Stock Market Updates and Economic Trends: Stocks Open Lower Amid China Economic Concerns, Positive US Retail Sales

US Markets Respond to Mixed Economic Signals: China's Struggles and US Consumer Resilience

The US stock market grappled with contrasting forces as concerns about China's economic performance clashed with robust US retail sales. As Wall Street opened its doors, investors witnessed a dip in stock values driven by apprehensions over China's economy, while simultaneously celebrating encouraging retail sales figures reflecting the steadfast strength of the US consumer sector.

US Stocks Experience Morning Dip Despite Resilient Retail Sales

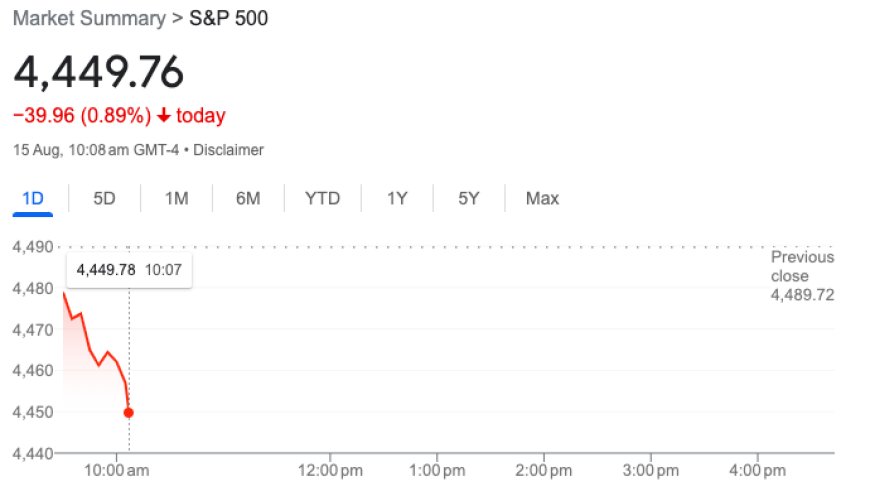

Early trading on Tuesday saw US stocks encountering a dip in value, setting a cautious tone amid ongoing uncertainties surrounding China's economic trajectory. At the opening bell, the Dow Jones Industrial Average (^DJI) and the S&P 500 (^GSPC) both registered minor declines of around 0.4%, while the technology-focused Nasdaq Composite (^IXIC) experienced a 0.3% dip.

This downward movement added a somber undertone to what has already been a subdued August for the stock market. This follows a modest recovery observed on Monday, where the Nasdaq recorded an impressive 1% surge.

July Retail Sales: A Pleasant Surprise for US Consumer Resilience

In a refreshing counterbalance to market concerns, July's retail sales data presented an optimistic outlook for the US consumer sector. Retail sales for July demonstrated resilience by surpassing Wall Street estimates, reaffirming the consistently strong performance of the US consumer.

July's retail sales witnessed a commendable 0.7% increase compared to the preceding month, a figure that exceeded Wall Street's projection of a 0.4% growth. The positive momentum extended beyond the headline figures, with sales excluding auto and gas experiencing an impressive 1.0% surge – a noteworthy accomplishment when compared to the estimated 0.3% compiled by Bloomberg. Furthermore, June's sales figures were revised upwards from 0.2% to 0.3%, signaling a broader trend of consumer strength.

The Commerce Department's released report is a pivotal snapshot of consumer spending, providing insights at a juncture when economic data has consistently outperformed expectations. Notably, the spending figures for the Commerce Department's control group – a significant contributor to the Gross Domestic Product (GDP) report – demonstrated a robust 1.0% rise in July, greatly surpassing the initially anticipated 0.5% increase by economists.

Prominent Pre-Market Stock Movers: Market Sentiments Mixed

As the pre-market session unfolded on Tuesday, several notable stocks captured investor attention on Yahoo Finance's trending tickers page, offering insight into shifting market sentiments.

-

D.R. Horton, Inc. (DHI): In the wake of Warren Buffett's announcement of new positions in three US homebuilders, including D.R. Horton, the company's shares experienced a promising 2% uptick.

-

Hawaiian Electric Industries, Inc. (HE): This power supplier, serving approximately 95% of Hawaii's residents, observed a 2% decline due to concerns regarding wildfires possibly ignited by downed power lines. The company's value suffered a reduction of over $1 billion in response.

-

The Home Depot, Inc. (HD): Pre-market trading saw Home Depot's stock dipping by 1%, prompted by the company's earnings beat coupled with cautionary statements about future consumer pressures.

-

Tencent Music Entertainment Group (TME): The Chinese tech giant's shares experienced a 7% drop following its announcement of a 5.5% revenue rise in the second quarter. Investors voiced apprehensions over China's ongoing economic challenges.

Futures Indicate Market Resilience Amid China Woes

As the dawn of August 15th broke, US stock futures reflected a measured decline, a reaction to a series of sobering economic indicators emanating from China. These indicators had an overnight impact on global markets, exerting downward pressure on investor sentiment just before Wall Street's opening bell.

Around 8:15 a.m. ET, Dow futures demonstrated a decline of approximately 0.7%, while S&P 500 futures registered a 0.6% drop. Nasdaq futures experienced a comparable slide of about 0.55%.

China's policy makers responded to the latest data by unexpectedly reducing the interest rate on medium-term loans offered for one year by 0.15%. This move followed reports of decelerating growth in consumer spending and a concurrent rise in unemployment. The resultant market reaction added to the challenges faced by US investors, accentuating the volatility experienced during this traditionally weaker phase of the stock market.

Also Read: Wall Street Slides as Tesla Impact Weighs; Economic Data Awaited