Steady Stocks and Inflation: How Fed Rates Might React - Latest Stock Market Update

Get the latest on stock market stability and inflation trends. Learn how it impacts the Federal Reserve's interest rates. Stay informed for smart investments.

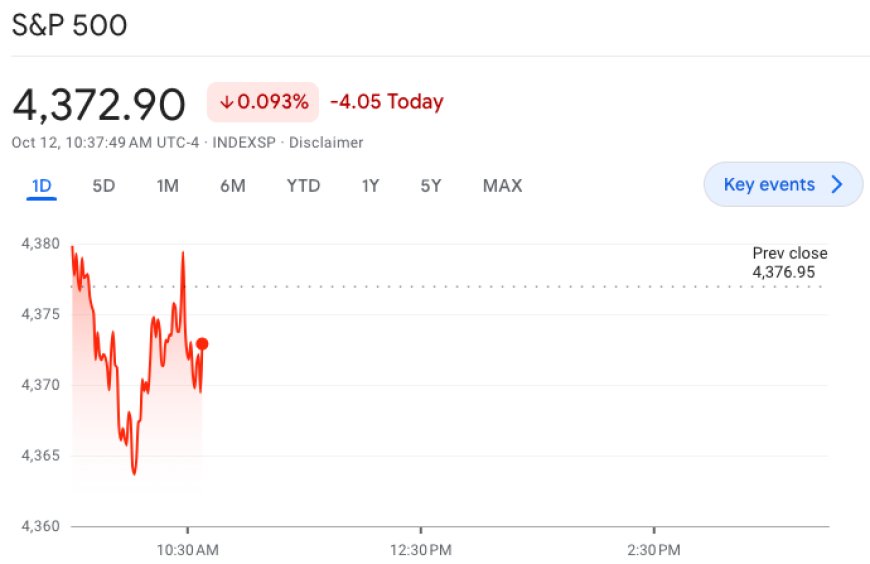

Stocks on Wall Street showed minimal movement as investors awaited the release of a critical consumer inflation report, which could influence the Federal Reserve's decision on interest rates. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all hovered around the same levels. The Consumer Price Index (CPI) report indicated that inflation remained stable in September, but with a slightly faster increase than anticipated by economists. While consumer prices rose 3.7% year-over-year, on a monthly basis, they saw a 0.4% increase.

Stock Market's Response:

Stocks on Wall Street opened largely flat on Thursday as investors digested a crucial consumer inflation report that could factor into whether the Federal Reserve decides to raise or hold interest rates. The Dow Jones Industrial Average (^DJI), S&P 500 (^GSPC), and tech-heavy Nasdaq Composite (^IXIC) all hovered around the flatline.

Inflation Data Analysis:

Wall Street on Thursday was closely focused on the Consumer Price Index (CPI) report, which showed that inflation held steady in September but increased at a slightly faster pace than economists expected. Consumer prices rose 3.7% over last year in September, matching August's increase. On a month-over-month basis, consumer prices rose 0.4%.

Market's Winning Streak:

The major US stock indexes scored their fourth winning session in a row on Wednesday as investors shrugged off hotter-than-expected wholesale inflation data.

Federal Reserve's View:

Minutes from the Fed's last meeting showed most policymakers predict one more interest-rate increase this year — though they still stressed that economic data will steer their decision-making.

Earnings Season and Market Expectations:

Eyes are also on the third-quarter earnings season, which gets going Thursday with reports from Delta (DAL) and Walgreens (WBA), then begins in earnest with big bank results Friday. Expectations are for earnings growth to be muted, but some analysts believe that low bar could deliver some surprises.

Oil Prices and Global Developments:

Oil prices erased their recent drop after a show of unity by Russia and Saudi Arabia, which have committed to extra cuts in crude output. But the market mood remains fragile as Israel builds up forces for an expected ground assault on Gaza. Crude oil futures (CL=F) rose to above $84 a barrel, while Brent crude futures (BZ=F) climbed to trade closer to $87.

Fed's Stance on Rates:

Thursday's inflation report came in slightly hotter than projected. But when removing volatile categories like food, energy and shelter, economists see a downward trajectory, a welcomed sign for the Federal Reserve which spent the days before the inflation reading indicating a bias against hiking interest rates in November.

Market Response to Economic Data:

After two rough weeks with rising yields and the Fed's "higher for longer" stance weighing on stocks, last Friday's jobs report brought a clear shift in investor sentiment. The report showed a still tight labor market adding more jobs than expected but with wages growing at their slowest pace in more than two years.

Dovish Comments and Market Impact:

Dovish comments by Fed officials followed up the jobs report as many in the central bank are starting to believe the recent rise in bond yields could be doing monetary tightening for them. This, the officials said, could lead to the Fed not raising rates in November.

Market Betting on Fed Hikes:

The confluence of the commentary with recent economic data has pushed markets to increasingly bet on no more Fed hikes in 2023. As of Thursday morning, markets are pricing in a 12% chance the Fed hikes in November, down from a 41% chance a month ago.

Market Openings:

Stocks were muted at the opening bell on Thursday as investor's digested a mixed inflation report. The Dow Jones Industrial Average (^DJI), the S&P 500 (^GSPC), and the Nasdaq Composite (^IXIC) were all little changed.

Inflation Figures:

The Consumer Price Index (CPI) rose 0.4% over last month and 3.7% over the prior year in September, according to the latest data from the Bureau of Labor Statistics. The year-over-year increase was slightly higher than economist forecasts of a 3.6% annual jump, according to data from Bloomberg. Economists had expected a 0.3% month-over-month increase.

Core Inflation:

On a "core" basis, which strips out the more volatile costs of food and gas, prices in September climbed 4.1% over last year — a slowdown from the 4.3% annual increase seen in August, according to Bloomberg data. Monthly core prices rose 0.3%, in line with economists had projected and unchanged from the month prior.

Futures and Anticipations:

Stocks were poised to open in the green on Thursday, as investors looked ahead to the release of US consumer inflation data. Futures on the Dow Jones Industrial Average (^DJI) were up 0.33%, or 112 points, while S&P 500 (^GSPC) futures rose 0.37%. Contracts on the tech-heavy Nasdaq 100 (^NDX) were 0.34% higher.

Also Read: Stock Market Shows Resilience in the Face of PPI Surge