U.S. Stock Market Opens Lower Amidst Awaited Jobs Data

Get the latest on the U.S. stock market's dip influenced by tech stocks, anticipating key jobs data. Understand market reactions and upcoming indicators.

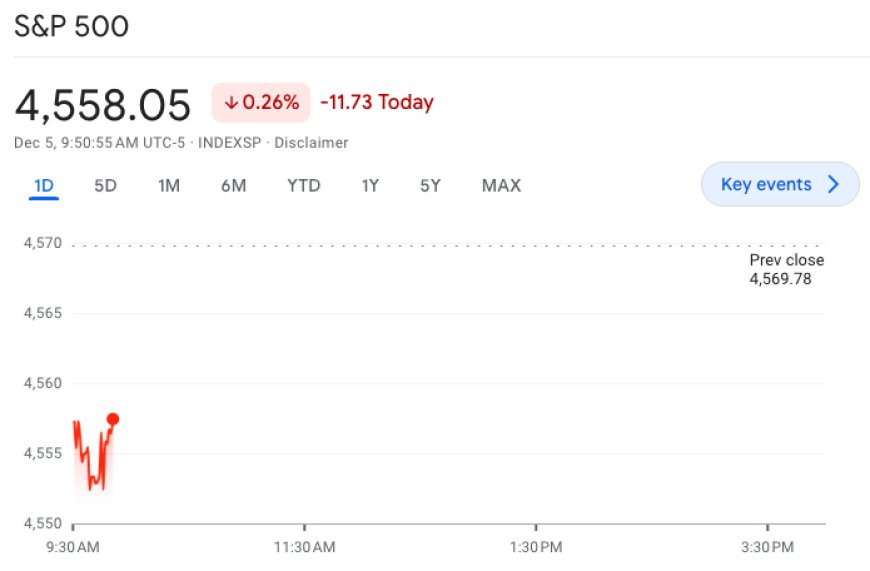

U.S. stocks experienced a dip as investors anticipated fresh jobs data, influencing expectations on the trajectory of interest rates. Tech stocks, notably the Nasdaq Composite (^IXIC), led the decline with a 0.4% decrease. Both the benchmark S&P 500 (^GSPC) and Dow Jones Industrial Average (^DJI) also saw approximately a 0.3% drop.

The negative start to December marks a departure from November's robust rally, casting doubts on the Federal Reserve's potential halt to rate hikes and dampening overall market enthusiasm. Investors are now closely monitoring upcoming data, particularly Tuesday's job openings reading for October, expected to reveal insights into the labor market's demand slowdown.

Concerns about a possible "soft landing" for the U.S. economy intensify, with investors eyeing key indicators such as ADP private payrolls and the crucial monthly jobs report later in the week. Moody's recent downgrade of China's credit outlook to negative further contributes to the cautious atmosphere, citing rising debt levels amid efforts to address a property downturn.

As the market awaits these critical data points, a cautious mood prevails, with the possibility of shifts in Federal Reserve policy on the horizon. The performance of China's economy and its impact on global markets remains an additional factor influencing the current market landscape.

Also Read: Bank of America Forecasts S&P 500 Surge to Record High in 2024