Top Commodity Trends this Week: Gold, Oil, Maple Syrup, Chemicals, Carbon Capture

This week’s key commodity trends: gold earnings, oil production, Canada’s record maple syrup harvest, chemical sector challenges, and carbon capture advances

Table of Contents

-

Gold

Gold This week kicks off the earnings season for gold producers, starting with Newmont Corp. reporting its second-quarter results on Wednesday. Gold prices have risen by 16% this year, reaching new highs and benefiting mining companies by offsetting extraction costs. Investors will be closely analyzing reports to understand the cost of producing gold and how it affects profitability. Monday’s fluctuations in spot gold prices reflect ongoing market uncertainty and investor reactions.

-

Oil

crude oil Despite a decrease in active oil rigs, US crude oil production remains strong at a record 13.3 million barrels per day in July. The number of operating rigs has fallen by almost 10% since mid-April, the lowest since late 2021, according to Baker Hughes. This stability is due to advances in drilling technology and the use of existing wells. These factors help maintain high production levels despite fewer rigs in operation.

-

Maple Syrup

Maple Syrup Canada is celebrating a remarkable maple syrup harvest this year. Quebec, which produces 92% of Canada’s maple syrup, has set a new record with 239 million pounds of syrup. The Quebec Maple Syrup Producers attribute this success to ideal weather conditions and improved production techniques. This bumper crop could affect syrup prices and availability on the global market, providing a boon for syrup enthusiasts.

-

Chemicals

Chemicals Germany's chemical industry continues to face difficulties due to last year’s high energy costs. The sector's capacity utilization has dropped to levels not seen since the 2007-2009 financial crisis, as reported by the VCI industry association. Although there has been some recovery, production levels are still below pre-crisis standards. The high cost of energy is impacting the production of essential chemical-based products, from plastics to pharmaceuticals, affecting supply chains across various industries.

-

Carbon Capture

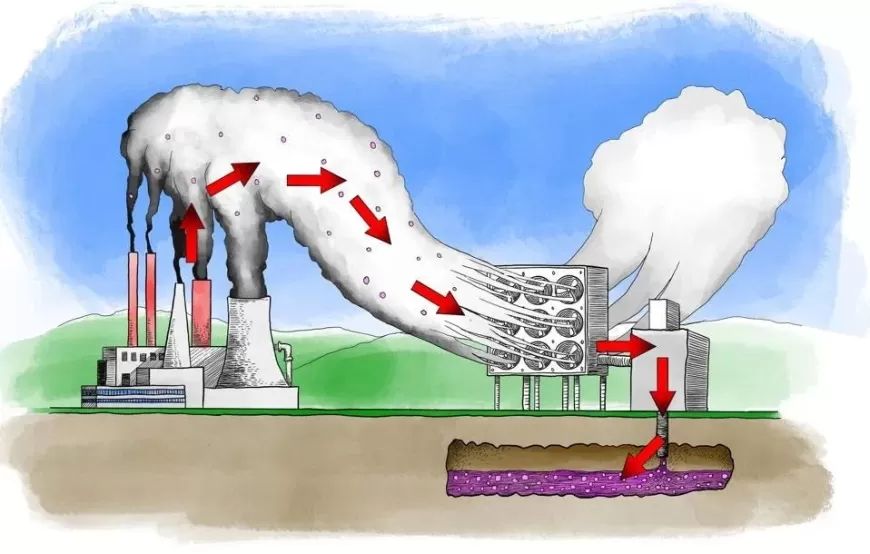

Carbon Capture The US is leading the way in carbon capture technology, supported by federal incentives from the Biden administration. The country is projected to capture up to 164 million tons of carbon dioxide by 2035, nearly equaling the combined total of the next three largest markets. This technology, which primarily captures carbon from natural gas processing, is increasingly used for enhanced oil recovery. In 2022, global investments in carbon capture exceeded $11 billion, with the US capturing a significant portion of these investments. This growth highlights a strong commitment to reducing carbon emissions and advancing climate technology.