Wall Street Opens Cautiously Amid Concerns Over China's Economic Data: Today Stock Market News

Stay informed on Wall Street's cautious start fueled by fresh data indicating challenges in China's economic recovery. Discover the market's performance and key trends.

The opening of today's trading session on Wall Street marked a cautious stance among investors. Following an extended weekend, market participants were greeted with fresh data, signaling ongoing challenges in China's economic recovery. These developments have raised questions about the global economic outlook, influencing market sentiment.

Stock Market Performance

-

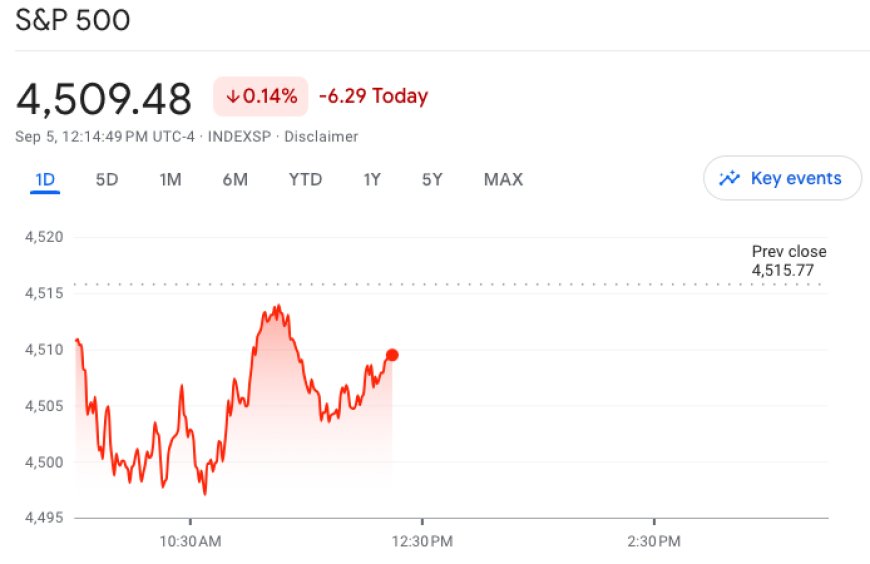

The S&P 500 (^GSPC) kicked off the day with a marginal decline of 0.1%. This modest retreat reflects the cautious sentiment prevalent among investors.

-

Meanwhile, the Dow Jones Industrial Average (^DJI) began the session with minimal changes, attempting to recover from earlier, more substantial losses.

-

The Nasdaq Composite (^IXIC), dominated by tech stocks, registered a slight dip of 0.4%. This decline was attributed to the impact of rising 10-year Treasury yields on growth-oriented stocks.

Impact on Key Stocks

-

Upon reopening after the Labor Day holiday, both Nvidia (NVDA) and Apple (AAPL) saw their shares slip, reflecting the prevailing cautious sentiment in the market.

China's Economic Data Concerns

Fresh data released today revealed a concerning trend in China's services sector. In August, the country's services activity hit its lowest level in eight months. This development has reignited concerns about the pace of China's economic recovery, with potential implications for global demand.

Focus on the Federal Reserve

In the coming days, as the earnings and economic calendar remain relatively light, market attention is expected to remain fixated on the Federal Reserve. Historically, September has often proven to be a less favorable month for stocks.

Optimism Amid Uncertainty

Despite the ongoing uncertainties, some analysts maintain a cautiously optimistic outlook for the month of September. Factors contributing to this optimism include the growing excitement surrounding artificial intelligence, ample cash reserves on the sidelines, and the potential launch of Apple's new iPhone.

Trending Stocks Tickers in Morning Trade

-

Tesla (TSLA) led the list of trending tickers on Yahoo Finance, rebounding by more than 3% after experiencing a more than 5% decline on Friday.

-

Airbnb (ABNB) shares surged by almost 8% in premarket trading, fueled by its upcoming inclusion in the S&P 500 scheduled for September 18.

-

The marijuana sector continued its upward trajectory, building on last week's rally. Following the Department of Health and Human Services' recommendation to ease restrictions on marijuana, Tilray Brands (TLRY) saw a 6% increase, while Canopy Growth Corporation (CGC) surged by more than 20%. This sector has experienced significant momentum since the announcement.

Goldman Sachs Revises Recession Outlook

Goldman Sachs made adjustments to its recession projection for the third time in as many months. The firm's Chief Economist, Jan Hatzius, now places the likelihood of a U.S. recession within the next 12 months at 15%, down from the previous estimate of 20%. This revision is attributed to encouraging developments in inflation and the labor market.

Stock Market Opening

As U.S. markets reopened after the Labor Day holiday, they exhibited a slightly bearish tone. While futures on the Dow Jones Industrial Average (^DJI) remained relatively stable, showing a minimal 0.03% decline equivalent to 10 points, futures for the S&P 500 (^GSPC) experienced a 0.12% decline. Nasdaq 100 futures recorded a 0.25% decrease.

Premarket Trading Highlights

-

Qualcomm (QCOM) saw its shares rise by 1% in premarket trading after announcing its partnership to supply chips for in-car infotainment systems to luxury automakers Mercedes and BMW.

-

Airbnb (ABNB) experienced a 5% premarket increase following the announcement of its imminent inclusion in the S&P 500 later this month.

-

Apple (AAPL) faced a 1% premarket decline despite enjoying a 5% rally last week.

-

VinFast (VFS), the Vietnamese electric vehicle company, continued to experience declines, with shares dropping by as much as 12%.

Also Read: Short Sellers Profit as U.S. Stock Rally Pauses: Ortex Report