Mixed Signals in US Stock Futures as Investors Wait for Jobs News

US stock market updates: Mixed futures signals, insights on interest rates, labor market trends, and oil price rebounds in this concise news update.

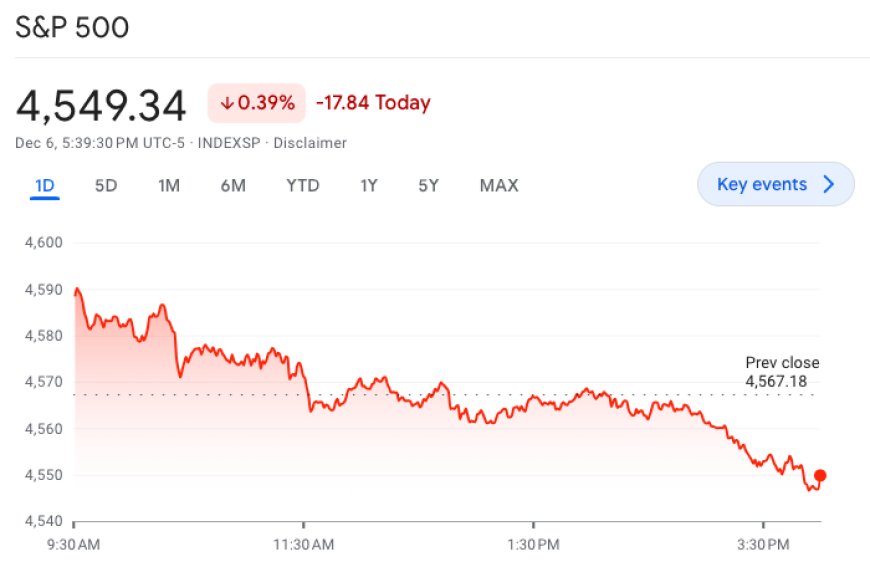

Today, the US stock market is showing a mix of different trends, leaving investors curious about what's coming next. The Dow Jones Industrial Average (^DJI) is a bit down by almost 0.2%, and S&P 500 (^GSPC) is holding steady after both had losses for the third day in a row. On a positive note, Nasdaq 100 (^NDX) is hinting that tech stocks might bounce back with a small increase of 0.2%.

This week, we've seen some good signs that the job market is getting better, thanks to the Federal Reserve making some adjustments to control inflation. People are hopeful for a smooth economic landing, and there's talk among traders that the Fed might reduce interest rates.

However, on Thursday, news from the Bank of Japan shook things up. They hinted that they might stop having negative interest rates soon. This news pushed up the 10-year Treasury yield (^TNX) by eight basis points to 4.18%.

Adding to the caution, there's a growing feeling that the stock market might take a break after its strong performance in November. December is usually seen as a "quieter" time for the markets, so investors are being extra careful.

With all this going on, everyone is keeping an eye on the weekly jobless claims data coming out on Thursday. But the big test for understanding inflation and what might happen with interest rates will be on Friday with the monthly US jobs report. This report will be the focus as we lead up to the last meeting of the year for the Federal Reserve next week.

Switching gears to commodities, the prices of oil went up a bit after reaching a low point for the past five months. West Texas Intermediate futures (CL=F) and Brent (BZ=F) crude futures, which is the international benchmark, both went up by less than 1%.

Also Read: U.S. Stock Market Opens Lower Amidst Awaited Jobs Data