Stock Market Sees Limited Movement as Investors Analyze Economic Data and GameStop Leadership Changes

Stock market news: Investors analyze economic data & GameStop leadership changes. Minimal fluctuations & disappointing earnings impact. Get insights now!

Stocks exhibited minimal fluctuations today as investors carefully examined the latest economic data ahead of the upcoming Federal Reserve meeting. Additionally, the market absorbed news of a leadership shakeup at GameStop (GME), the popular meme stock.

At the opening bell, the S&P 500 index (^GSPC) edged up by a mere 0.06%, while the Nasdaq Composite index (^IXIC) experienced a slight increase of 0.14%. Meanwhile, the Dow Jones Industrial Average (^DJI) remained near the flatline in early trading.

Yesterday, the Nasdaq 100 ended a four-day winning streak, signaling a potential pause in the artificial intelligence-driven rally. Throughout this week, the S&P 500 has been striving to enter bull-market territory, requiring a close above 4,292.44 to officially mark a 20% rally from its lowest point in October 2022.

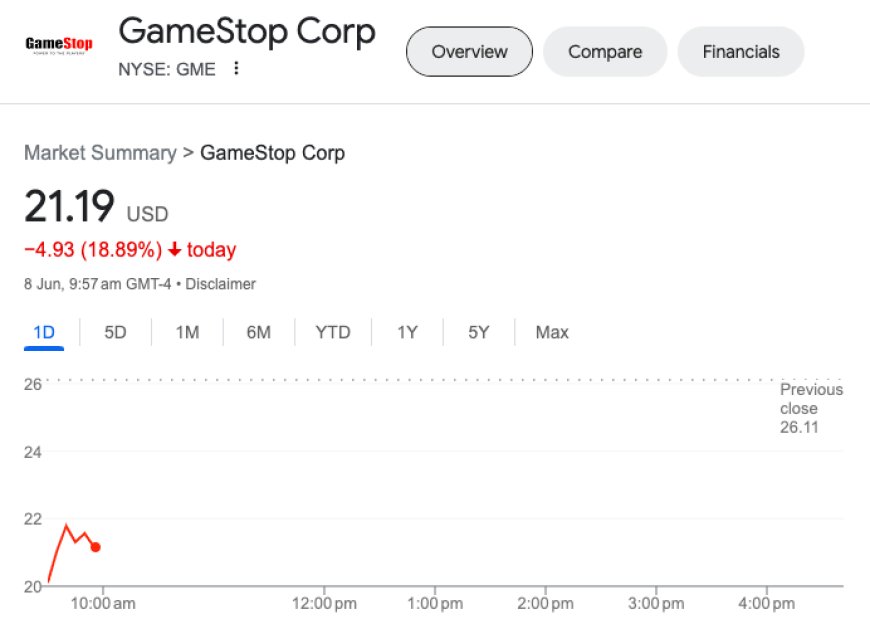

In company-specific news, GameStop, the beloved meme stock, announced its first-quarter earnings report, which also included the firing of CEO Matthew Furlong. Ryan Cohen, the chairman of GameStop's board, was appointed as the new executive chairman. Financially, GameStop's first-quarter performance fell short of Wall Street's expectations, with revenue totaling $1.24 billion, below the analysts' consensus estimate of $1.4 billion.

Remarkably, GameStop chose not to conduct an earnings call, a typical industry practice, leaving investors without an explanation for the quarterly results or the sudden executive reshuffling. As a result, the company's stock plummeted by nearly 20% during the early hours of trading today.

In a note to clients, Wedbush managing director Michael Pachter expressed a grim outlook for GameStop, stating, "We firmly believe that GameStop is destined for failure, as dwindling physical software sales and a shift towards subscription services and digital downloads seal its fate. While there may be some value in running the chain profitably, we see no signs of a turnaround without capable management."

On the economic front, the Department of Labor released new data indicating that 261,000 jobless claims were filed in the week ending June 3, surpassing the Bloomberg economists' consensus estimate of 235,000 claims. This figure represents an increase compared to the previous week's total of 233,000 claims.

While weekly jobless claims are not a major factor in the Federal Reserve's decision-making process, this report will be among the last economic data points taken into consideration before the Federal Open Market Committee meeting commences next week. Presently, market indicators suggest a 65% probability that the Federal Reserve will halt its historic interest rate hiking campaign during the upcoming meeting, according to the CME FedWatch Tool.

Also Read: Market Volatility Persists as S&P 500 Approaches Milestone