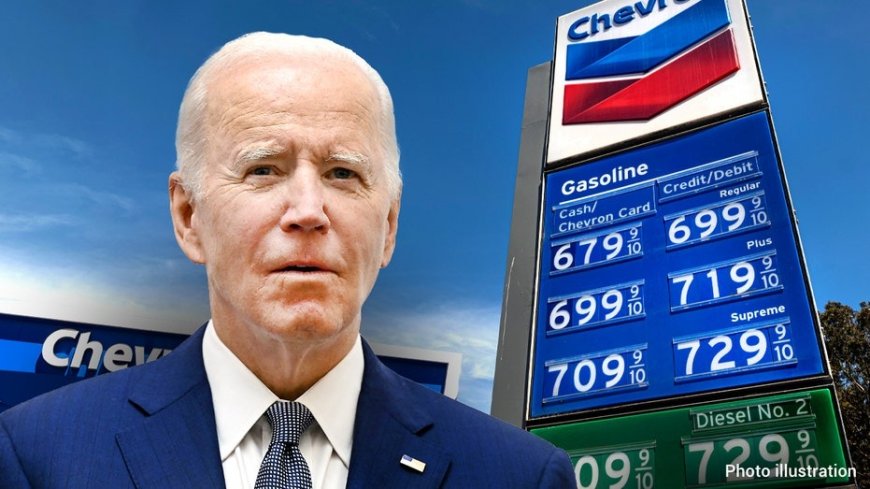

Rising Gas Prices and Joe Biden's Reelection: A Challenge on the Horizon

Rising gas prices pose a threat to President Biden's reelection bid. Explore the impact of gas prices on the economy and the potential consequences.

President Joe Biden is facing a persistent problem that just won't go away: rising gas prices. After briefly dropping from their peak of $5 per gallon last year to around $3.50, gas prices are back on the rise, currently hovering near $3.80 per gallon. And the outlook isn't reassuring either, as forecasts suggest they could soon surpass the $4 per gallon mark. This resurgence of gas prices has the potential to impact President Biden's chances of winning reelection, as noted by Clearview Energy Partners, a research firm, in a recent analysis.

Biden's Economic Snapshot

While President Biden's administration has witnessed robust job growth and solid economic output, public sentiment paints a less rosy picture. Recent polling by the Wall Street Journal indicates that only 37% of respondents approve of how President Biden is handling the economy, with a significant 59% expressing disapproval. With an overall job-approval rating of just 42%, President Biden's reelection bid faces a challenging path. Current polls show that he is in a neck-and-neck race with Donald Trump, the leading Republican contender.

Gas Prices and Inflation: A Thorn in Biden's Economic Record

Gas prices and inflation represent the most significant hurdles in President Biden's economic record, potentially influencing voters' perceptions of his presidency. Although overall inflation has eased from its peak of 9% in 2022 to a more manageable 3.2%, certain key categories remain persistently high, including food, rent, and energy costs.

While food and rent prices are expected to stabilize in the coming year as pandemic-related disruptions subside, gas prices are likely to remain elevated. This is largely due to factors beyond President Biden's control, such as decisions made by oil-producing nations. Saudi Arabia, for example, has recently announced an extension of its oil production cut, and Russia is also reducing production. These actions are taken by governments to maximize their energy revenue by selling less oil at higher prices.

The consequence of these production cuts is evident, with U.S. crude oil prices surging by approximately 28% since the end of June, reaching $87 per barrel. Bank of America predicts that U.S. crude prices may stabilize around $93 per barrel, with the possibility of hitting $100 per barrel.

The last time oil prices reached $100 per barrel in July 2022, gas prices soared to around $4.40 per gallon. While the correlation between oil and gasoline prices isn't exact, any gas price above $4 raises concerns for President Biden. Even though gasoline represents less than 3% of household spending, it's the most noticeable expense for most Americans, reminding them of economic challenges with every trip to the gas station.

Under President Biden's leadership, gas prices have averaged $3.62 per gallon, the highest of any president's tenure. When adjusted for inflation, gas prices were higher during President Obama's first term, reaching $4.44 per gallon in 2023 dollars. Nevertheless, President Biden likely finds little comfort in an average inflation-adjusted gas price of $3.94, the second-highest after President Obama.

Common Misconceptions About Energy Policies

Some misconceptions surround President Biden's energy policies, with critics suggesting that his administration has constrained the oil and gas industries, leading to higher prices. In reality, the rise of new "fracking" technology initiated a boom in U.S. energy production around 2011. However, American drillers pursued growth over profitability for a decade, resulting in lower oil and gasoline prices during the latter part of President Obama's second term and President Trump's tenure. These lower prices essentially acted as subsidies for consumers but proved unsustainable for drillers.

The COVID-19 pandemic in 2020 caused energy prices to plummet, inflicting significant losses on fossil-fuel producers. Subsequently, drillers and investors shifted their focus towards profitability, reducing U.S. supply compared to what might have been if they continued to produce at a loss. Nevertheless, U.S. oil production is poised to reach record highs in the coming years as producers capitalize on elevated prices to increase drilling activities.

It's crucial to recognize that oil prices are determined by global market dynamics that no American president can fully control. President Biden has made efforts to influence these dynamics by selling 180 million barrels of oil from the U.S. reserve in 2022, depleting this emergency supply to its lowest level since 1983. This may limit the reserve as a potential source of oil supply during the upcoming 2024 election cycle.

Additionally, President Biden has permitted increased oil imports from Venezuela and has been engaged in potential agreements regarding expanded oil exports from sanctioned Iran. There may also exist unspoken understandings between Washington and Riyadh for increased Saudi oil production if U.S. gasoline prices soar to politically uncomfortable levels.

Historical Context: Lessons from Obama's Reelection

For perspective, it's worth noting that President Obama secured his reelection in 2012 despite significantly higher gas prices than the average of the prior five years—a situation similar to what President Biden faces today. However, the key difference lies in overall inflation levels. Under President Obama, inflation remained low, and high gas prices didn't serve as a constant reminder of other escalating costs, as they do today.

In conclusion, rising gas prices present a persistent challenge for President Biden's reelection prospects, intertwined with inflation and public sentiment. The outcome of these dynamics in the lead-up to the 2024 election remains uncertain and a cause for concern for the administration.

Also Read: President Joe Biden to Spotlight Labor Unions Role at Philadelphia's Labor Day Parade