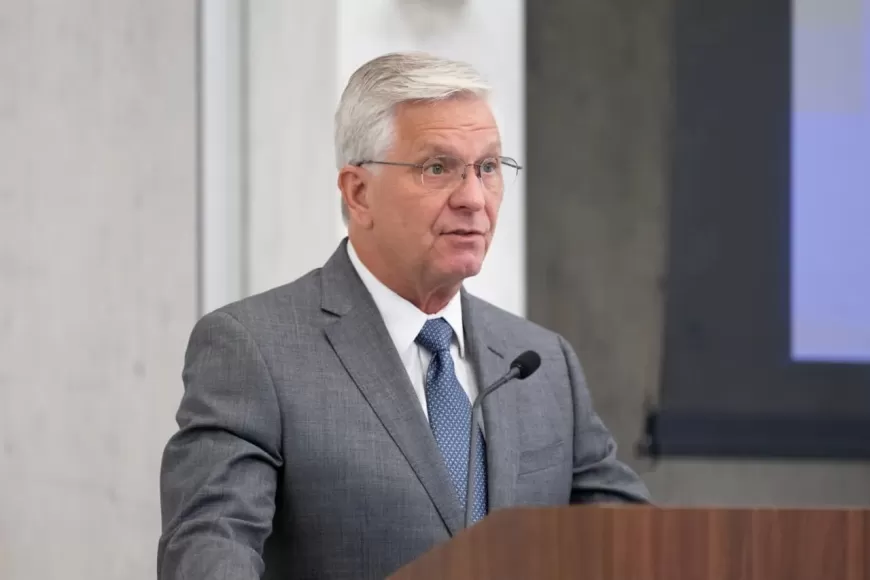

Fed Governor Waller Anticipates 2025 Rate Cuts Despite Donald Trump's Tariff Plans

Federal Reserve's Chris Waller reaffirms 2025 interest rate cuts, predicting inflation will ease despite Donald Trump's proposed tariffs.

Federal Reserve Governor Chris Waller reaffirmed his stance on reducing interest rates in 2025, expressing confidence that inflation will gradually decline despite potential economic pressures from proposed tariffs under the Trump administration.

Speaking in Paris on Wednesday, Waller said, "I believe that inflation will continue to make progress toward our 2 percent goal over the medium term, and further reductions will be appropriate." However, he acknowledged the uncertainty surrounding the economic impact of sweeping tariff proposals, emphasizing that the actual influence on inflation remains unclear.

Tariffs, as suggested by the Trump administration, include levies of 25% on Mexico and Canada and 10% on China. While such measures raise concerns about inflationary pressures, Waller noted that projections vary significantly and cautioned against premature assumptions.

"If, as I expect, tariffs do not have a significant or persistent effect on inflation, they are unlikely to affect my view of appropriate monetary policy," he added.

Economic Outlook and Rate Cut Expectations

Waller did not specify the number of rate cuts the Federal Reserve might implement in 2025 but reiterated that continued reductions would depend on inflation trends and labor market conditions. Last month, policymakers reduced their forecast from four to two cuts for the year, reflecting cautious optimism about inflation easing.

"The pace of those cuts will depend on how much progress we make on inflation while keeping the labor market from weakening," Waller said.

The U.S. economy, Waller added, remains "on solid footing." He pointed to a stable labor market, with unemployment at 4.2% in November, and expressed confidence that significant weakening in job growth is unlikely in the near term. December's labor market report, set for release Friday, is expected to show 153,000 jobs added, signaling a gradual cooling from November's 227,000.

Inflation and Policy Priorities

Central bank officials are closely monitoring inflation trends. November's Personal Consumption Expenditures (PCE) price index, the Fed's preferred gauge, showed inflation easing to 2.4%, a significant drop from the 7.2% peak in June 2022. Core PCE, which excludes food and energy costs, fell to 2.8%, compared to a September 2022 high of 5.6%.

Waller highlighted that two-thirds of core-PCE components have increased by less than 2% over the past 12 months. He also noted that higher inflation readings from early 2024 will phase out of year-over-year comparisons by March 2025, potentially leading to more favorable inflation figures.

"If the outlook evolves as I have described here, I will support continuing to cut our policy rate in 2025," Waller stated.

Diverging Opinions Among Fed Officials

While Waller struck a confident tone, other Federal Reserve officials expressed caution earlier this week. Governor Lisa Cook advocated for a slower pace of rate cuts, citing persistent inflation and a resilient labor market. Similarly, Fed Governor Adriana Kugler and San Francisco Fed President Mary Daly emphasized the need to balance inflation control with preserving job market stability.

As the Federal Reserve prepares for its next policy meeting on January 28-29, all eyes remain on inflation data and the labor market's performance. Waller and his colleagues face the ongoing challenge of steering the economy toward stability amid uncertainties tied to tariffs and global economic conditions.

Also Read: The 7 Health Insurance Companies Dominating 75% of the U.S. Market