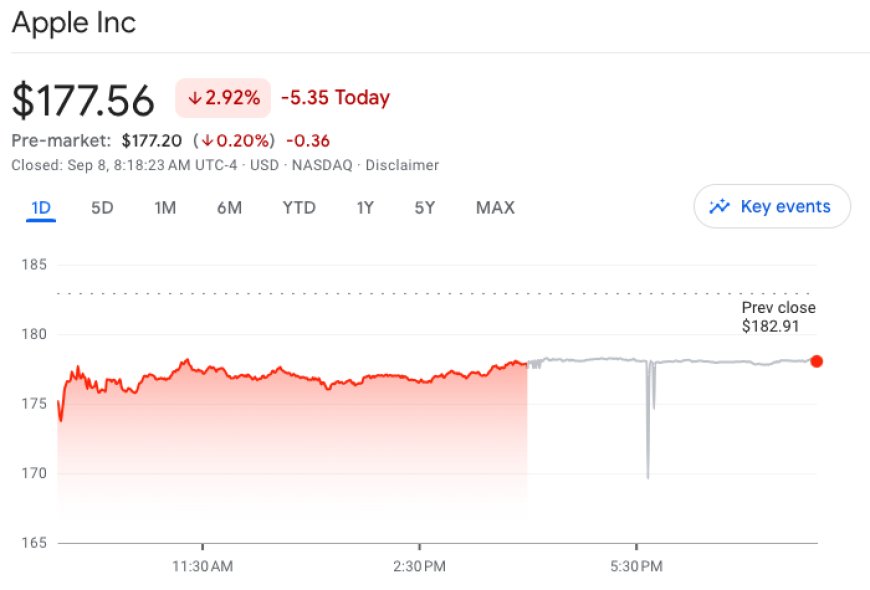

In the past two days, Apple (AAPL) has experienced a significant drop in its stock value, marking its largest consecutive decline in a span of ten months. This decline has resulted in a loss of approximately $200 billion in market capitalization since the start of the week. Reports suggest that Chinese officials are advising government employees to refrain from using Apple devices, adding to the company's challenges.

The Situation:

This drop in value occurs amidst a turbulent September for the stock market and just before the much-anticipated launch event for the iPhone 15. Enthusiasts can expect exciting features such as enhanced periscope zoom in the flagship Pro model, a new charging port (USB-C), and possibly even new color options.

Beyond Devices:

However, the current setback for Apple isn't tied to the quality of its products or the services it offers. Rather, it's a matter of the company's stock performance.

Historical Context:

Just a month ago, Apple's stock reached an all-time high, only to be followed by a sharp decline at an unprecedented pace. Historical data suggests that this weakness might persist for at least a month. Despite a noteworthy recovery in the latter half of August, the recent downturn wiped out most of those gains, leaving the stock at levels not seen in months.

Analyst Insights:

With the much-anticipated iPhone event on the horizon, analysts have expressed caution regarding Apple's stock. Notably, this caution isn't primarily due to recent news from Beijing regarding iPhone usage restrictions.

Market Trends:

Looking back over four decades of Apple's history, data from Yahoo Finance indicates that the stock generally experiences an upswing in July and August, followed by a downturn in September. In fact, in 10 out of the last 12 years, Apple's stock has seen negative returns in September, a pattern that has held even before the introduction of the iPhone.

Unusual Behavior:

This year, however, has shown a different pattern. The anticipated surge in August failed to materialize, leading JPMorgan's Ron Adler to suggest that Apple's stock is exhibiting an atypical defensive posture. Apple's performance has lagged behind AI-related stocks and is also displaying countercyclical behavior, acting as a funding source for other stock purchases. While Apple has seen a respectable 35% increase in value this year, it pales in comparison to the 210% increase for Nvidia (NVDA) and the 150% return for Meta Platforms (META).

Looking Forward:

Apple is now grappling with three consecutive quarters of declining year-over-year revenue growth, prompting comparisons to tech giant IBM. Bernstein emphasizes two key takeaways from IBM's experience: the importance of revenue growth and the understanding that robust profit growth alone may not sustain Apple's stock valuation as a growth company.

Outlook:

If current trends continue into 2023, Adler suggests that investors may shift from Apple stock after the upcoming iPhone event and redirect their investments towards Meta, Microsoft (MSFT), and Nvidia (NVDA) — the top three picks according to his team.